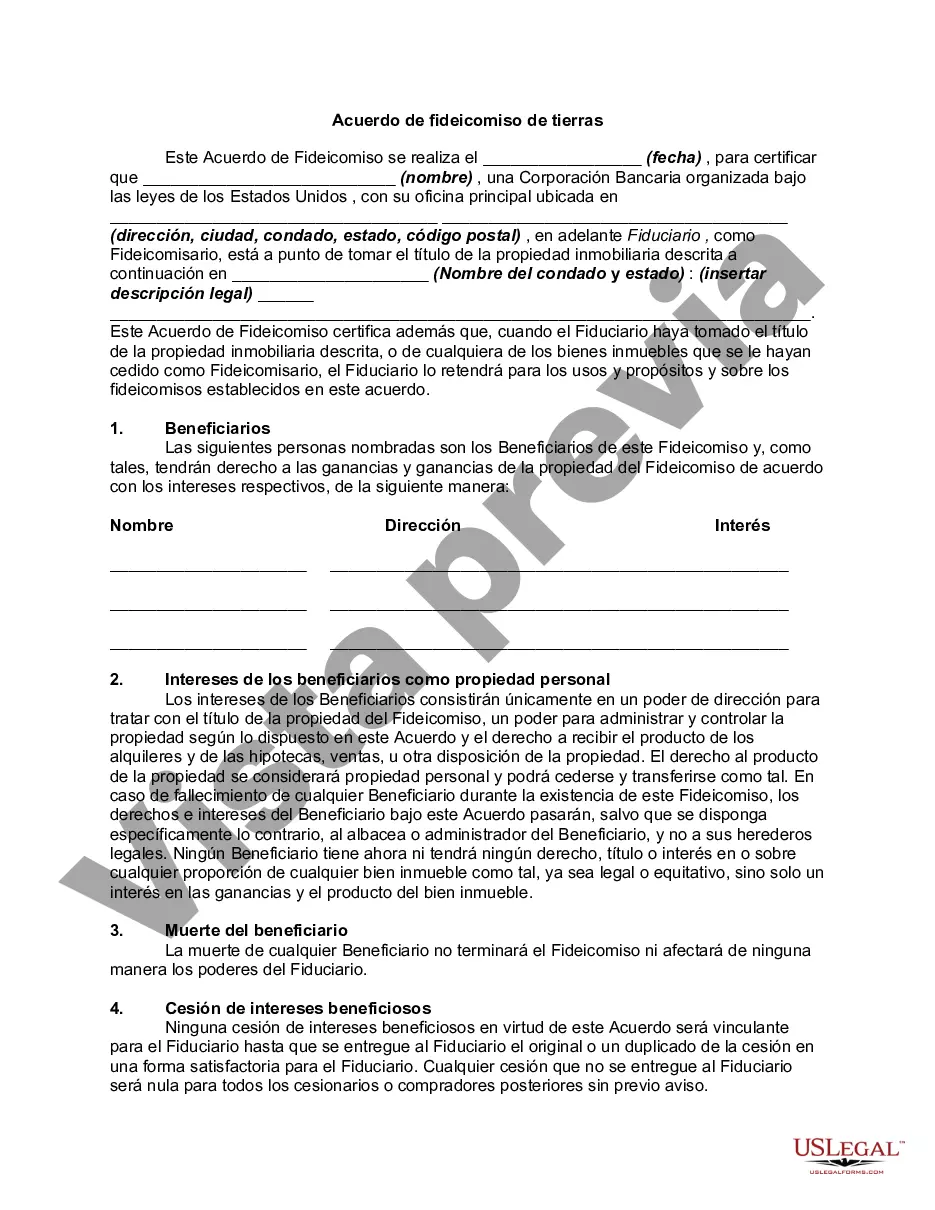

There are two basic instruments required to establish a land trust. One is a deed in trust conveying the real estate to a trustee. The other is a trust agreement defining the rights and duties of the trustee and the beneficiaries, which is mentioned in the deed of trust but is not recorded. The deed in trust should convey title to real property to a trustee and confer complete trust powers on the trustee so that the trustee can deal with third parties without reference to the trust agreement. Restrictions on the trustee's powers should be set forth in the trust agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Illinois Land Trust Agreement refers to a legal arrangement recognized in the state of Illinois that allows individuals or entities to hold real estate property through a trust. This agreement provides a secure and flexible method for managing and protecting real estate assets while maintaining privacy and minimizing potential risks. A land trust agreement in Illinois involves three primary parties: the beneficiary, the trustee, and the property owner. The beneficiary is the individual or entity who will receive the benefits of the land trust, such as income or proceeds from the property. The trustee is the entity responsible for managing the trust and ensuring the property's management in accordance with the terms of the agreement. Finally, the property owner is the individual or entity that places the property into the trust. The Illinois Land Trust Agreement offers several advantages for property owners. Firstly, it provides an additional layer of privacy and asset protection as the trust becomes the legal owner of the property, shielding the true owner's identity. Secondly, the agreement allows for seamless transfer of property interests, avoiding public record updates or unnecessary taxes associated with changing property ownership. Furthermore, the land trust agreement can streamline management and allows properties to be held together in a single trust, facilitating easier control and decision-making. In Illinois, there are different types of land trust agreements available, each tailored to cater to specific needs. Some notable types include: 1. Residential Land Trust: This type of trust is commonly used for residential properties, enabling homeowners to transfer the property into a trust while retaining full control and use of the property. Income generated through leasing or renting the property remains the beneficiary's. 2. Commercial Land Trust: Designed for commercial properties, this type of trust agreement provides the flexibility and benefits similar to residential land trusts but is specialized for commercial real estate, including office buildings, retail spaces, or industrial warehouses. 3. Conservation Land Trust: It is a specific type of land trust agreement geared towards protecting environmentally significant land or natural areas. By placing land into a conservation trust, the beneficiary ensures its preservation while enjoying potential tax benefits or access to grants. 4. Agricultural Land Trust: Agricultural land trusts serve the purpose of preserving farmland, managing it sustainably, and protecting it against urbanization. This type of trust helps farmers maintain control over their land while ensuring it remains dedicated to agricultural purposes. In conclusion, the Illinois Land Trust Agreement allows real estate property owners to create a trust to hold and manage their property, offering various benefits such as privacy, asset protection, ease of transfer, and efficient management. Different types of land trust agreements cater to residential, commercial, conservation, and agricultural properties, addressing the specific needs of property owners.The Illinois Land Trust Agreement refers to a legal arrangement recognized in the state of Illinois that allows individuals or entities to hold real estate property through a trust. This agreement provides a secure and flexible method for managing and protecting real estate assets while maintaining privacy and minimizing potential risks. A land trust agreement in Illinois involves three primary parties: the beneficiary, the trustee, and the property owner. The beneficiary is the individual or entity who will receive the benefits of the land trust, such as income or proceeds from the property. The trustee is the entity responsible for managing the trust and ensuring the property's management in accordance with the terms of the agreement. Finally, the property owner is the individual or entity that places the property into the trust. The Illinois Land Trust Agreement offers several advantages for property owners. Firstly, it provides an additional layer of privacy and asset protection as the trust becomes the legal owner of the property, shielding the true owner's identity. Secondly, the agreement allows for seamless transfer of property interests, avoiding public record updates or unnecessary taxes associated with changing property ownership. Furthermore, the land trust agreement can streamline management and allows properties to be held together in a single trust, facilitating easier control and decision-making. In Illinois, there are different types of land trust agreements available, each tailored to cater to specific needs. Some notable types include: 1. Residential Land Trust: This type of trust is commonly used for residential properties, enabling homeowners to transfer the property into a trust while retaining full control and use of the property. Income generated through leasing or renting the property remains the beneficiary's. 2. Commercial Land Trust: Designed for commercial properties, this type of trust agreement provides the flexibility and benefits similar to residential land trusts but is specialized for commercial real estate, including office buildings, retail spaces, or industrial warehouses. 3. Conservation Land Trust: It is a specific type of land trust agreement geared towards protecting environmentally significant land or natural areas. By placing land into a conservation trust, the beneficiary ensures its preservation while enjoying potential tax benefits or access to grants. 4. Agricultural Land Trust: Agricultural land trusts serve the purpose of preserving farmland, managing it sustainably, and protecting it against urbanization. This type of trust helps farmers maintain control over their land while ensuring it remains dedicated to agricultural purposes. In conclusion, the Illinois Land Trust Agreement allows real estate property owners to create a trust to hold and manage their property, offering various benefits such as privacy, asset protection, ease of transfer, and efficient management. Different types of land trust agreements cater to residential, commercial, conservation, and agricultural properties, addressing the specific needs of property owners.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.