A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

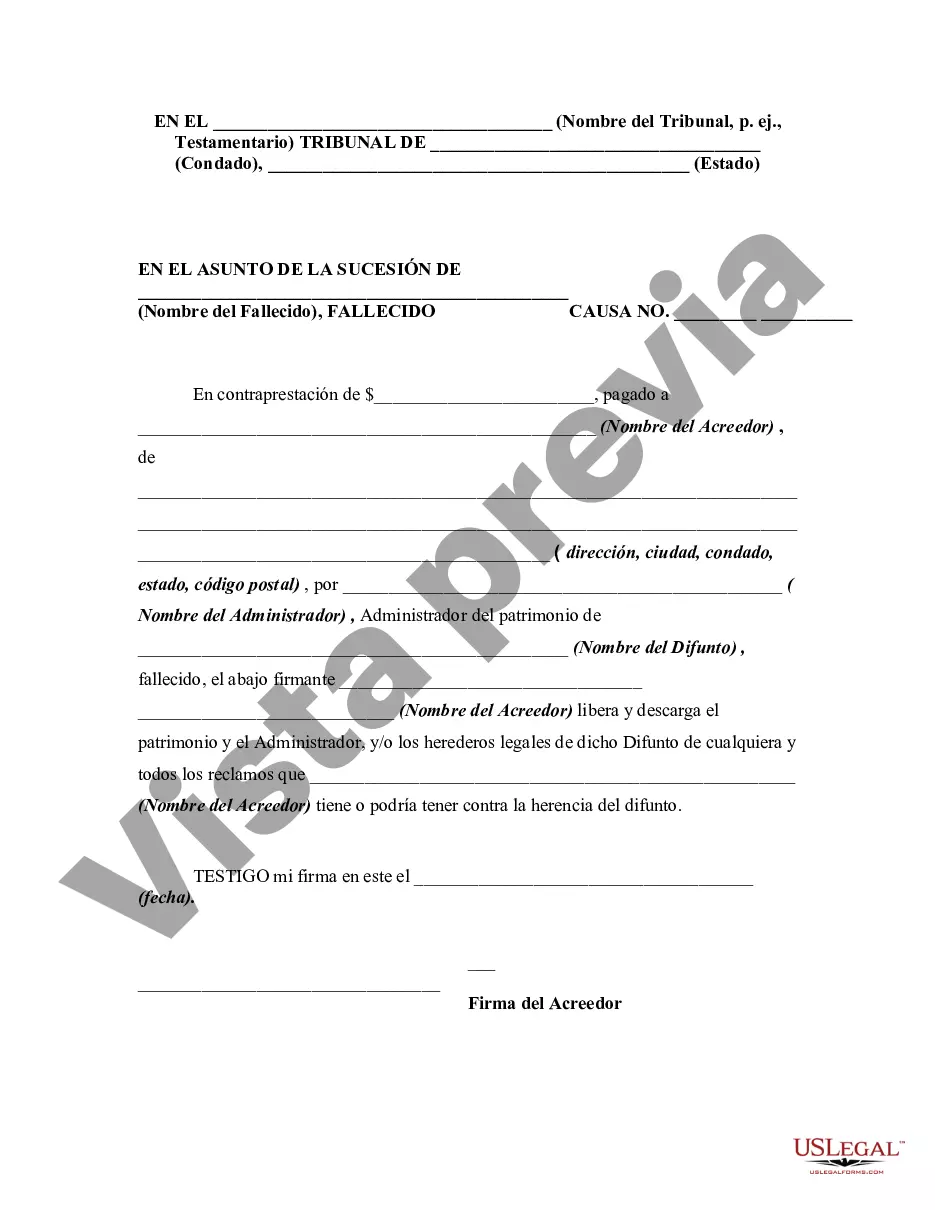

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Release of Claims Against an Estate By Creditor is a legal document used to release a creditor's claim against an estate in the state of Illinois. This document is essential when a creditor wants to waive their right to claim any debts owed to them by the deceased individual's estate. The purpose of an Illinois Release of Claims Against an Estate By Creditor is to ensure a fair and transparent settlement of the deceased's outstanding debts. It demonstrates the creditor's acknowledgement and acceptance that they will not pursue any further action to recover the owed debts. In the state of Illinois, there are various types of Release of Claims Against an Estate By Creditor, including: 1. General Release of Claims Against an Estate By Creditor: This type of release is used when a creditor wants to release all claims against the estate, including both secured and unsecured debts. It covers all outstanding debts without any specific exceptions. 2. Partial Release of Claims Against an Estate By Creditor: This form is utilized when a creditor intends to release only a portion of the debts owed to them. This type of release may be agreed upon when the creditor and the estate reach a negotiated settlement on the amount to be waived. 3. Specific Release of Claims Against an Estate By Creditor: This release is employed when a creditor wants to release a specific debt or claim against the estate. It may be used if the creditor does not wish to forgive all debts but rather only a particular obligation owed to them. Regardless of the type of Release of Claims Against an Estate By Creditor in Illinois, the document typically includes the following key information: — Creditor's full name, address, and contact details — Name and personal information of the deceased individual — Executor/Administrator of the estate's details — Description of the debt or claim being released — Declaration of the creditor's intent to release all or part of their claim against the estate — Signatures of both the creditor and the executor/administrator, along with the date Note that it is recommended to consult with an attorney to ensure compliance with Illinois probate laws and to customize the Release of Claims Against an Estate By Creditor to fit the specific circumstances of the estate and creditor's claim.Illinois Release of Claims Against an Estate By Creditor is a legal document used to release a creditor's claim against an estate in the state of Illinois. This document is essential when a creditor wants to waive their right to claim any debts owed to them by the deceased individual's estate. The purpose of an Illinois Release of Claims Against an Estate By Creditor is to ensure a fair and transparent settlement of the deceased's outstanding debts. It demonstrates the creditor's acknowledgement and acceptance that they will not pursue any further action to recover the owed debts. In the state of Illinois, there are various types of Release of Claims Against an Estate By Creditor, including: 1. General Release of Claims Against an Estate By Creditor: This type of release is used when a creditor wants to release all claims against the estate, including both secured and unsecured debts. It covers all outstanding debts without any specific exceptions. 2. Partial Release of Claims Against an Estate By Creditor: This form is utilized when a creditor intends to release only a portion of the debts owed to them. This type of release may be agreed upon when the creditor and the estate reach a negotiated settlement on the amount to be waived. 3. Specific Release of Claims Against an Estate By Creditor: This release is employed when a creditor wants to release a specific debt or claim against the estate. It may be used if the creditor does not wish to forgive all debts but rather only a particular obligation owed to them. Regardless of the type of Release of Claims Against an Estate By Creditor in Illinois, the document typically includes the following key information: — Creditor's full name, address, and contact details — Name and personal information of the deceased individual — Executor/Administrator of the estate's details — Description of the debt or claim being released — Declaration of the creditor's intent to release all or part of their claim against the estate — Signatures of both the creditor and the executor/administrator, along with the date Note that it is recommended to consult with an attorney to ensure compliance with Illinois probate laws and to customize the Release of Claims Against an Estate By Creditor to fit the specific circumstances of the estate and creditor's claim.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.