An Illinois Revocable Living Trust for House is a legal document established by the owner of a property in Illinois to ensure the effective management and distribution of their assets, particularly their house, during their lifetime and after their death. This type of trust is revocable, meaning the creator has the flexibility and authority to amend or revoke the trust at any time. By creating a Revocable Living Trust for House in Illinois, individuals can maintain control over their property while avoiding probate, ensuring privacy, and potentially minimizing estate taxes. This trust allows the homeowner to name themselves as the initial trustee, enabling them to retain full control over their property during their lifetime. The trust also designates a successor trustee who will manage the trust assets upon the owner's incapacity or death. There are different types of Illinois Revocable Living Trusts for Houses designed to serve specific purposes or accommodate various scenarios. Here are some common variations: 1. Single Granter Trust: This type of trust is formed by a single individual who owns a house in Illinois. The individual creates the trust, designates themselves as the initial trustee, and appoints a successor trustee to manage the trust upon their incapacity or death. 2. Joint Granter Trust: A joint granter trust is established by a married couple owning a house together in Illinois. Both spouses act as co-trustees, maintaining control over the trust assets during their joint lifetimes. Upon the death of one spouse, the surviving spouse becomes the sole trustee with the ability to manage and distribute the assets in accordance with the trust document. 3. Testamentary Trust: While not a Revocable Living Trust, a testamentary trust is worth mentioning. It is created through a will and comes into effect upon the property owner's death. This trust allows individuals to outline detailed instructions regarding the management and distribution of their house and other assets. 4. Irrevocable Living Trust: Though not revocable like a standard Revocable Living Trust, an irrevocable living trust may also be used for houses in Illinois. It offers some unique benefits, including potential tax advantages, asset protection, and long-term care planning. In summary, an Illinois Revocable Living Trust for House is a legal instrument that allows homeowners to maintain control over their property during their lifetime, while ensuring a smooth transfer of assets upon death. Different variations of this trust exist to accommodate various circumstances, including single granter trusts, joint granter trusts, testamentary trusts, and irrevocable living trusts.

Illinois Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

Finding the correct official document format can be a challenge.

Of course, there are numerous templates accessible online, but how can you secure the official form you need.

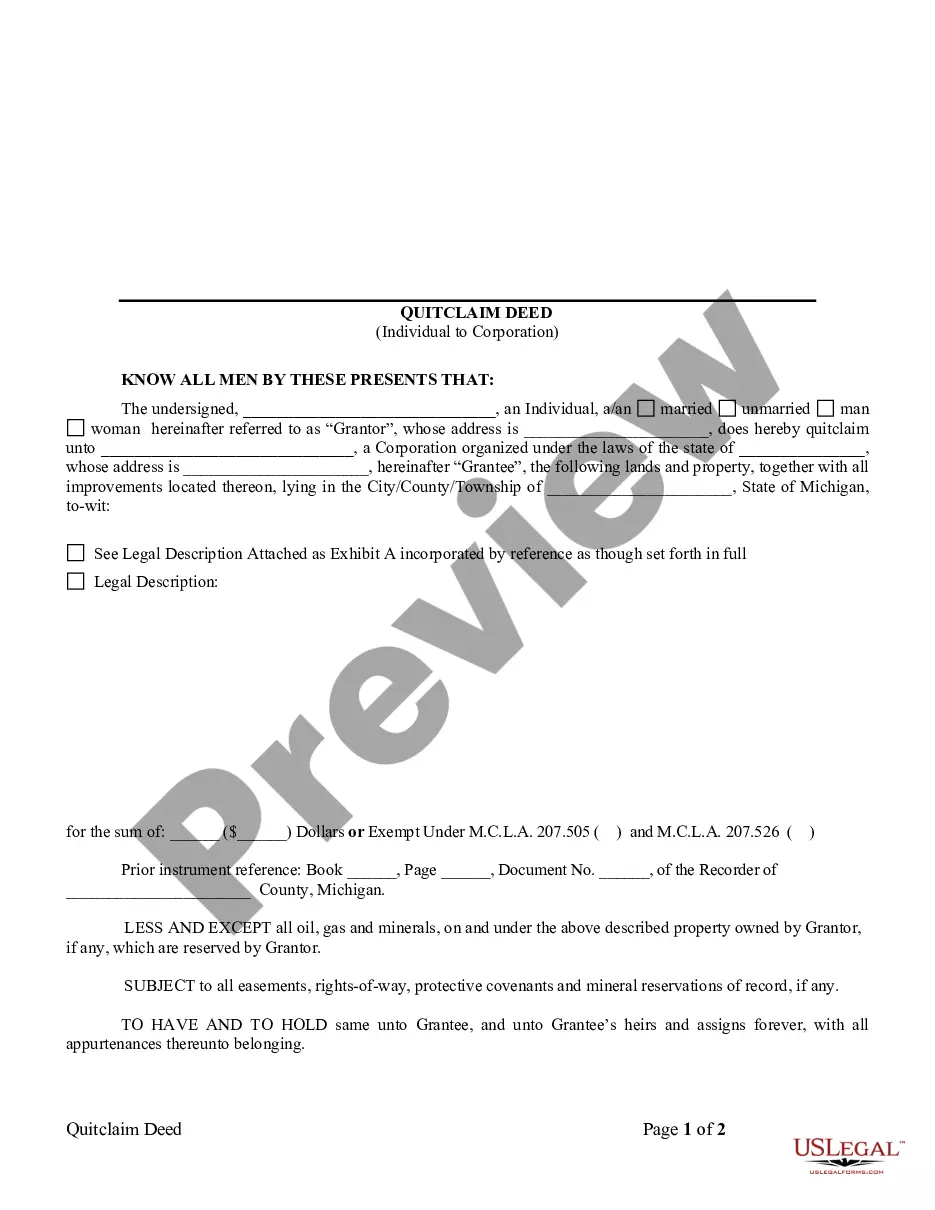

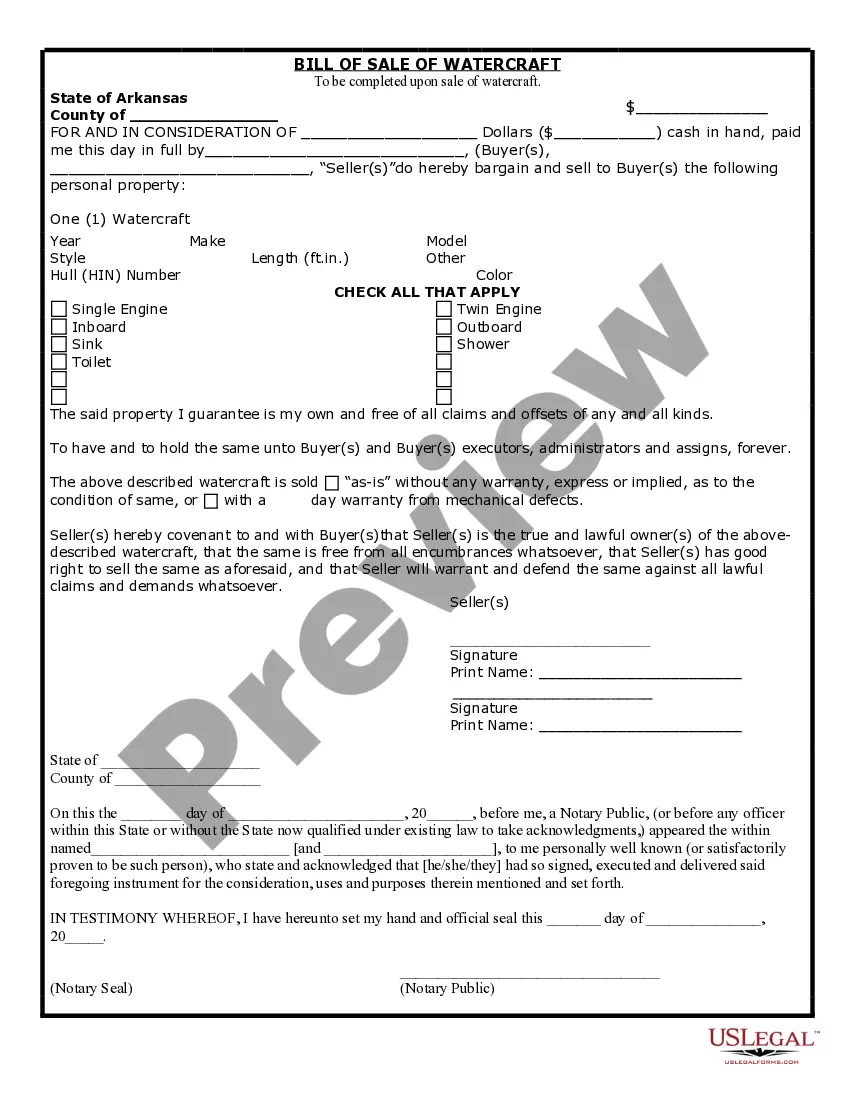

Utilize the US Legal Forms website. This service offers thousands of templates, including the Illinois Revocable Living Trust for Property, that can be used for both business and personal purposes.

You can browse the form using the Review button and read the form details to confirm this is the correct one for you.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Download button to obtain the Illinois Revocable Living Trust for Property.

- Use your account to review the official forms you have previously purchased.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your area/region.

Form popularity

FAQ

To place your house in an Illinois revocable living trust, you need to take a few straightforward steps. First, you will create the trust document, specifying you as the trustee and naming your beneficiaries. Then, transfer the property title into the trust. Since this can be complex, using a platform like uslegalforms can simplify the process of setting up your Illinois revocable living trust for house.

As noted, trusts in Illinois, specifically revocable living trusts for house, do not require recording. This feature can simplify your estate planning process and provide you with peace of mind. While you don’t have to file your trust with the state, keeping comprehensive records is crucial for effective management.

Creating a revocable living trust in Illinois does not require filing with the state. This offers flexibility and privacy, allowing you to retain control over your assets without state interference. To help you navigate the creation of your Illinois revocable living trust for house, consider using a trusted platform like uslegalforms.

In Illinois, a revocable living trust does not need to be recorded. This means your estate can remain private, allowing you to manage your assets without unnecessary public disclosure. However, while recording is not required, it’s essential to maintain proper documentation to protect your Illinois revocable living trust for house.

The new Illinois trust law introduces updates that improve the framework for setting up Illinois revocable living trusts for house ownership. This law provides clearer guidelines on how trusts operate, which can simplify the management of your estate. By navigating these updates, you can ensure your Illinois revocable living trust for house is compliant and serves your needs effectively.

Setting up an Illinois Revocable Living Trust for House involves several clear steps. First, you need to draft a trust document outlining the terms and conditions, which is often best done with a legal expert. Next, you will transfer your assets, such as your house, into the trust by changing the title. Utilizing a platform like uslegalforms can simplify this process, as it provides templates and guides tailored for Illinois residents.

Yes, you can place your house in an Illinois Revocable Living Trust for House even if it has a mortgage. However, it is essential to inform your lender about your decision, as some loans may contain due-on-sale clauses which could be triggered. Generally, most lenders allow property to be placed in a trust without penalty. By transferring your home into a revocable trust, you can ensure a smoother transfer of the property upon your passing.

While it is possible to create a trust on your own, working with a lawyer can ensure that your Illinois Revocable Living Trust for House meets all legal requirements. A lawyer can help you navigate complex laws, understand tax implications, and ensure that your assets are properly titled in the trust's name. Furthermore, their expertise can provide peace of mind, knowing that your plan is legally sound. Choosing to consult a lawyer can ultimately save you time and trouble in the long run.

When considering estate planning in Illinois, many people wonder whether a Will or a trust is more beneficial. An Illinois Revocable Living Trust for House allows for the easy transfer of property without going through probate, which can save time and reduce costs. While a Will goes through probate, which can be lengthy and public, a trust can provide privacy and streamline the process. Ultimately, the choice depends on your specific needs, and both can work together effectively.

To put your house in an Illinois Revocable Living Trust for House, you begin by drafting the trust agreement. After that, you will need to execute a deed that transfers ownership of the property into the trust. It's crucial to file the deed with your local recorder's office to finalize the transfer. Platforms like uslegalforms make this process straightforward by providing the necessary forms and guidance for a seamless transition.

Interesting Questions

More info

From wars to revolutions to famine, every major society has faced similar issues throughout history. But most people still find it difficult to think about it as a whole. I recently read this quote from John Donne: “I have known a great many things, I suppose that I have learned one great thing.” And in the same essay, the philosopher and playwright William Blake wrote: “What is real? To me, it is the idea that it does not seem so, and the idea that it can be so.” And in the same poem of William Blake, he wrote: “If I am dead I am dead, but if I don't exist — how can I lose?” Living Trusts isn't an application or a website that will teach you about these ideas. We are a real company that has real products that you can use to protect your wealth and live securely by investing in your home with Living Trusts today. To the uninitiated, living trusts are a type of mortgage for your personal home.