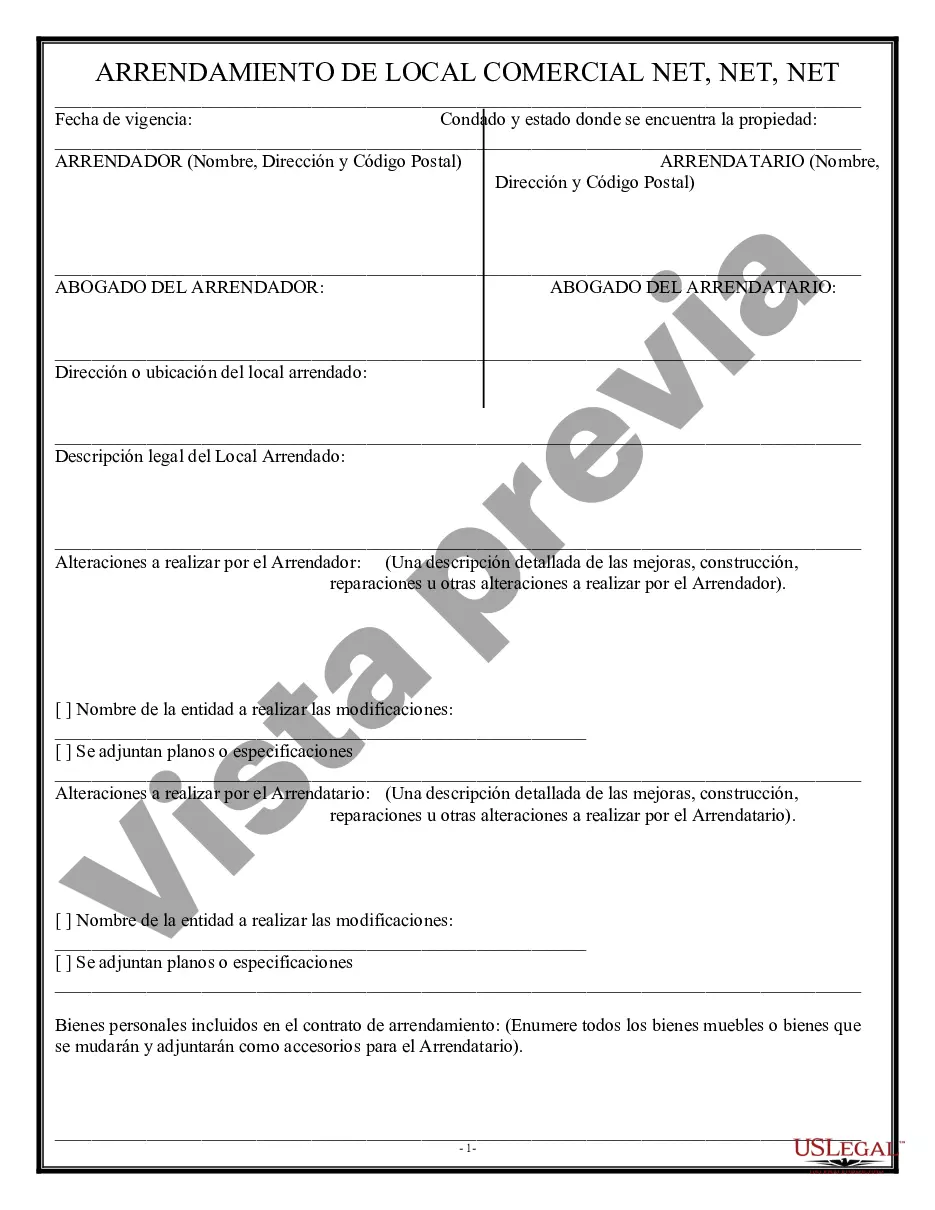

Illinois Triple Net Lease for Commercial Real Estate A triple net lease (NNN lease) is a commonly utilized form of commercial lease agreement in Illinois. This lease structure is characterized by the tenant taking on the responsibility for paying the property's operating expenses, including real estate taxes, insurance premiums, and maintenance costs, in addition to the base rent. The landlord, on the other hand, typically transfers the property's ownership and management duties to the tenant. In Illinois, there are several types of triple net leases for commercial real estate, each with its unique terms and conditions. These variations help accommodate different business and investment needs. Here are a few examples: 1. Absolute Triple Net Lease: This type of lease places the highest level of responsibility on the tenant as they assume responsibility not only for operating expenses but also for structural repairs and capital expenditures. The tenant becomes effectively responsible for all the costs associated with the property's ownership and must maintain it accordingly. 2. Double Net Lease: Although not as common as absolute triple net leases, a double net lease maintains similarities by shifting some operational costs to the tenant. In this case, the tenant will be responsible for property taxes and insurance, while the landlord continues to handle maintenance and repairs. 3. Modified Gross Lease: While not a true triple net lease, a modified gross lease still allots some financial obligations to the tenant. Operating expenses are typically shared between the landlord and tenant as negotiated in the lease agreement. This type of lease provides a more balanced approach compared to triple net lease structures. 4. Bendable Net Lease: This variation of a triple net lease typically includes a lease agreement with bendable features. A surety bond is used to ensure the landlord's protection in case the tenant defaults on their obligations. This type of lease adds an extra layer of security for landlords. When engaging in an Illinois triple net lease for commercial real estate, tenants and landlords need to carefully review and negotiate the lease agreement to ensure that all terms align with their respective obligations and expectations. Seeking legal advice is highly recommended to fully comprehend the terms and comply with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Illinois Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Finding the right legitimate file design could be a struggle. Obviously, there are plenty of templates available on the Internet, but how do you obtain the legitimate form you will need? Take advantage of the US Legal Forms website. The service delivers a huge number of templates, such as the Illinois Triple Net Lease for Commercial Real Estate, that can be used for business and private demands. Every one of the varieties are inspected by professionals and satisfy state and federal specifications.

Should you be presently listed, log in in your accounts and click on the Download button to obtain the Illinois Triple Net Lease for Commercial Real Estate. Use your accounts to search through the legitimate varieties you might have acquired in the past. Visit the My Forms tab of the accounts and have yet another duplicate of your file you will need.

Should you be a whole new customer of US Legal Forms, here are simple recommendations that you should comply with:

- Initial, ensure you have chosen the correct form for your area/state. You can examine the shape utilizing the Review button and study the shape description to make sure it will be the best for you.

- In the event the form fails to satisfy your requirements, use the Seach industry to get the right form.

- Once you are certain that the shape is suitable, select the Purchase now button to obtain the form.

- Select the prices program you want and type in the required information and facts. Design your accounts and purchase the transaction using your PayPal accounts or charge card.

- Pick the document format and down load the legitimate file design in your gadget.

- Full, modify and print out and sign the acquired Illinois Triple Net Lease for Commercial Real Estate.

US Legal Forms is definitely the largest collection of legitimate varieties for which you can discover various file templates. Take advantage of the service to down load professionally-made files that comply with condition specifications.