This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Illinois General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract that outlines the terms and conditions for the sale of a business by a sole proprietor in the state of Illinois. This agreement is specifically designed for asset purchase transactions, where the buyer acquires the assets of the business instead of buying the entire company. Keywords: Illinois, general form, agreement, sale of business, sole proprietor, asset purchase agreement. Different types or variations of the Illinois General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement, which covers the sale and purchase of all the assets belonging to the business. These assets typically include inventory, equipment, customer lists, intellectual property, leases, licenses, and goodwill. 2. Specific Asset Purchase Agreement: In some cases, the parties may decide to negotiate the sale of specific assets rather than the entire business. This type of agreement allows for a more targeted transaction where only certain assets, such as equipment or inventory, are being sold. 3. Real Estate Asset Purchase Agreement: If the business being sold includes real estate properties, this type of agreement is used to outline the terms and conditions for the purchase of those specific assets. It covers the transfer of ownership, financing options, closing conditions, and any other relevant details related to the real estate transaction. 4. Intellectual Property Asset Purchase Agreement: In instances where the value of the business lies primarily in its intellectual property assets, such as trademarks, copyrights, or patents, an intellectual property asset purchase agreement is used. This agreement specifically addresses the transfer of these intangible assets and any associated rights or licenses. 5. Franchise Asset Purchase Agreement: When a franchised business is being sold, a franchise asset purchase agreement is necessary. This agreement not only covers the purchase of the franchise's assets but also outlines the terms and conditions for the buyer to assume the existing franchise agreement and maintain the franchisor-franchisee relationship. It's important to note that the specific type of asset purchase agreement used may vary depending on the nature of the business being sold and the preferences of the parties involved. Consulting with a qualified attorney is advised to ensure that the agreement accurately reflects the intentions and protects the rights of all parties.The Illinois General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract that outlines the terms and conditions for the sale of a business by a sole proprietor in the state of Illinois. This agreement is specifically designed for asset purchase transactions, where the buyer acquires the assets of the business instead of buying the entire company. Keywords: Illinois, general form, agreement, sale of business, sole proprietor, asset purchase agreement. Different types or variations of the Illinois General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement, which covers the sale and purchase of all the assets belonging to the business. These assets typically include inventory, equipment, customer lists, intellectual property, leases, licenses, and goodwill. 2. Specific Asset Purchase Agreement: In some cases, the parties may decide to negotiate the sale of specific assets rather than the entire business. This type of agreement allows for a more targeted transaction where only certain assets, such as equipment or inventory, are being sold. 3. Real Estate Asset Purchase Agreement: If the business being sold includes real estate properties, this type of agreement is used to outline the terms and conditions for the purchase of those specific assets. It covers the transfer of ownership, financing options, closing conditions, and any other relevant details related to the real estate transaction. 4. Intellectual Property Asset Purchase Agreement: In instances where the value of the business lies primarily in its intellectual property assets, such as trademarks, copyrights, or patents, an intellectual property asset purchase agreement is used. This agreement specifically addresses the transfer of these intangible assets and any associated rights or licenses. 5. Franchise Asset Purchase Agreement: When a franchised business is being sold, a franchise asset purchase agreement is necessary. This agreement not only covers the purchase of the franchise's assets but also outlines the terms and conditions for the buyer to assume the existing franchise agreement and maintain the franchisor-franchisee relationship. It's important to note that the specific type of asset purchase agreement used may vary depending on the nature of the business being sold and the preferences of the parties involved. Consulting with a qualified attorney is advised to ensure that the agreement accurately reflects the intentions and protects the rights of all parties.

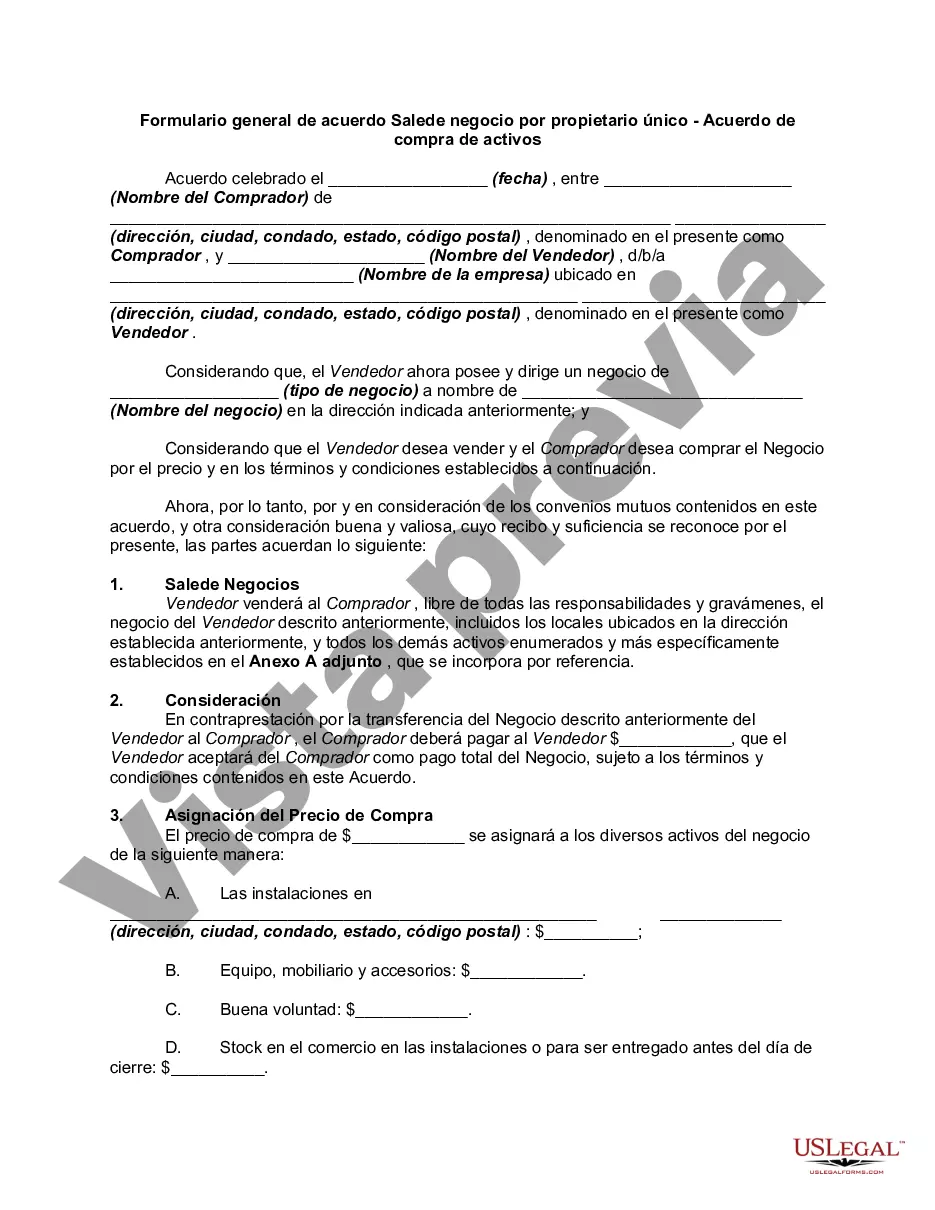

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.