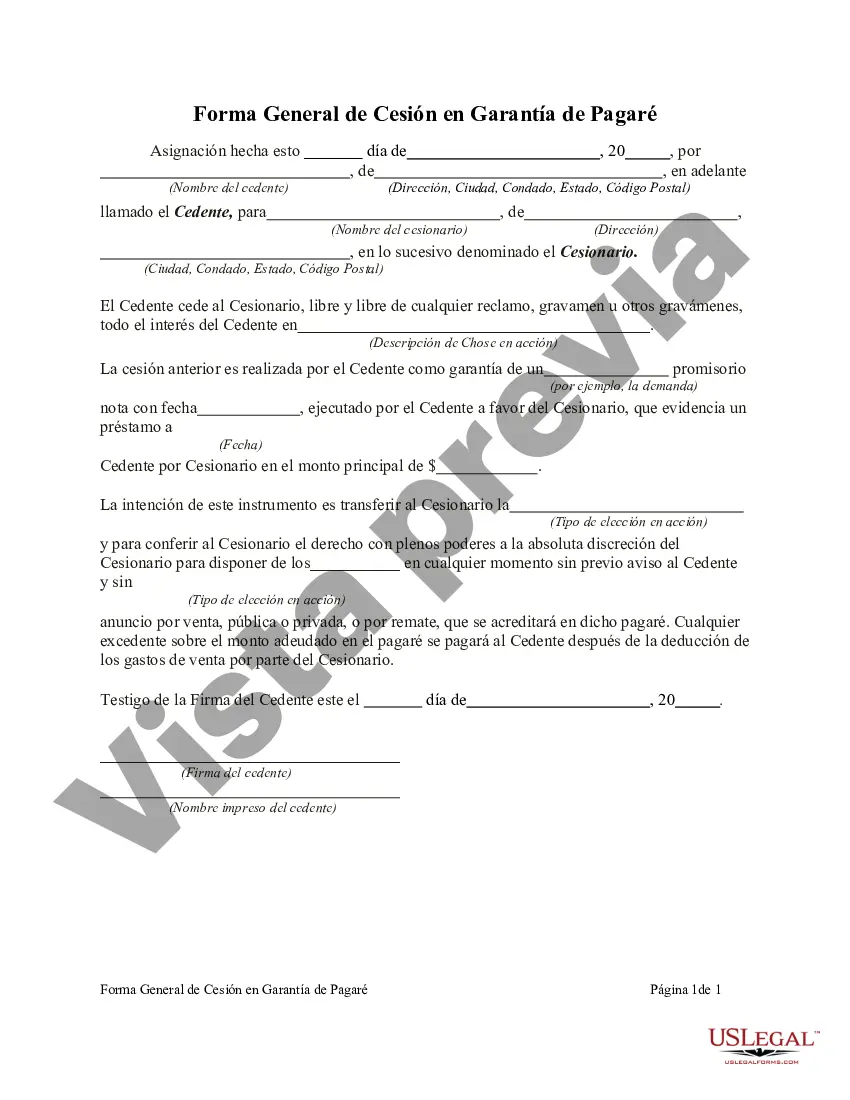

The Illinois General Form of Assignment as Collateral for Note is a legal document that outlines the transfer of ownership rights for an asset to secure a note or loan. This assignment serves as a form of collateral, ensuring that the lender has a claim to the asset in the event of default or non-payment. Key elements included in the Illinois General Form of Assignment as Collateral for Note include: 1. Parties Involved: The document identifies the assignor, who is the borrower or debtor transferring the rights to the collateral, and the assignee, who is the lender or note holder receiving the collateral. 2. Description of Collateral: The form provides a detailed description of the asset being assigned as collateral. This can include real estate, vehicles, equipment, accounts receivable, securities, or any other valuable property or item specified by both parties. 3. Loan Agreement Terms: The assignment document references the underlying loan agreement or promissory note, specifying the terms and conditions of the loan. It may include information such as the amount borrowed, interest rate, repayment schedule, and any applicable fees or penalties. 4. Security Interest: The assignment establishes a security interest in the collateral, granting the lender the right to repossess and sell the asset to recover the outstanding debt if the borrower defaults. 5. Assignment Clause: This clause states that the assignor intends to transfer ownership of the collateral as security for the note and acknowledges that the assignee has the right to collect the debt and enforce the security interest. 6. Perfection and Filing: In Illinois, to ensure the assignment is valid and enforceable against third parties, it must be perfected by filing a financing statement with the appropriate state authority. This filing provides notice to other potential creditors about the lender's interest in the collateral. Types of Illinois General Form of Assignment as Collateral for Note may vary depending on the nature of the collateral being assigned. Some common variations include: 1. Real Estate Mortgage: When the collateral is a real property, such as land, buildings, or homes, a separate mortgage agreement is executed alongside the general assignment to secure the loan. 2. Security Agreement: In cases where the collateral consists of personal property, such as equipment, inventory, or accounts receivable, a security agreement is used instead of a general assignment. This document provides more comprehensive details about the collateral, including specific terms and conditions. It is essential for all parties involved to consult with legal professionals or use standardized forms approved by the state of Illinois to ensure compliance with applicable laws and to protect their rights and interests in the assignment as collateral for a note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Illinois Forma General De Cesión En Garantía De Pagaré?

Choosing the right lawful papers template might be a battle. Obviously, there are tons of templates available online, but how do you get the lawful form you require? Utilize the US Legal Forms website. The service provides a huge number of templates, such as the Illinois General Form of Assignment as Collateral for Note, which you can use for enterprise and private requires. All the kinds are inspected by specialists and meet up with federal and state demands.

When you are currently registered, log in for your account and then click the Download switch to find the Illinois General Form of Assignment as Collateral for Note. Make use of your account to search with the lawful kinds you might have bought formerly. Go to the My Forms tab of your respective account and get an additional backup of your papers you require.

When you are a new consumer of US Legal Forms, here are straightforward instructions that you can adhere to:

- First, make certain you have selected the proper form for the metropolis/state. It is possible to examine the shape while using Preview switch and look at the shape outline to ensure it will be the right one for you.

- In the event the form will not meet up with your expectations, use the Seach area to obtain the appropriate form.

- When you are certain that the shape is proper, go through the Acquire now switch to find the form.

- Choose the pricing plan you would like and type in the necessary information. Build your account and pay money for the transaction making use of your PayPal account or bank card.

- Pick the submit formatting and obtain the lawful papers template for your product.

- Comprehensive, revise and print out and indication the received Illinois General Form of Assignment as Collateral for Note.

US Legal Forms will be the most significant local library of lawful kinds in which you can see various papers templates. Utilize the company to obtain appropriately-created papers that adhere to express demands.