The Illinois Sales Receipt refers to a document provided to customers after a purchase has been made in the state of Illinois. It serves as concrete proof of the transaction and includes vital information such as the date of purchase, details of the purchased items or services, payment method used, and relevant taxes paid. This receipt not only serves as a record for customers but also holds legal significance for businesses. Keywords: Illinois Sales Receipt, customers, purchase, transaction, date of purchase, purchased items, services, payment method, taxes, legal significance, businesses. There are various types of Illinois Sales Receipts catering to different business sectors. Some notable types include: 1. Retail Sales Receipt: This type of receipt is used by retail businesses that provide goods directly to end consumers. It itemizes the purchased products, their quantities, prices, any discounts applied, and the total amount paid. 2. Restaurant Sales Receipt: This type of receipt is commonly used in the food service industry. It includes details of the meal, such as the items ordered, their individual prices, any additions or modifications made, taxes, and the grand total. Additionally, a restaurant receipt might also include gratuity or tip amounts. 3. Service Sales Receipt: This receipt type is applicable to businesses offering services rather than physical products. It lists the specific services provided, their charges, any additional fees incurred, taxes, and the total payment received. 4. Online Sales Receipt: As e-commerce continues to flourish, online sales receipts have become increasingly prevalent. These receipts are generated when purchases are made through websites or digital platforms. They include information on the purchased items, their prices, shipping details, and any additional charges like delivery fees or taxes. 5. Wholesale Sales Receipt: This type of receipt is commonly used in wholesale businesses where products are sold in bulk to retailers or other businesses. It showcases the products purchased, quantities, bulk prices, any applicable discounts, taxes, and the final payment made. 6. Auto Sales Receipt: Auto dealerships issue this type of receipt to buyers upon the purchase of a vehicle. It typically includes important details, such as the vehicle's make, model, year, identification number, purchase price, applicable taxes, any trade-ins or financing details, and the customer's information. These are just a few types of Illinois Sales Receipts, each tailored to cater to different industries and business models. Businesses must adhere to Illinois state regulations to ensure that these receipts are accurately generated and provided to customers for transparency and record-keeping purposes.

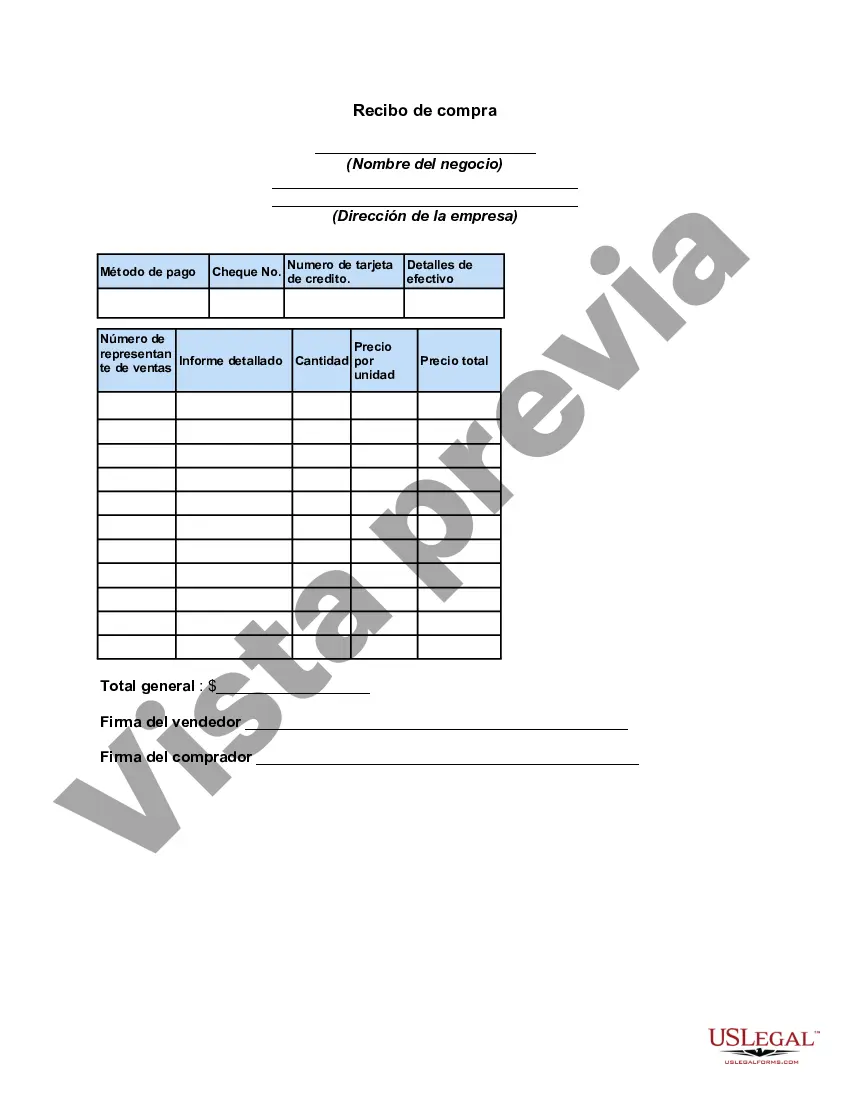

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Recibo de compra - Sales Receipt

Description

How to fill out Illinois Recibo De Compra?

You may devote several hours online looking for the legal file template that fits the federal and state requirements you require. US Legal Forms provides a large number of legal varieties which can be examined by experts. You can easily acquire or print the Illinois Sales Receipt from our service.

If you have a US Legal Forms accounts, it is possible to log in and click the Download option. Following that, it is possible to full, change, print, or sign the Illinois Sales Receipt. Every legal file template you buy is the one you have for a long time. To get yet another copy for any bought develop, go to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms web site initially, follow the simple instructions below:

- Initially, make certain you have chosen the correct file template to the state/area that you pick. See the develop explanation to make sure you have chosen the proper develop. If available, make use of the Review option to search throughout the file template at the same time.

- If you want to get yet another edition in the develop, make use of the Search industry to obtain the template that fits your needs and requirements.

- Once you have identified the template you would like, click on Acquire now to continue.

- Find the rates prepare you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legal develop.

- Find the structure in the file and acquire it to the device.

- Make adjustments to the file if needed. You may full, change and sign and print Illinois Sales Receipt.

Download and print a large number of file themes while using US Legal Forms site, that offers the most important variety of legal varieties. Use skilled and state-distinct themes to tackle your small business or individual requires.