Illinois Agreement to Repay Cash Advance on Credit Card is a legal contract between a credit card holder and the credit card company or lender in the state of Illinois. This agreement outlines the terms and conditions for obtaining and repaying a cash advance taken from the credit card. A cash advance on a credit card allows the cardholder to withdraw money from their credit line. This option can be convenient in emergency situations or when immediate access to cash is necessary. However, it is important to understand the terms and conditions of the Illinois Agreement to Repay Cash Advance on Credit Card before proceeding. The Illinois Agreement to Repay Cash Advance on Credit Card typically includes details such as: 1. Loan Amount: The maximum cash advance limit available on the credit card. 2. Interest Rate: The interest rate charged on the cash advance. It is typically higher than the regular purchase interest rate and usually starts accruing from the day the advance is taken. 3. Repayment Terms: The agreement specifies the repayment terms, including the minimum monthly payment required, the repayment period, and any additional fees or penalties for late or missed payments. 4. Fees and Charges: The agreement outlines any upfront fees associated with the cash advance, such as transaction fees or ATM withdrawal charges. 5. Grace Period: Some credit cards may provide a grace period during which no interest is charged on the cash advance. The agreement will specify whether such a grace period exists and its duration. 6. Payment Allocation: If the credit card holder has an existing balance on the card, the agreement may specify how payments will be allocated between the cash advance and the outstanding balance. Types of Illinois Agreements to Repay Cash Advance on Credit Card: 1. Standard Cash Advance Agreement: This is the most common type of agreement for cash advances on credit cards, where the terms and conditions are set by the credit card company within the guidelines of Illinois laws and regulations. 2. Promotional Cash Advance Agreement: Some credit card issuers may offer special promotional rates or terms for cash advances. These promotions may have specific time limits or eligibility criteria, which are outlined in the agreement. 3. Secured Cash Advance Agreement: In certain cases, a credit cardholder may provide collateral to secure a cash advance. This type of agreement may have different terms and conditions due to the added security. It is crucial for the credit cardholder to carefully read and understand the Illinois Agreement to Repay Cash Advance on Credit Card before finalizing the cash advance transaction. This understanding ensures compliance with the agreement's terms and allows the cardholder to manage the cash advance effectively, avoid any unnecessary fees or penalties, and ensure timely repayment.

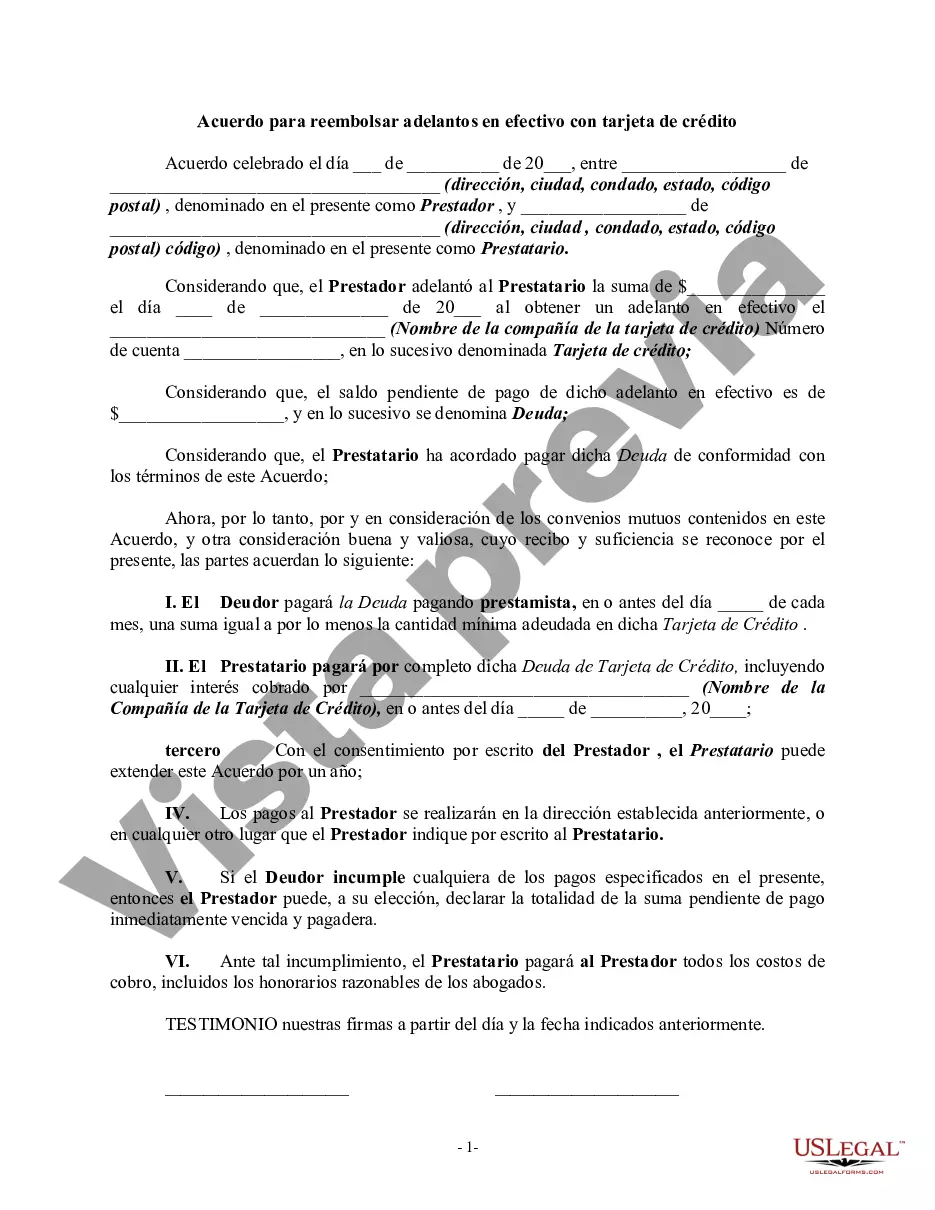

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Illinois Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

You can invest time online attempting to find the legal papers web template that suits the federal and state requirements you need. US Legal Forms gives thousands of legal forms which are analyzed by experts. You can easily down load or printing the Illinois Agreement to Repay Cash Advance on Credit Card from my service.

If you already possess a US Legal Forms account, it is possible to log in and click the Obtain switch. Next, it is possible to full, modify, printing, or indicator the Illinois Agreement to Repay Cash Advance on Credit Card. Each and every legal papers web template you buy is your own forever. To obtain an additional backup of the purchased kind, check out the My Forms tab and click the related switch.

Should you use the US Legal Forms internet site the first time, keep to the straightforward instructions below:

- Very first, make sure that you have selected the right papers web template for your region/town that you pick. See the kind explanation to make sure you have selected the right kind. If accessible, make use of the Preview switch to look throughout the papers web template as well.

- If you wish to locate an additional version in the kind, make use of the Lookup field to discover the web template that meets your requirements and requirements.

- When you have located the web template you need, click Get now to proceed.

- Pick the rates strategy you need, key in your credentials, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal account to fund the legal kind.

- Pick the formatting in the papers and down load it for your system.

- Make modifications for your papers if necessary. You can full, modify and indicator and printing Illinois Agreement to Repay Cash Advance on Credit Card.

Obtain and printing thousands of papers templates utilizing the US Legal Forms web site, that offers the biggest assortment of legal forms. Use expert and status-distinct templates to deal with your business or specific requires.