An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

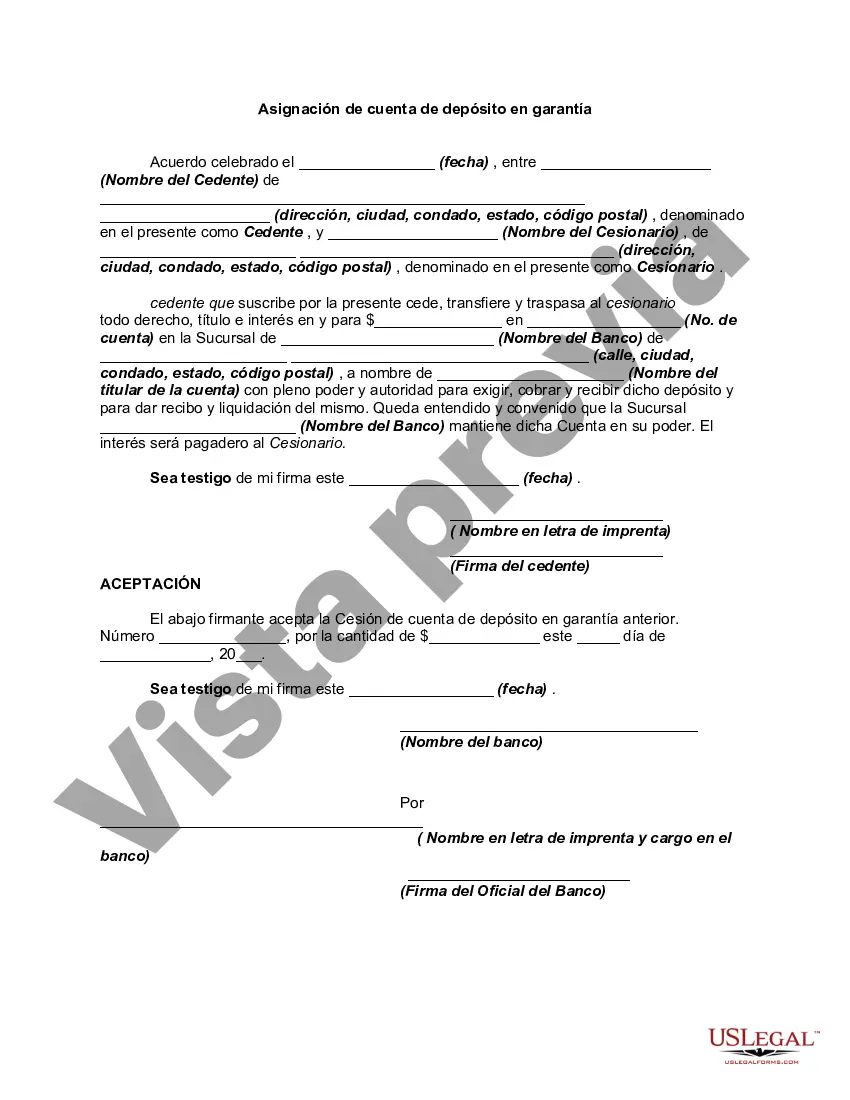

Illinois Assignment of Escrow Account refers to the legal process by which one party transfers their rights and obligations associated with an escrow account to another individual or entity in the state of Illinois. This assignment is typically done through a written agreement, which outlines the terms and conditions of the transfer. An escrow account is a financial instrument that holds funds for a specific purpose, such as a real estate transaction or the payment of taxes. It acts as a neutral third party, ensuring that the funds are protected and disbursed appropriately according to the terms agreed upon by the parties involved. In Illinois, there are several types of Assignment of Escrow Account, including: 1. Real Estate Assignment of Escrow Account: This type of assignment is commonly used in real estate transactions where the buyer or seller transfers their rights and obligations related to an escrow account to another party. It may involve the transfer of funds for down payments, closing costs, or other transaction-related expenses. 2. Mortgage Assignment of Escrow Account: This type of assignment occurs when the original lender transfers the responsibility of managing an escrow account to a new lender. This often happens during the refinancing of a mortgage or the transfer of a loan from one financial institution to another. 3. Tax Assignment of Escrow Account: This assignment involves the transfer of funds held in an escrow account for the payment of taxes. It may occur when a property owner transfers their tax obligations to a new owner, or when a taxpayer assigns their escrow account to a tax professional or attorney responsible for managing their tax payments. 4. Legal Assignment of Escrow Account: In some cases, parties involved in a legal dispute may assign their escrow account to a third party, typically an attorney or a court-appointed trustee. This assignment ensures that the funds in the escrow account will be managed impartially and disbursed in accordance with the court's decisions. When executing an Illinois Assignment of Escrow Account, it is crucial to consult with legal professionals experienced in escrow laws to ensure compliance with the state's regulations. Proper documentation and clear terms are essential to protect the interests of all parties involved and ensure a smooth transfer of responsibilities related to the escrow account.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.