Illinois Revocable Trust for Minors

Description

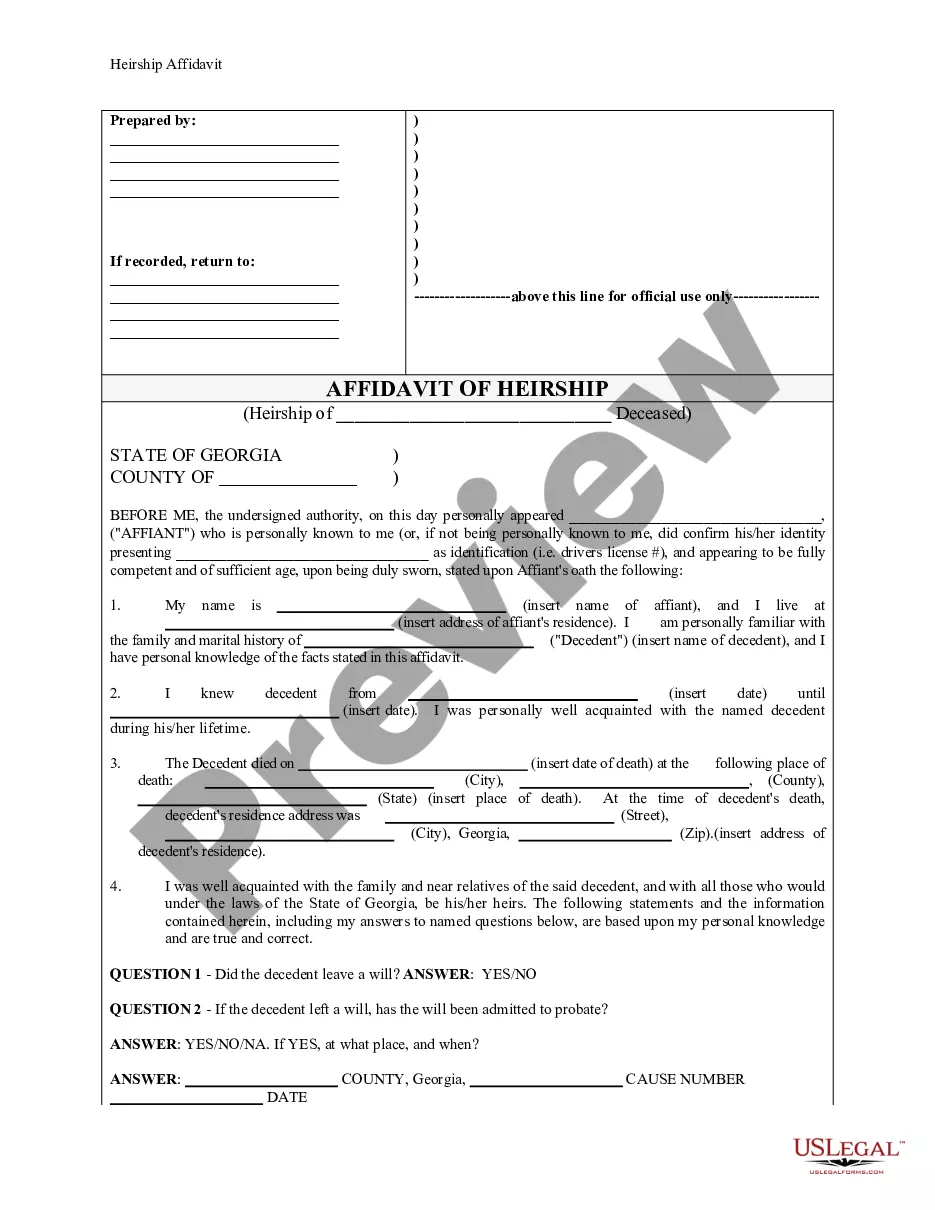

How to fill out Revocable Trust For Minors?

It is feasible to spend hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can conveniently download or print the Illinois Revocable Trust for Minors from the service.

If needed, utilize the Search field to find the template that satisfies your needs and specifications. Once you have identified the template you want, click Acquire now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to the document if required. You can complete, edit, and sign and print the Illinois Revocable Trust for Minors. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Illinois Revocable Trust for Minors.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure that you have selected the correct document template for your region/town that you have chosen.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Creating an Illinois Revocable Trust for Minors involves several key steps. First, you need to choose a suitable trustee who will manage the trust for your minor beneficiaries. Next, you will draft the trust document, clearly outlining the terms and conditions, including distribution guidelines for the trust assets. Lastly, ensure that the trust is properly funded, which may involve transferring assets into the trust, helping to secure your child's financial future.

An Illinois Revocable Trust for Minors is often a great choice for providing financial support to children. This type of trust offers parents the ability to control the distribution of assets until the child reaches a predetermined age. Additionally, parents can adjust the trust's terms as their child's needs evolve. Creating a trust instead of a will helps ensure that funds are protected and used for defined purposes, fostering financial responsibility as the child matures.

The best age to set up an Illinois Revocable Trust for Minors typically depends on when you start to accumulate significant assets or have specific wishes for your child's future. Many parents consider establishing a trust at the time of their child’s birth, especially if they are concerned about inheritance or financial management later in life. Early planning allows you to outline how and when your child will receive their assets, providing peace of mind as they grow. Consider working with uslegalforms to develop a tailored plan that reflects your family's needs.

Yes, an Illinois Revocable Trust for Minors must be properly executed to be valid. While the trust document itself does not technically require notarization, having it notarized can provide additional legal protection and verification of the grantor's intentions. It's advisable to consult with a legal professional when drafting your trust to ensure it meets all legal requirements. This practice helps prevent disputes and strengthens the trust's credibility.

A minor trust, often referred to in the context of an Illinois Revocable Trust for Minors, is designed to manage assets for children until they reach legal adulthood. This type of trust ensures that financial resources are available for the minor's education, healthcare, and other needs. By using a revocable trust, parents can maintain control over the assets while providing security for their children. It offers flexibility, allowing for adjustments in management as the child grows.

One of the biggest mistakes parents make is failing to fund the Illinois Revocable Trust for Minors after its establishment. Creating the trust is only the first step; you must transfer the intended assets into it for it to be effective. Additionally, neglecting to keep the trust updated as circumstances change can lead to complications. Regularly reviewing your trust ensures it meets your family's evolving needs.

Placing your home in an Illinois Revocable Trust for Minors can be a wise decision. This action helps ensure that your home is managed according to your wishes after your passing. It can protect your asset from probate, making it easier for your loved ones to access. Consider your financial situation and goals to see if this step aligns with your estate planning strategy.

Both a will and a trust have their benefits, but the Illinois Revocable Trust for Minors offers unique advantages. A trust helps you avoid probate, providing quicker access to assets for your beneficiaries. Additionally, it allows for more control over asset distribution. While a will may be simpler to create, a trust often provides greater long-term benefits in managing and protecting your children's inheritance.

Yes, you can set up an Illinois Revocable Trust for Minors without an attorney, but it is crucial to be well-informed about the legal requirements. Our platform offers comprehensive resources and templates, making the process more accessible. However, for complex situations or significant assets, consulting with a legal expert might be beneficial. This ensures all aspects of the trust are legally sound.

To set up an Illinois Revocable Trust for Minors, begin by drafting the trust document outlining the terms and conditions. You can choose to do this with the help of a legal professional or utilize our platform for simplified templates and guidance. Once the document is complete, fund the trust by transferring assets into it. These steps ensure your trust operates smoothly and effectively for your family.