When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: Illinois Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Illinois, credit card, company, lower payments, financial difficulties Introduction: In Illinois, individuals facing financial challenges may find themselves struggling with credit card debt. Writing a well-crafted letter to their credit card company can be an effective way to seek relief by requesting a lower payment option. This article will provide a detailed description of an Illinois letter designed to help individuals in financial distress reduce their credit card payments. Types of Illinois Letters for Seeking Lower Payments: 1. Illinois Hardship Letter to Credit Card Company: An Illinois hardship letter serves as a formal request from a debtor experiencing significant financial difficulties. By outlining the reasons behind their hardships and providing supporting documentation, debtors can appeal for reduced or modified credit card payments. 2. Illinois Income Reduction Letter to Credit Card Company: An Illinois income reduction letter is ideal for individuals who faced sudden income cuts, such as reduced working hours, job loss, or decreased wages. This type of letter highlights the debtor's income reduction and argues for a lower monthly payment based on their current financial state. 3. Illinois Medical Debt Hardship Letter to Credit Card Company: Medical bills can substantially impact an individual's finances in Illinois. This specialized letter targets those who have accumulated substantial medical debt and faced financial distress. Debtors explain the medical situation, burdensome expenses, and implications on their ability to make regular credit card payments, requesting a payment reduction. 4. Illinois Divorce or Separation Letter to Credit Card Company: Divorce or separation can greatly impact an individual's finances. An Illinois divorce or separation letter to the credit card company details the debtor's altered financial circumstances and the subsequent struggle to meet their credit card payments. This letter highlights the need for a reduced payment arrangement during this transitional period. 5. Illinois Natural Disaster Hardship Letter to Credit Card Company: Following a devastating natural disaster, Illinois residents might experience financial hardships due to property damage, displacement, or loss of income. This letter clearly explains the connection between the natural disaster and the debtor's inability to fulfill their credit card obligations, essentially requesting lower payments to alleviate immediate financial strain. Conclusion: Illinois residents encountering financial difficulties with their credit card payments have various options to communicate with their credit card company. Crafting a tailored and persuasive letter that highlights the specific circumstances and needs can greatly increase the chances of securing a reduced payment arrangement. By using the appropriate type of Illinois letter based on their situation, debtors can take a proactive step towards easing their financial burdens.Title: Illinois Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Illinois, credit card, company, lower payments, financial difficulties Introduction: In Illinois, individuals facing financial challenges may find themselves struggling with credit card debt. Writing a well-crafted letter to their credit card company can be an effective way to seek relief by requesting a lower payment option. This article will provide a detailed description of an Illinois letter designed to help individuals in financial distress reduce their credit card payments. Types of Illinois Letters for Seeking Lower Payments: 1. Illinois Hardship Letter to Credit Card Company: An Illinois hardship letter serves as a formal request from a debtor experiencing significant financial difficulties. By outlining the reasons behind their hardships and providing supporting documentation, debtors can appeal for reduced or modified credit card payments. 2. Illinois Income Reduction Letter to Credit Card Company: An Illinois income reduction letter is ideal for individuals who faced sudden income cuts, such as reduced working hours, job loss, or decreased wages. This type of letter highlights the debtor's income reduction and argues for a lower monthly payment based on their current financial state. 3. Illinois Medical Debt Hardship Letter to Credit Card Company: Medical bills can substantially impact an individual's finances in Illinois. This specialized letter targets those who have accumulated substantial medical debt and faced financial distress. Debtors explain the medical situation, burdensome expenses, and implications on their ability to make regular credit card payments, requesting a payment reduction. 4. Illinois Divorce or Separation Letter to Credit Card Company: Divorce or separation can greatly impact an individual's finances. An Illinois divorce or separation letter to the credit card company details the debtor's altered financial circumstances and the subsequent struggle to meet their credit card payments. This letter highlights the need for a reduced payment arrangement during this transitional period. 5. Illinois Natural Disaster Hardship Letter to Credit Card Company: Following a devastating natural disaster, Illinois residents might experience financial hardships due to property damage, displacement, or loss of income. This letter clearly explains the connection between the natural disaster and the debtor's inability to fulfill their credit card obligations, essentially requesting lower payments to alleviate immediate financial strain. Conclusion: Illinois residents encountering financial difficulties with their credit card payments have various options to communicate with their credit card company. Crafting a tailored and persuasive letter that highlights the specific circumstances and needs can greatly increase the chances of securing a reduced payment arrangement. By using the appropriate type of Illinois letter based on their situation, debtors can take a proactive step towards easing their financial burdens.

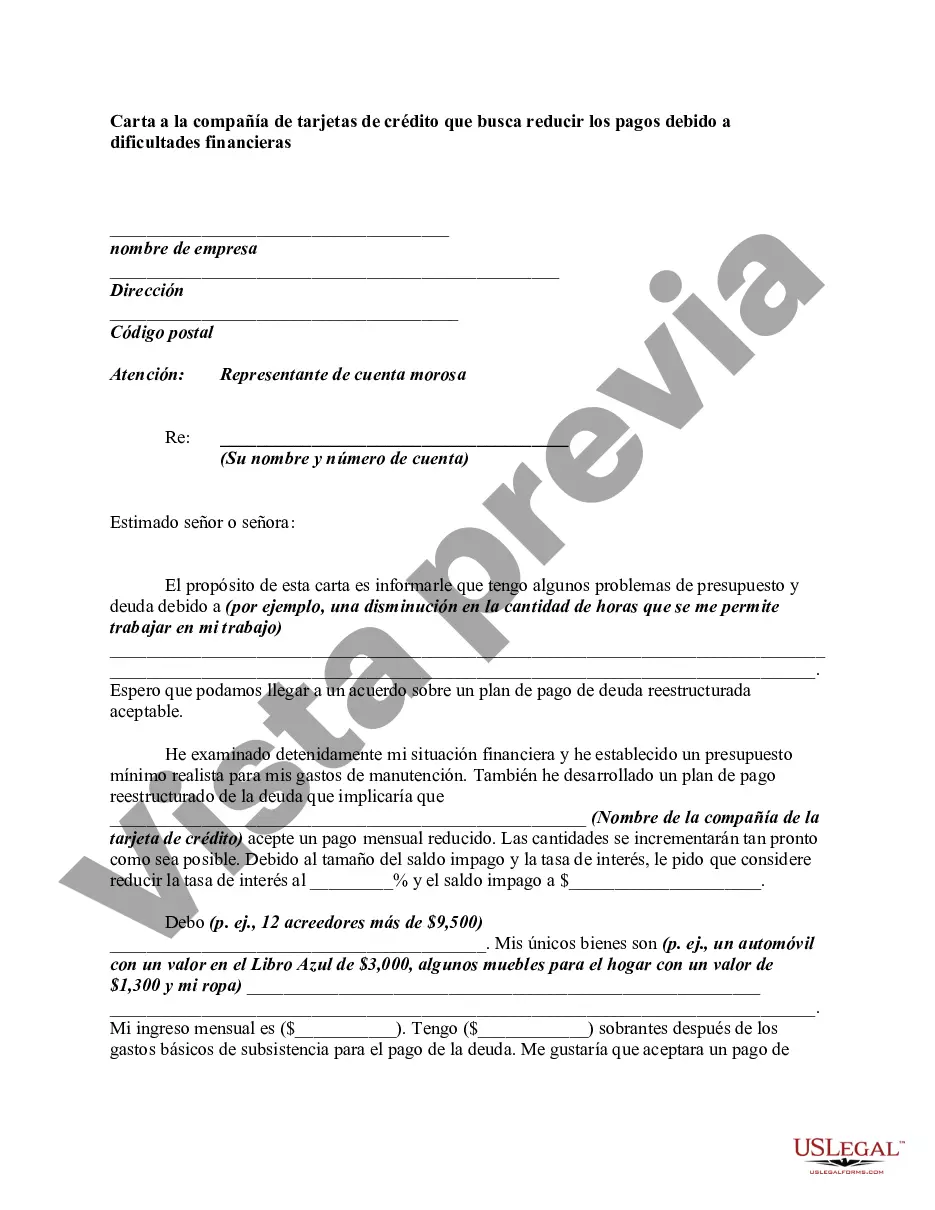

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.