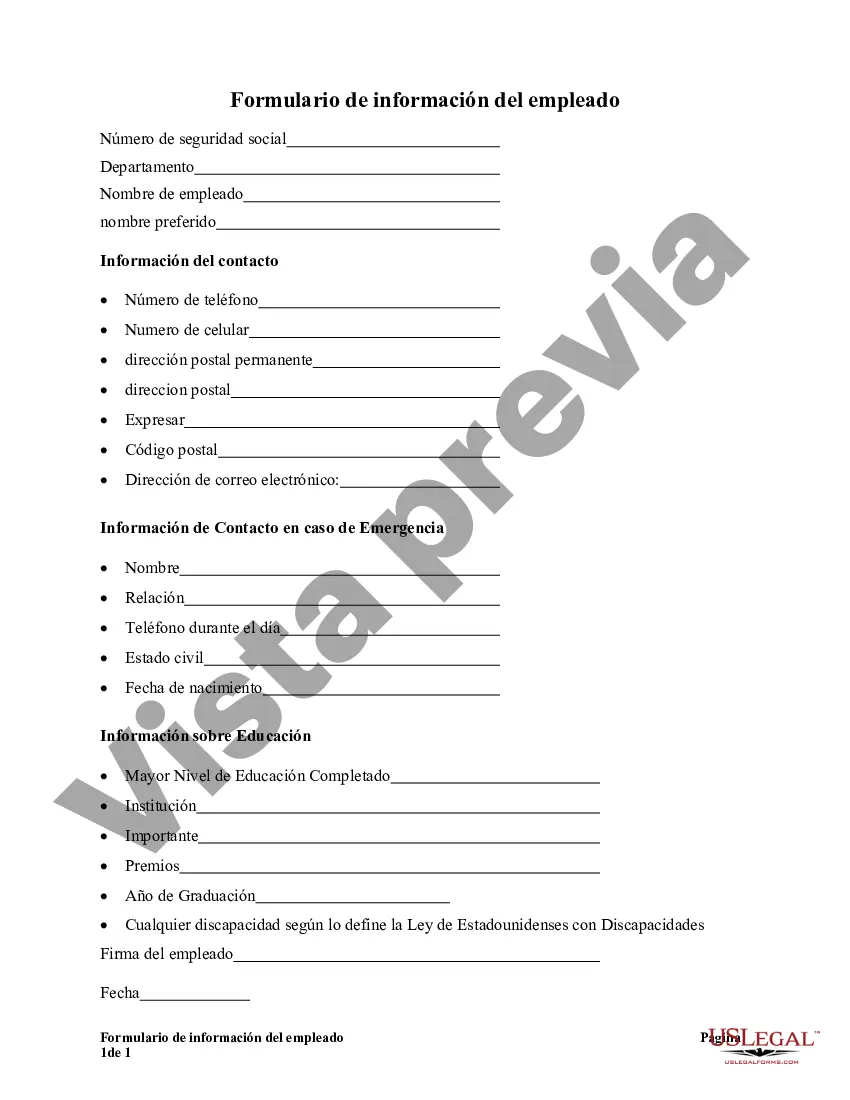

The Illinois Employee Information Form is a comprehensive document that employers in Illinois used to gather important details about their employees for various administrative purposes. This form serves as a crucial tool for maintaining accurate employee records and ensuring legal compliance with state regulations. It captures essential information about individuals employed within the state, and specific variations of this form may exist based on different organizational needs. Here is a detailed description of the Illinois Employee Information Form and its potential types: 1. Basic Employee Information: This section of the form contains fields to collect fundamental details about the employee, including their full name, contact information (address, phone number, and email), Social Security number, date of birth, and marital status. This data is essential for verifying employee identity, communicating with the employee, and handling taxation and employee benefits. 2. Employment Details: In this section, employers gather specific information related to an employee's job. This includes their job title, department, start date, and employment status (full-time, part-time, or temporary). Additionally, employers may need to record information about an employee's work schedule, shift timings, and compensation structure (salary, wages, or hourly rate). 3. Emergency Contact Information: Employers often request emergency contact details to ensure they can reach someone close to the employee in case of an emergency at the workplace. This typically includes the name, relationship, and contact number of at least one individual the employer can contact in such situations. 4. Tax Withholding Data: To maintain proper tax compliance, the Illinois Employee Information Form will include a section to record the employee's federal and state tax filing status, number of allowances or exemptions claimed, and any additional withholding requested by the employee. This information is vital for accurate payroll processing and ensuring the correct deduction of taxes. 5. Employment Eligibility Verification: Employers also need to include a section to comply with federal immigration laws, particularly the completion of Form I-9. This section will entail recording the employee's citizenship or immigration status, along with verifying their eligibility to work in the United States by collecting appropriate documentation. 6. Benefits and Insurance: Depending on the organization's policies, the form may include sections to gather information about the employee's enrollment in different benefit programs such as health insurance, retirement plans, disability coverage, and life insurance. This data helps employers efficiently manage employee benefits and administer insurance programs. By utilizing the Illinois Employee Information Form, employers can ensure that they have comprehensive and accurate records for all their employees according to state-specific requirements. It serves as a key document for hiring, payroll processing, tax compliance, benefits administration, emergency preparedness, and overall workforce management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Formulario de información del empleado - Employee Information Form

Description

How to fill out Illinois Formulario De Información Del Empleado?

Finding the right legal papers design could be a have difficulties. Naturally, there are a lot of templates accessible on the Internet, but how can you obtain the legal develop you need? Make use of the US Legal Forms internet site. The assistance gives thousands of templates, for example the Illinois Employee Information Form, that can be used for business and personal requires. All the varieties are examined by specialists and meet state and federal demands.

When you are previously authorized, log in in your account and click the Download option to get the Illinois Employee Information Form. Utilize your account to check with the legal varieties you possess ordered earlier. Proceed to the My Forms tab of the account and obtain one more backup in the papers you need.

When you are a fresh consumer of US Legal Forms, here are straightforward recommendations that you can adhere to:

- Initial, ensure you have chosen the correct develop to your area/region. You may look through the form utilizing the Preview option and read the form outline to guarantee it will be the best for you.

- In case the develop is not going to meet your preferences, make use of the Seach field to find the proper develop.

- Once you are certain that the form would work, select the Purchase now option to get the develop.

- Opt for the costs prepare you desire and enter the essential information. Design your account and pay money for an order making use of your PayPal account or charge card.

- Choose the submit structure and download the legal papers design in your system.

- Complete, modify and print out and indicator the acquired Illinois Employee Information Form.

US Legal Forms is definitely the biggest collection of legal varieties for which you can find different papers templates. Make use of the service to download professionally-created paperwork that adhere to state demands.