The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

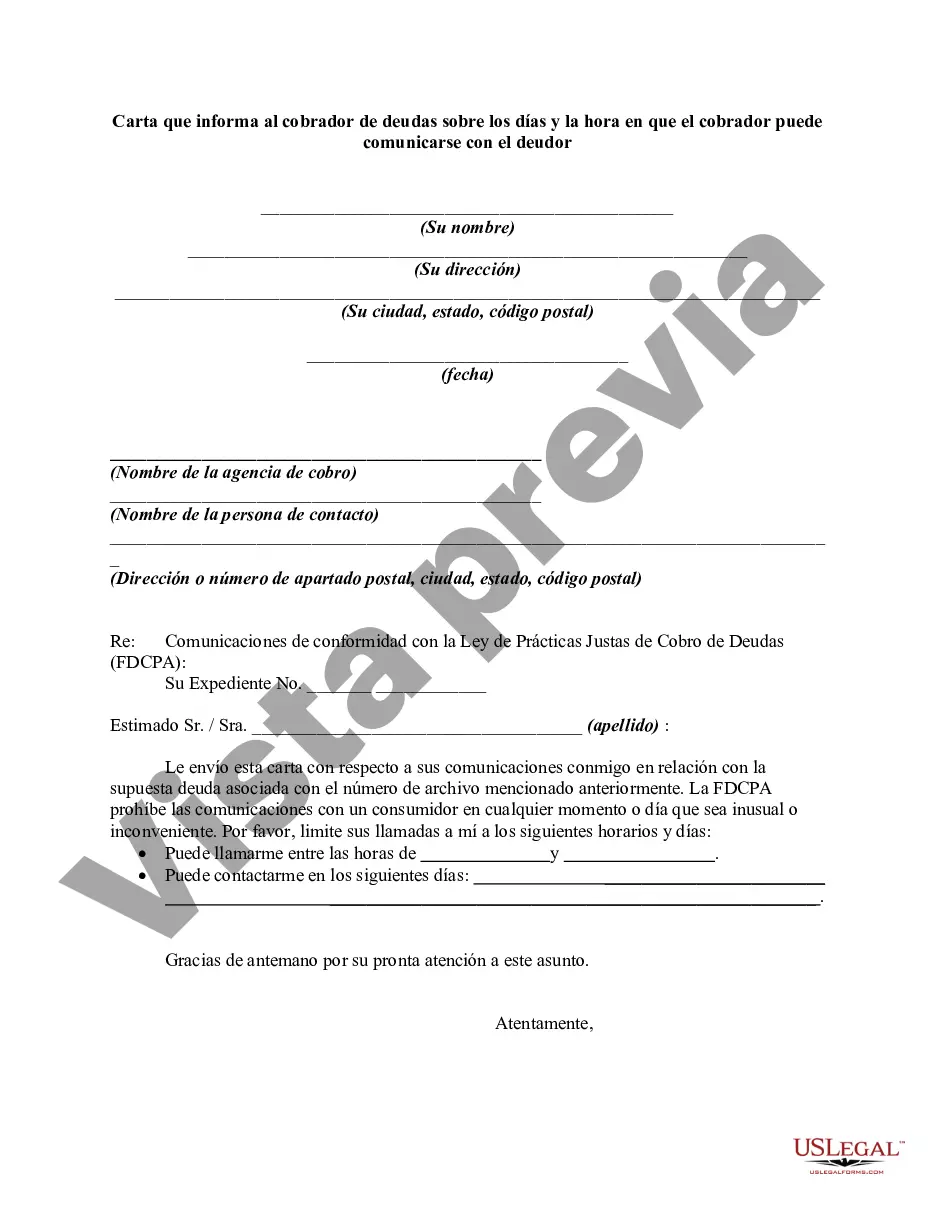

Title: Unveiling the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor Description: If you find yourself faced with debt-related challenges in Illinois, it's essential to understand your rights as a debtor. One crucial aspect of debt collection practices is limiting the days and times debt collectors can contact you. In this comprehensive guide, we will explore the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor, ensuring you have the knowledge to protect yourself. Keywords: Illinois, debt collector, letter, informing, days, time, contact, debtor, types, regulations, rights, restrictions Types of Illinois Letters Informing Debt Collector as to Days and Time Collector May Contact Debtor: 1. Standard Illinois Letter Informing Debt Collector: This type of letter acts as a formal notice sent by the debtor to inform the debt collector about the preferred days and times for contact. 2. Certified Illinois Letter Informing Debt Collector: A certified letter is used as a more legally binding and traceable method of communication. By sending a certified letter, debtors have a verifiable record that the letter was received by the debt collector. 3. Illinois Debt Collection Cease and Desist Letter: This type of letter is used when the debtor wants to completely halt all contact from the debt collector. It demands that the debt collector ceases all communication attempts immediately. 4. Illinois Letter Restricting Contact Frequency: Debtors can use this letter to specify the frequency of contact they deem appropriate. It restricts the frequency at which debt collectors can attempt contact, ensuring a more manageable and balanced communication approach. 5. Illinois Limited Hours of Contact Letter: This letter informs the debt collector about the specific hours during which they can contact the debtor. By specifying the allowed hours, debtors can regain control over their daily routines and avoid unnecessary disturbances. 6. Illinois Preferred Means of Communication Letter: This letter allows debtors to instruct the debt collector on their preferred method of communication, such as email, mail, or phone calls. It ensures that debt collectors respect the debtor's preferences when reaching out. 7. Illinois Letter Revoking Consent for Phone Contact: For debtors who prefer written communication or do not wish to be contacted via phone at all, this letter is used to revoke consent for phone contact by the debt collector. Remember, the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor is an essential tool to assert your rights as a debtor. Utilize these letter types to effectively communicate your preferences and establish boundaries within the debt collection process in Illinois.Title: Unveiling the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor Description: If you find yourself faced with debt-related challenges in Illinois, it's essential to understand your rights as a debtor. One crucial aspect of debt collection practices is limiting the days and times debt collectors can contact you. In this comprehensive guide, we will explore the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor, ensuring you have the knowledge to protect yourself. Keywords: Illinois, debt collector, letter, informing, days, time, contact, debtor, types, regulations, rights, restrictions Types of Illinois Letters Informing Debt Collector as to Days and Time Collector May Contact Debtor: 1. Standard Illinois Letter Informing Debt Collector: This type of letter acts as a formal notice sent by the debtor to inform the debt collector about the preferred days and times for contact. 2. Certified Illinois Letter Informing Debt Collector: A certified letter is used as a more legally binding and traceable method of communication. By sending a certified letter, debtors have a verifiable record that the letter was received by the debt collector. 3. Illinois Debt Collection Cease and Desist Letter: This type of letter is used when the debtor wants to completely halt all contact from the debt collector. It demands that the debt collector ceases all communication attempts immediately. 4. Illinois Letter Restricting Contact Frequency: Debtors can use this letter to specify the frequency of contact they deem appropriate. It restricts the frequency at which debt collectors can attempt contact, ensuring a more manageable and balanced communication approach. 5. Illinois Limited Hours of Contact Letter: This letter informs the debt collector about the specific hours during which they can contact the debtor. By specifying the allowed hours, debtors can regain control over their daily routines and avoid unnecessary disturbances. 6. Illinois Preferred Means of Communication Letter: This letter allows debtors to instruct the debt collector on their preferred method of communication, such as email, mail, or phone calls. It ensures that debt collectors respect the debtor's preferences when reaching out. 7. Illinois Letter Revoking Consent for Phone Contact: For debtors who prefer written communication or do not wish to be contacted via phone at all, this letter is used to revoke consent for phone contact by the debt collector. Remember, the Illinois Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor is an essential tool to assert your rights as a debtor. Utilize these letter types to effectively communicate your preferences and establish boundaries within the debt collection process in Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.