Illinois Revocable Trust for House

Description

How to fill out Revocable Trust For House?

You can spend numerous hours online trying to locate the legal document template that meets the state and federal criteria you need.

US Legal Forms offers a wide selection of legal documents that are reviewed by experts.

It's easy to download or print the Illinois Revocable Trust for House from my service.

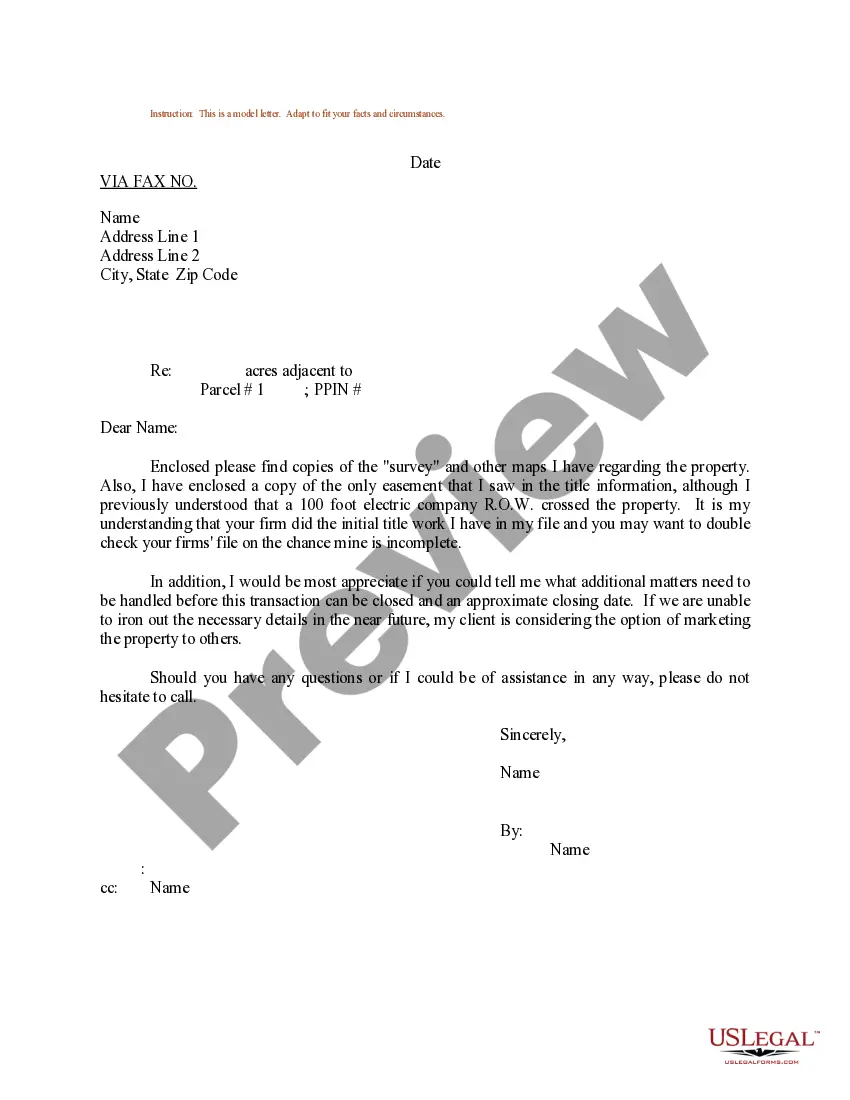

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Illinois Revocable Trust for House.

- Every legal document template you download is yours to keep indefinitely.

- To obtain another copy of the downloaded form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, verify that you have selected the correct document template for the state/region of your choice.

- Review the form description to ensure you have chosen the right document.

Form popularity

FAQ

To put your house in an Illinois Revocable Trust for House, start by creating the trust document to outline the terms and beneficiaries. Afterward, execute a deed transferring the property into the trust. You may want to use a platform such as US Legal Forms to assist you in drafting the trust and deed correctly, making the process smooth and compliant with Illinois laws.

An Illinois Revocable Trust for House is often considered the best option for holding residential property. This type of trust allows you to maintain control of your home during your lifetime, while providing a straightforward transfer of assets upon your passing. It simplifies estate management and can help avoid probate. For personalized guidance, consider using resources like US Legal Forms.

To transfer property to an Illinois Revocable Trust for House, you will need to execute a deed that names the trust as the new owner. This process typically involves drafting a new deed, signing it in front of a notary, and then recording it with the county clerk. It's important to consult an attorney or use a reliable platform like US Legal Forms to ensure that all paperwork is completed correctly, safeguarding your interests.

While an Illinois revocable trust for house offers many benefits, there are some disadvantages to consider. The primary concern is that establishing and maintaining the trust requires time and effort, along with potential costs for legal advice and documentation. Additionally, assets in a revocable trust are still included in your taxable estate, which may impact your heirs’ tax situation. It's essential to weigh these factors along with the advantages to make the best decision for your needs.

You should consider putting your house in an Illinois revocable trust to maintain flexibility and control over your property while alive. This allows you to make changes as needed without significant legal hurdles. It also ensures that your property is distributed according to your wishes after you pass, providing peace of mind for you and your loved ones.

Putting a house in an Illinois revocable trust allows for seamless transfer of ownership upon your passing, avoiding probate. This arrangement can save your heirs time, legal fees, and hassle, while also maintaining control over your asset during your lifetime. By choosing this option, you simplify your estate management and ensure your wishes are respected.

To place your house in an Illinois revocable trust, you first need to create the trust document, naming yourself as the trustee. Next, you'll transfer the ownership of the house to the trust by executing a new deed that specifies the trust as the owner. UsLegalForms provides templates and guidance that make this process straightforward, ensuring that your Illinois revocable trust for house is set up correctly and in accordance with state laws.

A nursing home can potentially access the assets in an Illinois revocable trust for house if the homeowner needs increased financial aid for care. However, since the trust remains revocable, the assets may still be considered part of your estate when determining eligibility for Medicaid. It's important to understand that a properly structured Illinois revocable trust for house can provide some protection, but consulting a legal expert can help you make informed decisions.

A common mistake parents make when establishing an Illinois Revocable Trust for House is failing to fund the trust properly. Simply creating the trust document is not enough; all intended assets, including property and investments, must be transferred into the trust. This oversight can lead to confusion, legal complications, and unintended consequences, ultimately defeating the purpose of the trust.

In Illinois, an Illinois Revocable Trust for House does not need to be recorded with the county. Unlike wills, trusts operate privately and do not go through probate. However, it is essential to maintain organized records and documentation regarding the trust's assets and terms to ensure effective management and clarity for beneficiaries.