The Uniform Commercial Code (UCC) has been adopted in whole or in part by the legislatures of all 50 states.

If a party has reasonable grounds to believe that another will not perform, he or she may demand in writing an assurance of performance. While waiting for a response, the party may suspend his or her own performance. If an assurance is not given within thirty days, this can be considered repudiation of the contract. This same rule applies if cooperation is needed and not given [UCC 2-311(3)(b)].

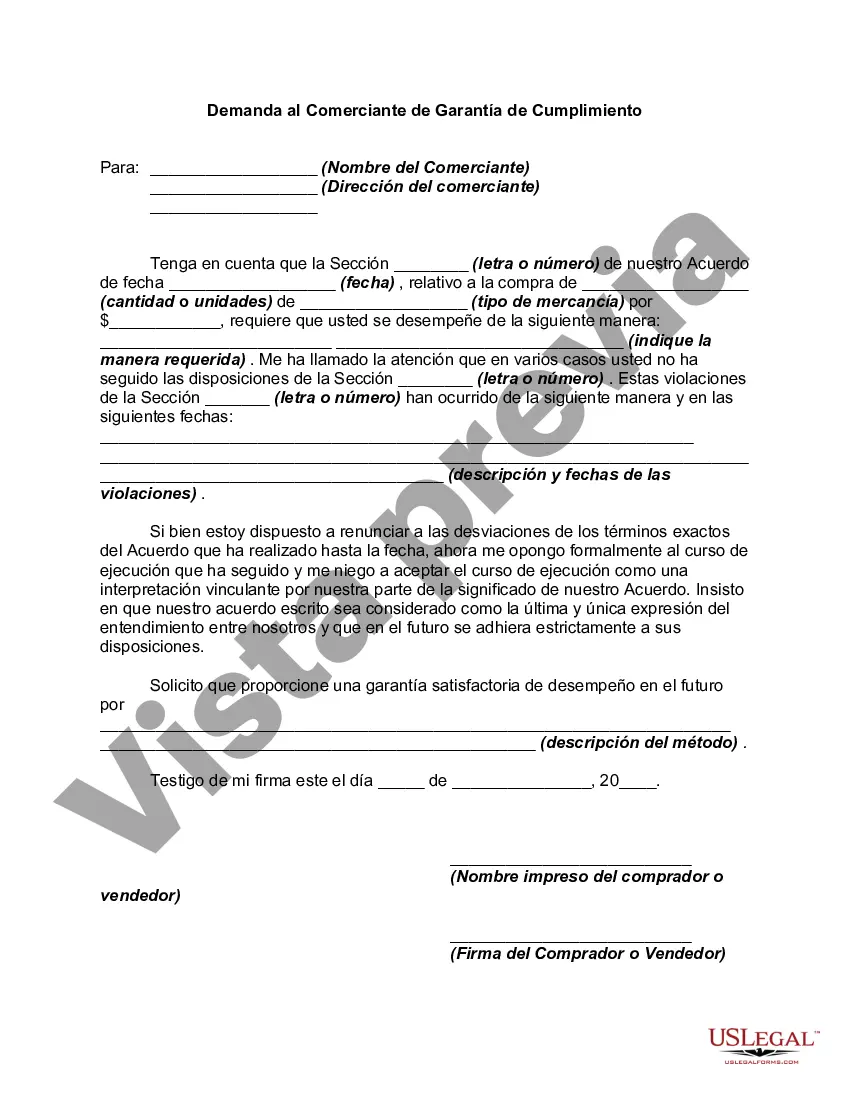

When conducting business transactions in Illinois, it is crucial to understand the concept of Demand to Merchant for Assurance of Performance. This legal mechanism serves as a means to safeguard the interests of parties involved in commercial dealings within the state. An Illinois Demand to Merchant for Assurance of Performance is a formal written request made by one party (the demanding party) to another party (the merchant) seeking assurances regarding the performance of contractual obligations. This demand is typically made in situations where the merchant's ability or willingness to fulfill their contractual duties is questioned or in doubt. The purpose of this demand is to compel the merchant to provide explicit assurances and guarantees, instilling confidence in the demanding party. By demanding assurance of performance, the requesting party aims to minimize the risks associated with the merchant's potential non-performance. This demand is an essential legal tool that facilitates the resolution of disputes and encourages transparency and trust in business transactions. It enables parties to address any uncertainties promptly and seek suitable remedies, ensuring the smooth flow of commerce within Illinois. Different types of Illinois Demand to Merchant for Assurance of Performance may include: 1. Demand for Financial Assurances: In cases where the merchant's financial stability is questionable, the demanding party can seek assurances regarding their ability to fulfill financial obligations. This type of demand may involve requesting the merchant to provide financial statements, bank guarantees, or letters of credit, demonstrating their financial capacity. 2. Demand for Delivery Assurances: When the merchant's ability to timely deliver goods or services is doubtful, the demanding party may request delivery assurances. This demand typically includes specifications regarding delivery dates, methods, and any necessary warranties or guarantees. 3. Demand for Performance Assurances: In situations where the merchant's performance under the contract is in question, the demanding party can request specific assurances related to the quality, quantity, or other performance metrics. The demand may outline the expected standards and seek guarantees that these standards will be met. 4. Demand for Compliance Assurances: In cases where the merchant's compliance with legal or regulatory requirements is uncertain, the demanding party may request compliance assurances. This demand may involve seeking documentation or proof of adherence to applicable laws, regulations, or industry standards. In summary, an Illinois Demand to Merchant for Assurance of Performance is a formal request seeking guarantees from a merchant regarding their ability to fulfill contractual duties. Different types of demands can be made depending on the specific concerns and uncertainties surrounding the merchant's performance, financial stability, delivery, or compliance. By utilizing this legal mechanism, parties can ensure transparency, minimize risks, and foster a business environment built on trust and confidence.When conducting business transactions in Illinois, it is crucial to understand the concept of Demand to Merchant for Assurance of Performance. This legal mechanism serves as a means to safeguard the interests of parties involved in commercial dealings within the state. An Illinois Demand to Merchant for Assurance of Performance is a formal written request made by one party (the demanding party) to another party (the merchant) seeking assurances regarding the performance of contractual obligations. This demand is typically made in situations where the merchant's ability or willingness to fulfill their contractual duties is questioned or in doubt. The purpose of this demand is to compel the merchant to provide explicit assurances and guarantees, instilling confidence in the demanding party. By demanding assurance of performance, the requesting party aims to minimize the risks associated with the merchant's potential non-performance. This demand is an essential legal tool that facilitates the resolution of disputes and encourages transparency and trust in business transactions. It enables parties to address any uncertainties promptly and seek suitable remedies, ensuring the smooth flow of commerce within Illinois. Different types of Illinois Demand to Merchant for Assurance of Performance may include: 1. Demand for Financial Assurances: In cases where the merchant's financial stability is questionable, the demanding party can seek assurances regarding their ability to fulfill financial obligations. This type of demand may involve requesting the merchant to provide financial statements, bank guarantees, or letters of credit, demonstrating their financial capacity. 2. Demand for Delivery Assurances: When the merchant's ability to timely deliver goods or services is doubtful, the demanding party may request delivery assurances. This demand typically includes specifications regarding delivery dates, methods, and any necessary warranties or guarantees. 3. Demand for Performance Assurances: In situations where the merchant's performance under the contract is in question, the demanding party can request specific assurances related to the quality, quantity, or other performance metrics. The demand may outline the expected standards and seek guarantees that these standards will be met. 4. Demand for Compliance Assurances: In cases where the merchant's compliance with legal or regulatory requirements is uncertain, the demanding party may request compliance assurances. This demand may involve seeking documentation or proof of adherence to applicable laws, regulations, or industry standards. In summary, an Illinois Demand to Merchant for Assurance of Performance is a formal request seeking guarantees from a merchant regarding their ability to fulfill contractual duties. Different types of demands can be made depending on the specific concerns and uncertainties surrounding the merchant's performance, financial stability, delivery, or compliance. By utilizing this legal mechanism, parties can ensure transparency, minimize risks, and foster a business environment built on trust and confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.