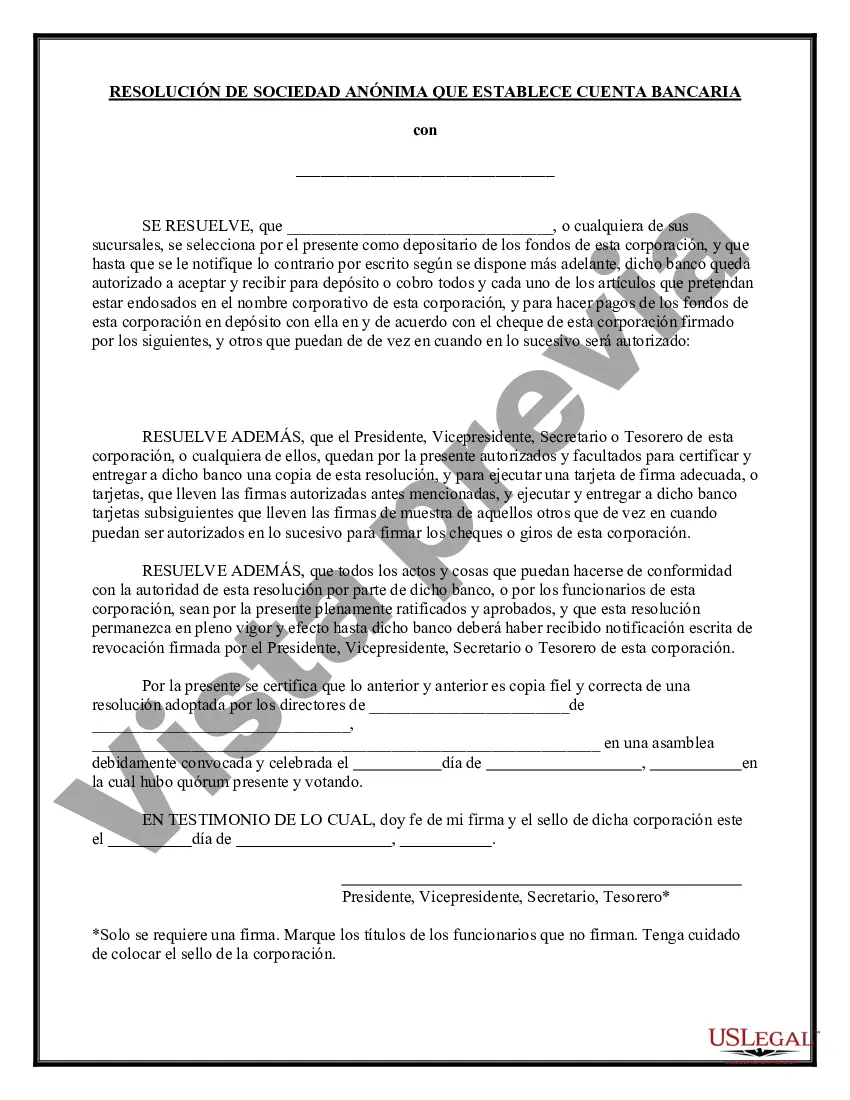

The Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories is a legal document that outlines the process and requirements for a corporation in Illinois to choose a depository bank for their financial operations and designate account signatories. This resolution is crucial for ensuring proper financial management and transparency within a corporation and facilitating banking interactions effectively. The resolution begins with an introduction, stating the corporation's name, purpose, and registered office in Illinois. It also mentions the need for selecting a depository bank and account signatories to handle the corporation's financial affairs. The different types of Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories include: 1. General Resolution: This type of resolution covers the overall selection of a depository bank and the appointment of account signatories. It is commonly used by corporations that have regular banking needs and want a comprehensive resolution to handle their financial affairs. 2. Specific Resolution: Specific resolutions are designed for corporations that need to select a depository bank and appoint account signatories for a particular project or event. This resolution specifies the duration or nature of the project/event and the financial requirements associated with it. 3. Amended Resolution: In case a corporation needs to modify or update the previously adopted resolution, an amended resolution is used. It allows for changes in depository bank selection or the appointment of new account signatories based on evolving financial needs or circumstances. The key elements of the Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories include: 1. Designation of Depository Bank: The resolution identifies the depository bank by name and specifies its location or branch details. The rationale behind selecting the particular bank should be provided, considering factors such as reputation, services offered, fees, and proximity to the corporation's registered office or primary place of business. 2. Account Types: This section discusses the desired types of bank accounts to be opened for the corporation, such as checking accounts, savings accounts, or specialized accounts for specific purposes. It may also include details about the designation of signatories for each account. 3. Authorized Signatories: The resolution names individuals authorized to sign on behalf of the corporation for all banking transactions. It outlines the procedure for appointing or removing account signatories, and specifies their powers, responsibilities, and any limitations set by the corporation's bylaws or articles of incorporation. 4. Required Documentation: The resolution may specify the documents required by the depository bank to open accounts on behalf of the corporation. This typically includes corporate resolutions, corporate bylaws, articles of incorporation, and any other relevant legal documents. 5. Term and Renewal: The resolution may state the initial term for the depository bank selection and account signatories, as well as the renewal process. It can detail whether the resolution needs to be revisited at specified intervals or if it remains in effect until amended or revoked. 6. Revocation or Amendment: This section outlines the process for revoking or amending the resolution in the future, providing guidelines on how to propose and pass a new resolution. Overall, the Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories is a vital document that ensures the smooth management of financial matters within a corporation. It safeguards the corporation's interests and promotes transparency and accountability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Illinois Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

US Legal Forms - one of the greatest libraries of lawful types in the United States - provides a variety of lawful document templates it is possible to download or print. Utilizing the web site, you may get 1000s of types for enterprise and personal functions, sorted by categories, says, or keywords and phrases.You will discover the most up-to-date versions of types like the Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories in seconds.

If you already possess a membership, log in and download Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories in the US Legal Forms library. The Down load switch will show up on every form you perspective. You have access to all formerly acquired types within the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, allow me to share easy instructions to obtain started off:

- Make sure you have chosen the proper form for the city/state. Select the Preview switch to review the form`s articles. Browse the form outline to actually have selected the proper form.

- In the event the form does not satisfy your demands, take advantage of the Lookup industry towards the top of the monitor to find the one which does.

- In case you are content with the shape, affirm your choice by clicking on the Get now switch. Then, opt for the prices prepare you want and give your accreditations to register on an account.

- Method the purchase. Make use of charge card or PayPal account to accomplish the purchase.

- Find the format and download the shape on your device.

- Make adjustments. Complete, revise and print and sign the acquired Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories.

Every format you included with your bank account lacks an expiration particular date and it is the one you have eternally. So, in order to download or print another duplicate, just go to the My Forms section and then click on the form you will need.

Get access to the Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories with US Legal Forms, one of the most comprehensive library of lawful document templates. Use 1000s of expert and status-certain templates that meet your company or personal requirements and demands.