A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

If you need to aggregate, obtain, or print authorized document formats, utilize US Legal Forms, the largest assortment of authorized forms, which can be accessed online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and individual uses are categorized by types and regions, or keywords. Use US Legal Forms to find the Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Case Filed on Behalf of the Minor in just a few clicks.

Every authorized document template you obtain is yours forever.

You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to locate the Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

- You can also access forms you previously downloaded from the My documents section of your account.

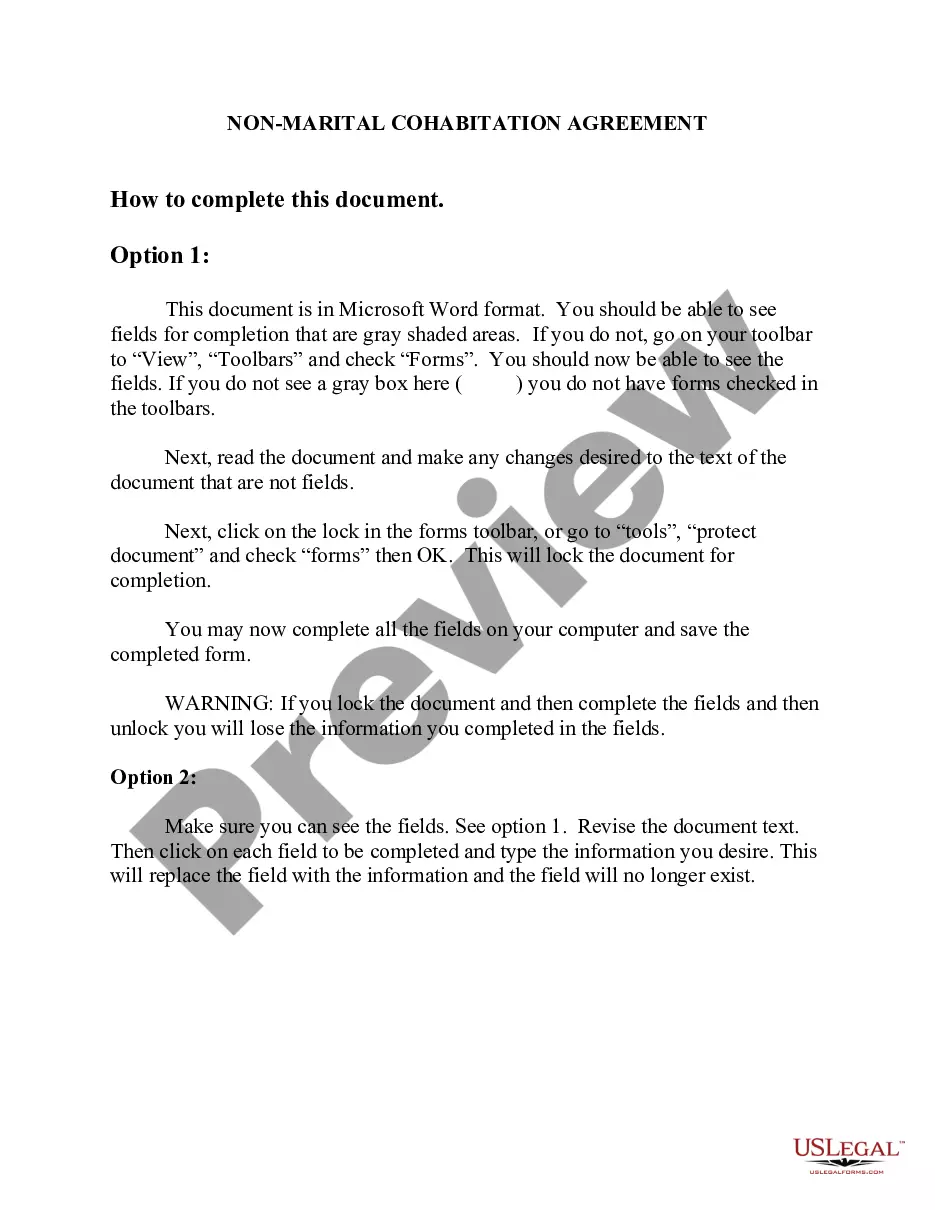

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

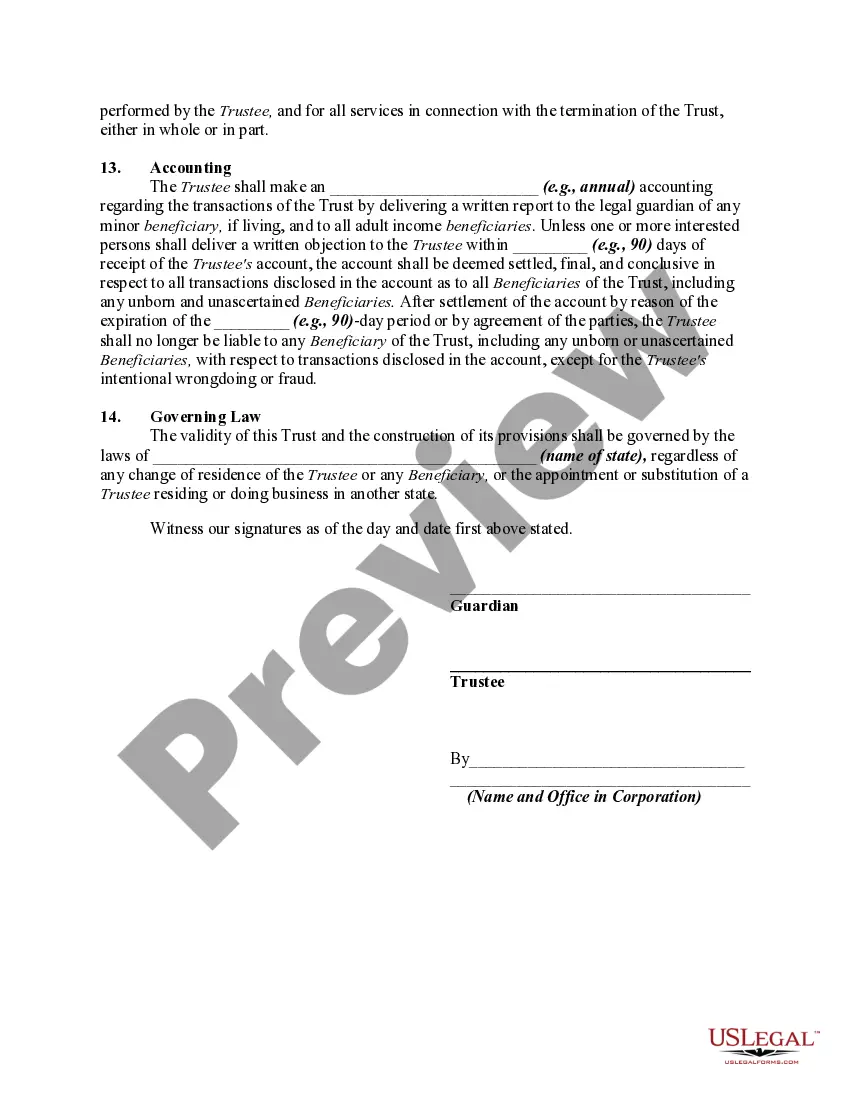

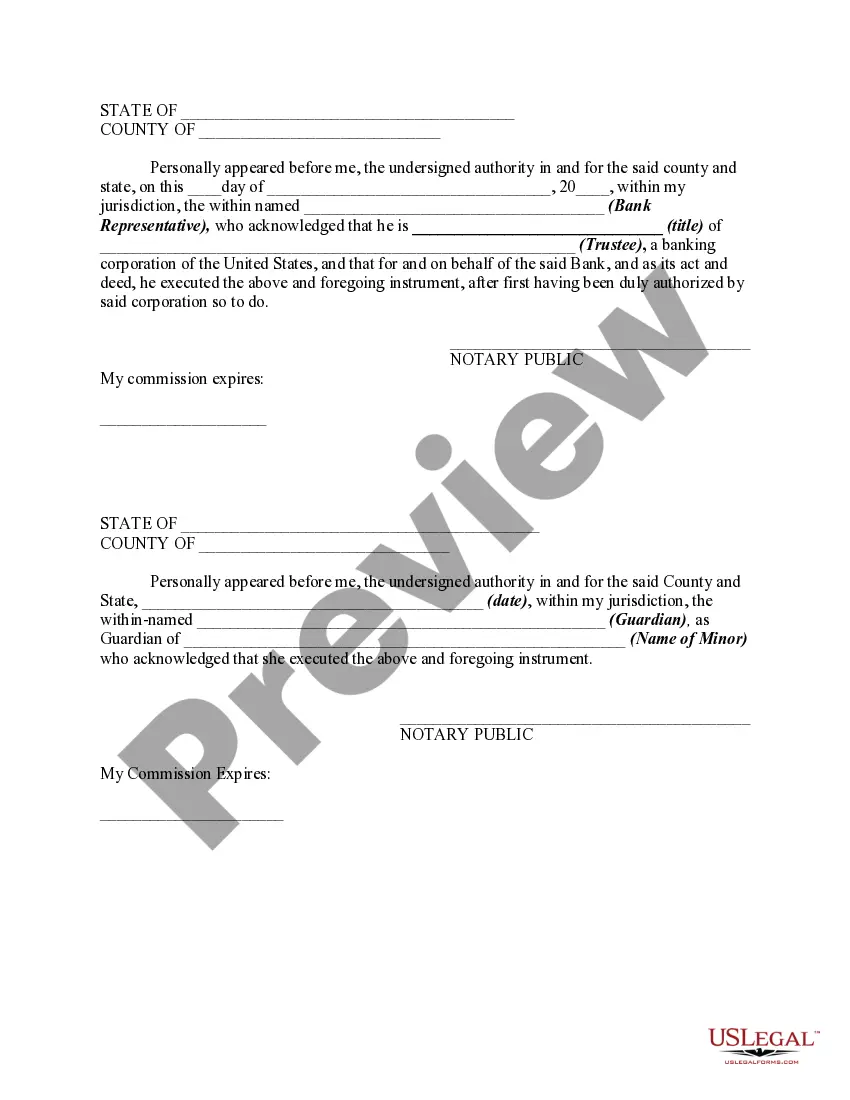

- Step 2. Use the Preview option to review the form's content.

- Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the authorized form template.

- Step 4. Once you have found the form you need, click on the Purchase now button.

- Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa, Mastercard or PayPal account to finalize the payment.

- Step 6. Select the format of the authorized form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

Form popularity

FAQ

In Illinois, a child support lien can indeed attach to personal injury settlements. If a settlement is awarded for a child’s personal injury, any outstanding child support can result in a lien against that settlement amount. Using an Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor can help manage these funds appropriately, ensuring compliance with support obligations while protecting the child's interests.

To settle a minor's claim in Illinois, you must first file a petition in court, detailing the circumstances of the injury and the proposed settlement amount. The court will hold a hearing to ensure the settlement is in the child's best interest. If approved, the funds may then be placed in an Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, protecting the child’s financial future and allowing for safe, judicious access to the funds as needed.

In Illinois, child support can potentially claim a portion of your personal injury settlement if it is deemed necessary for the child's welfare. When courts determine support obligations, they will consider various financial resources, including settlements. This means that if the settlement addresses costs related to the child's care, the Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor may be utilized to safeguard those funds, ensuring they are allocated appropriately.

Yes, you can sue a minor in Illinois, but there are specific rules and procedures to follow. Typically, a court-appointed guardian or parent represents the minor in such cases. It is crucial to handle these actions with care, as the laws are designed to protect the minor's interests. If you are navigating this process, consider using platforms like uslegalforms to access the necessary documents and resources for setting up an Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

When a minor wins a lawsuit, the court typically requires the establishment of an Illinois Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor. This arrangement ensures that the funds are managed properly until the minor reaches adulthood. The trust safeguards the funds, protecting the minor's financial interests while allowing for necessary expenses to be covered. Additionally, a representative, often a parent or guardian, will oversee the trust on behalf of the minor.