Title: Illinois Sample Letter for Insufficient Amount to Reinstate Loan: Detailed Description and Types Introduction: In Illinois, individuals facing financial difficulties and unable to pay the full amount owed to reinstate a loan often require a formal document to communicate their situation to the lender. This article provides a detailed description of an Illinois Sample Letter for Insufficient Amount to Reinstate Loan, including the essential information to include and its importance. Additionally, it highlights various types of similar letters based on specific loan types or reasons for financial hardship. Keyword: Illinois Sample Letter for Insufficient Amount to Reinstate Loan 1. Definition and Purpose: The Illinois Sample Letter for Insufficient Amount to Reinstate Loan is a professionally drafted document used by borrowers who cannot pay the required amount to reinstate their loan. It serves as a formal request to the lender, explaining the inability to meet the necessary payment obligations and requesting possible alternatives or arrangements. 2. Essential Components of the Letter: — Header: Include the borrower's contact information (name, address, email, and phone number) and the lender's details (name, address, email, and phone number). — Salutation: Address the letter to the appropriate person or department within the lender's organization. — Introduction: State the purpose of the letter, indicating the loan account number, the amount due for reinstatement, and the date it is required. — Explanation: Clearly explain the reasons for the financial hardship faced and the inability to pay the full amount due. — Supporting Documentation: Attach relevant supporting documents that substantiate the financial difficulties faced, such as bank statements, pay stubs, medical bills, etc. — Request for Assistance: Politely request the lender to consider modifying the loan terms, providing a payment plan option, or offering alternative solutions. — Appreciation: Express gratitude for considering the borrower's situation and for any assistance the lender can provide. — Closing: Use an appropriate closing remark (e.g., Sincerely, Best regards) followed by the borrower's name and signature. 3. Types of Illinois Sample Letter for Insufficient Amount to Reinstate Loan: a. Mortgage Loan: — Illinois Sample Letter for Insufficient Amount to Reinstate Mortgage Loan — Illinois Sample Letter for Insufficient Payment to Reinstate Mortgage Loan b. Auto Loan: — Illinois Sample Letter for Insufficient Amount to Reinstate Auto Loan — Illinois Sample Letter for Insufficient Payment to Reinstate Auto Loan c. Student Loan: — Illinois Sample Letter for Insufficient Amount to Reinstate Student Loan — Illinois Sample Letter for Insufficient Payment to Reinstate Student Loan d. Personal Loan: — Illinois Sample Letter for Insufficient Amount to Reinstate Personal Loan — Illinois Sample Letter for Insufficient Payment to Reinstate Personal Loan e. Business Loan: — Illinois Sample Letter for Insufficient Amount to Reinstate Business Loan — Illinois Sample Letter for Insufficient Payment to Reinstate Business Loan Conclusion: A well-crafted Illinois Sample Letter for Insufficient Amount to Reinstate Loan is crucial when facing financial hardship and being unable to pay the full reinstatement amount. The provided description and various types of letters can help borrowers in Illinois approach their lenders professionally, increasing the chances of securing alternative solutions and navigating through challenging financial situations.

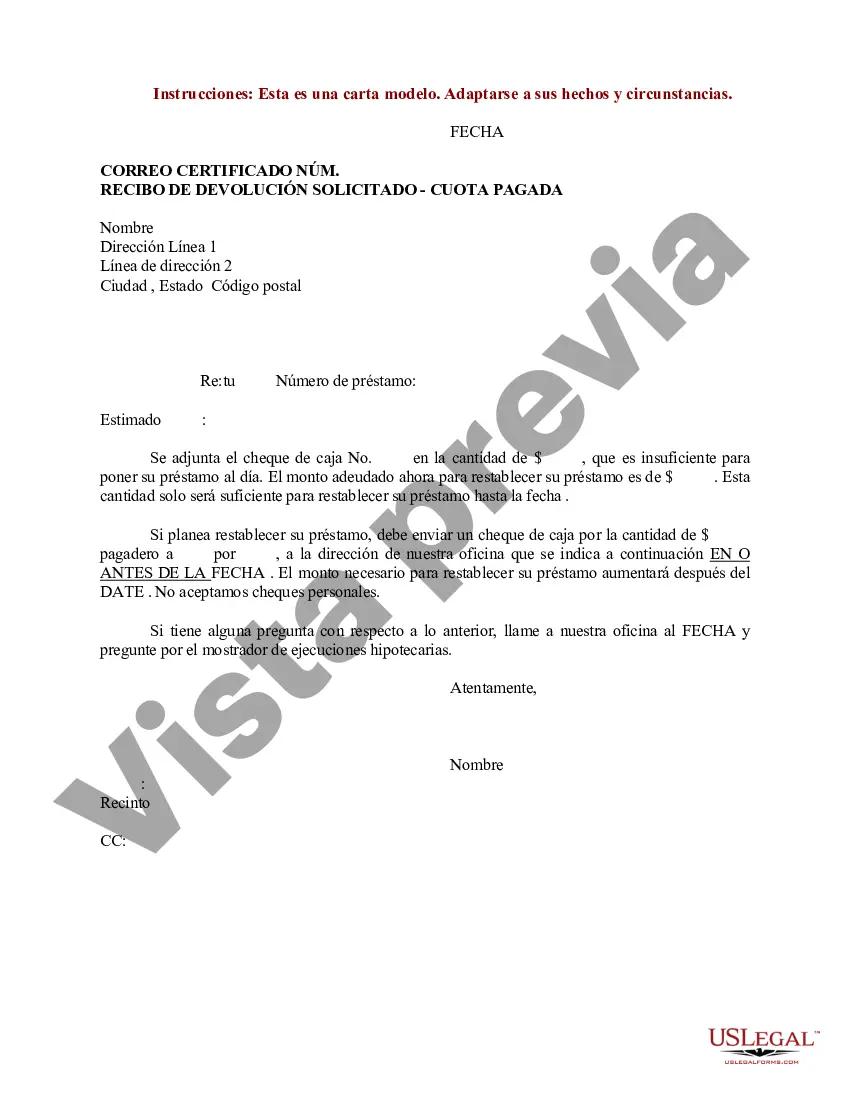

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Modelo de carta por monto insuficiente para restablecer el préstamo - Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Illinois Modelo De Carta Por Monto Insuficiente Para Restablecer El Préstamo?

If you need to full, acquire, or produce legal document layouts, use US Legal Forms, the largest collection of legal forms, that can be found online. Use the site`s easy and hassle-free research to discover the files you need. A variety of layouts for business and specific reasons are sorted by types and says, or search phrases. Use US Legal Forms to discover the Illinois Sample Letter for Insufficient Amount to Reinstate Loan in just a handful of mouse clicks.

In case you are presently a US Legal Forms consumer, log in in your bank account and click on the Obtain switch to obtain the Illinois Sample Letter for Insufficient Amount to Reinstate Loan. You may also access forms you previously delivered electronically inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that right city/country.

- Step 2. Use the Review choice to examine the form`s information. Do not overlook to read through the outline.

- Step 3. In case you are unhappy using the develop, take advantage of the Lookup field towards the top of the display to find other variations from the legal develop format.

- Step 4. After you have found the form you need, go through the Buy now switch. Opt for the pricing plan you like and put your references to register for the bank account.

- Step 5. Method the transaction. You can use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Pick the formatting from the legal develop and acquire it on your own device.

- Step 7. Full, edit and produce or sign the Illinois Sample Letter for Insufficient Amount to Reinstate Loan.

Every single legal document format you get is the one you have forever. You might have acces to each and every develop you delivered electronically within your acccount. Click the My Forms section and select a develop to produce or acquire yet again.

Be competitive and acquire, and produce the Illinois Sample Letter for Insufficient Amount to Reinstate Loan with US Legal Forms. There are many skilled and condition-particular forms you can utilize for the business or specific requires.