A sale of all or substantially all corporate assets is authorized by statute in most jurisdictions, and the procedures and requirements set forth in the applicable statutes must be complied with. Typical requirements for a sale of all or substantially all corporate assets include appropriate action by the directors establishing the need for and directing the sale, and approval by a prescribed number or percentage of the shareholders.

Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation

Description

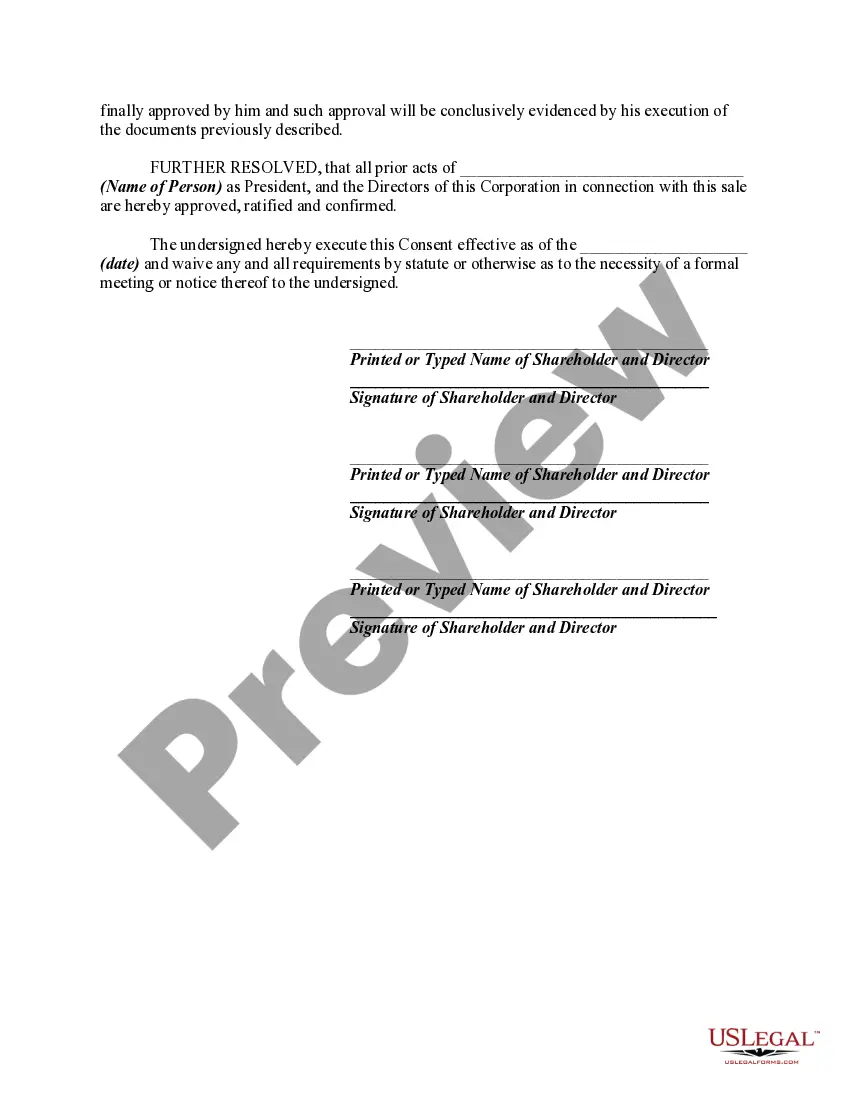

How to fill out Unanimous Written Consent By Shareholders And The Board Of Directors Electing A New Director And Authorizing The Sale Of All Or Substantially Of The Assets Of A Corporation?

US Legal Forms - one of the most extensive collections of official documents in the USA - provides a range of legal document templates that you can download or print.

On the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation in just a few seconds.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you want and provide your information to register for an account.

- If you already have an account, Log In to download the Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation from the US Legal Forms collection.

- The Download button will appear on every form you review.

- You can access all previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you start.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form’s content.

Form popularity

FAQ

Involuntary dissolution occurs when an Illinois corporation is dissolved against its will, typically due to legal issues or non-compliance with state regulations. This process can significantly impact shareholders and involves a court intervention. Understanding mechanisms like Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation may help corporations navigate potential legal challenges and avoid involuntary dissolution.

The replacement tax in Illinois applies to corporations and partnerships that generate income in the state. For small business corporations, this tax is calculated based on their net income, ensuring that even smaller entities contribute to state revenue. Utilizing Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation can help streamline discussions about tax implications and financial strategies.

The Corporation Act in Illinois provides a framework for businesses to operate smoothly and efficiently. One of its key benefits is allowing corporations to use Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation. This process facilitates decision-making without needing a formal meeting, saving time and enhancing flexibility for corporations.

The survival statute in Illinois refers to the legal provisions that allow a corporation to maintain its identity after significant changes, such as mergers or asset sales. This statute protects the interests of shareholders and ensures that corporate activities remain legally binding. Keeping this in mind is crucial for understanding the implications of Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

Statute 11-709 in Illinois pertains to the governance of corporate actions and clarifies the responsibilities of directors. This law helps ensure that corporate maneuvers, including those related to shareholder consent, follow legal protocols. Familiarity with this statute is essential for those involved in Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

The corporate survival statute in Illinois refers to laws that enable corporations to continue existing after certain events, like mergers or asset sales. This statute ensures that all rights and obligations of a corporation are preserved despite these changes. Knowledge of this law is important when considering Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

Section 9.20 of the Illinois Business Corporation Act pertains to the requirements for filing and maintaining certain corporate records. This section emphasizes transparency and accountability within corporations, facilitating an effective governance structure. Proper adherence to this section aligns well with the Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

Statute 11-501.1 in Illinois addresses issues related to the unlawful use of corporation assets and remedies for shareholders. It provides crucial protections for shareholders against unauthorized actions that could jeopardize their investments. Understanding this statute can be vital in the context of Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

Section 7.75 of the Illinois Business Corporation Act outlines the procedures for Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation. This section allows actions to be taken without a formal meeting if all shareholders and directors agree. It streamlines decision-making, ensuring timely and efficient corporate governance.

Section 8.65 of the Illinois Business Corporation Act addresses the procedures and regulations surrounding written consents by shareholders and directors. This section helps define how actions can be taken without a formal meeting, ensuring that corporate governance remains effective and compliant. By understanding the implications of the Illinois Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation, businesses can navigate their responsibilities more effectively.