In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Illinois Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association

Description

How to fill out Resolution To Incorporate ASCAP Nonprofit Corporation By Members Of Unincorporated Association?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous online templates accessible, but how do you discover the legal design you need.

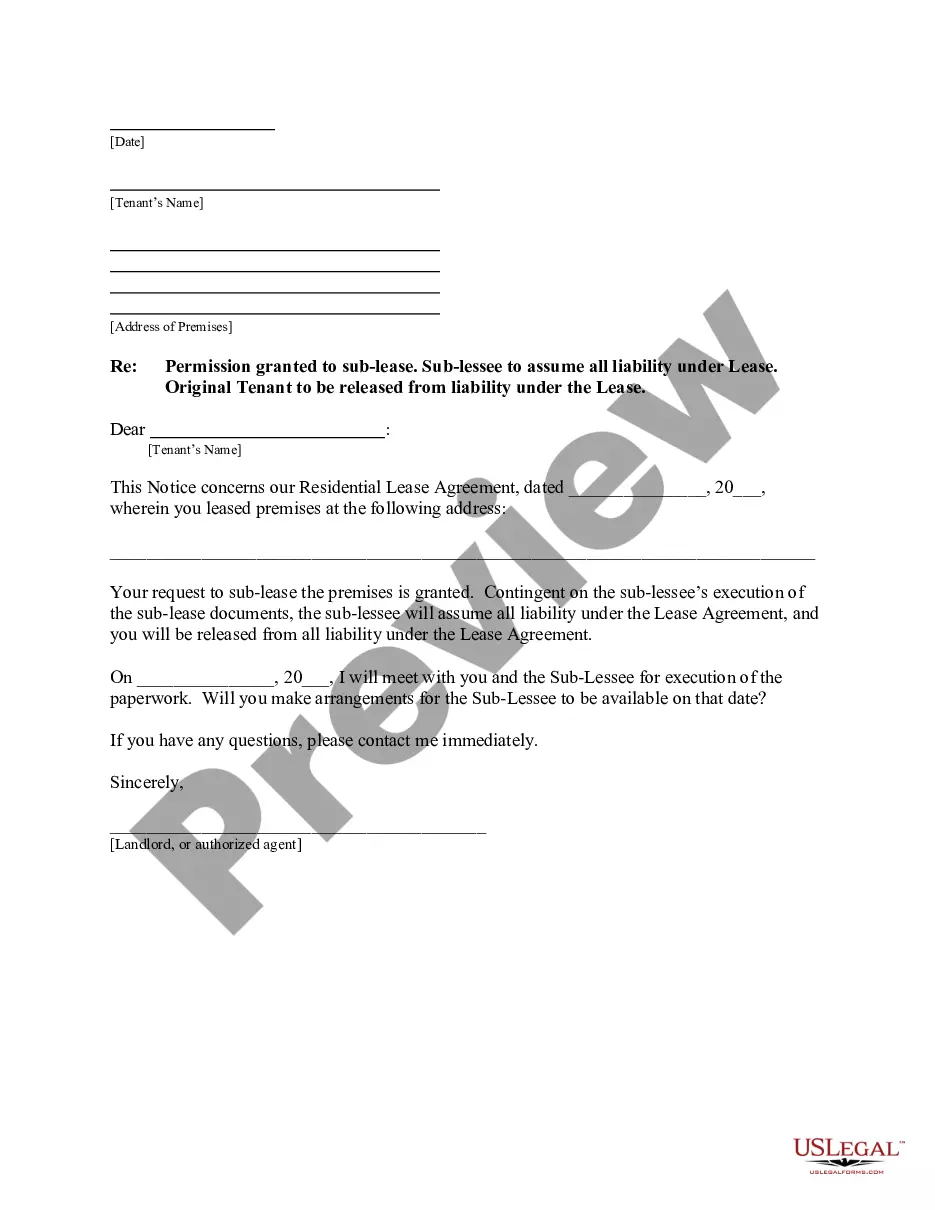

Use the US Legal Forms website.

First, ensure you have selected the correct form for your city/county. You can preview the document using the Review option and read the form description to confirm it is suitable for you.

- The service provides a vast array of templates, including the Illinois Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, which you can utilize for business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Acquire button to obtain the Illinois Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association.

- Use your account to navigate through the legal forms you have obtained in the past.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Dissolving a not-for-profit corporation in Illinois starts with gathering your board and reaching an agreement on the dissolution. Refer to the guidelines of the Illinois Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association for compliance. After obtaining the necessary approvals, submit the dissolution paperwork to the Illinois Secretary of State. It is also important to settle any debts and manage your assets according to the guidelines set forth in your corporation's governing documents.

Illinois requires at least three board members when forming a 501(c)(3) nonprofit organization. These members cannot be related to each other, ensuring a diversity of perspectives within the board. When establishing the Illinois Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, having a strong and diverse board is vital for effective governance.