Illinois General Form of Inter Vivos Irrevocable Trust Agreement

Description

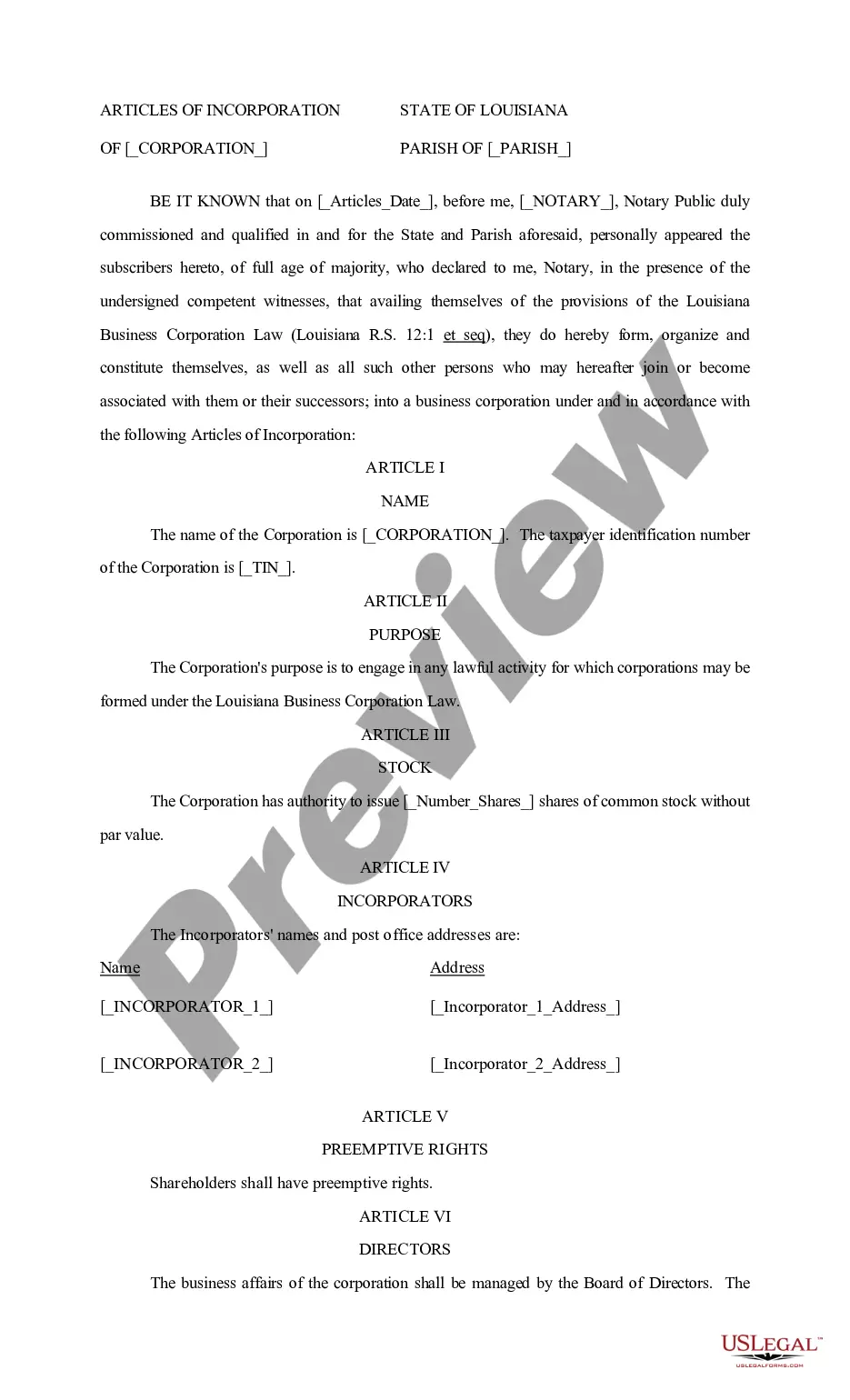

How to fill out General Form Of Inter Vivos Irrevocable Trust Agreement?

If you need to obtain thorough, download, or print authentic document templates, utilize US Legal Forms, the most extensive variety of authentic forms available online.

Take advantage of the site`s user-friendly and convenient search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Illinois General Form of Inter Vivos Irrevocable Trust Agreement in just a few clicks.

Every legal document template you procure is yours permanently. You will have access to all forms you saved within your account. Navigate to the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Illinois General Form of Inter Vivos Irrevocable Trust Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- In case you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the Illinois General Form of Inter Vivos Irrevocable Trust Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form`s contents. Don’t forget to check the outline.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois General Form of Inter Vivos Irrevocable Trust Agreement.

Form popularity

FAQ

You file Form 1041 for your irrevocable trust with the IRS, typically using the address listed in the instructions for the form. If your trust is set up through the Illinois General Form of Inter Vivos Irrevocable Trust Agreement, ensure you include all required documentation to avoid delays. Make sure to stay updated on where to send federal forms to comply with IRS requirements.

For an irrevocable trust, you need to file Form 1041 to report income generated by the trust. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement suggests maintaining proper records to ease this process. Filing this form effectively helps you meet IRS obligations while keeping the trust's financial matters in order.

You would file IRS Form 1041 with an irrevocable trust to report its income. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement establishes the framework for this reporting. Keep accurate records of the trust's income and expenses, as this will simplify the filing process and ensure compliance with federal tax laws.

In Illinois, you typically do not need to file an irrevocable trust with the court. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement functions outside of the probate process, allowing for private management of trust assets. However, ensure that all necessary documents are properly organized to avoid potential disputes among beneficiaries.

Form 1041 is used for reporting income for an irrevocable trust, while Form 706 is the estate tax return. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement focuses on income tax matters, whereas Form 706 addresses potential taxes due at the time of death. Understanding both forms is crucial for proper estate planning, as they serve different purposes.

Yes, you generally need to file Form 1041 for an irrevocable trust. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement creates a separate tax entity, so the trust must report its income, deductions, and credits. By filing Form 1041, you ensure compliance with IRS regulations. Consulting a tax professional can help clarify your specific situation.

Various types of trusts qualify as inter vivos trusts, including revocable living trusts and irrevocable trusts. These trusts are established during a person's lifetime and allow for the direct management of assets. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement is specifically designed as an irrevocable option for individuals seeking to maintain control over their assets while providing clear instructions for the future. Using this framework can simplify the estate planning process.

The three primary types of irrevocable trusts include irrevocable life insurance trusts, charitable remainder trusts, and special needs trusts. Each trust serves unique purposes, like protecting assets from taxes or ensuring that beneficiaries with disabilities receive support. When considering the Illinois General Form of Inter Vivos Irrevocable Trust Agreement, you can find a flexible framework that may align with various irrevocable trust types. Consulting with a legal professional can help clarify which structure fits your needs.

To obtain a copy of a trust document in Illinois, you typically need to contact the trustee directly. If the trust is irrevocable, the trustee has a legal obligation to provide a copy upon request. Using resources from uslegalforms, you can find guidance on how to approach this situation. It's crucial to understand that trust documents can usually be kept confidential unless a court order requires disclosure.

Yes, an irrevocable trust can indeed be an inter vivos trust. This type of trust is established during a person’s lifetime, as opposed to being created through a will after death. The Illinois General Form of Inter Vivos Irrevocable Trust Agreement serves as a model for those who want to set up such a trust. By using this agreement, individuals can ensure their assets are managed according to their wishes while also providing tax benefits.