Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Meeting Name: Special Meeting of the Board of Directors Corporation Name: [Name of Corporation] Objective: Adoption of Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: Illinois, Minutes, Special Meeting, Board of Directors, Adopt, Stock Ownership Plan, Section 1244, Internal Revenue Code 1. Introduction The Illinois Minutes of Special Meeting serve as an official record of the proceedings held by the Board of Directors of [Name of Corporation]. The purpose of this specific meeting is to discuss and adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 2. Opening of the Meeting The Special Meeting of the Board of Directors commences on [Date] at [Time], at the designated location specified in the notice of the meeting. 3. Attendance The minutes will include a list of directors present at the meeting, along with any absence or remote attendance arrangements made. 4. Call to Order The Chairman of the Board (or acting chair) calls the meeting to order, ensuring a quorum is present as required by the corporation's bylaws. 5. Adoption of Agenda The agenda for the meeting is presented and duly adopted by the Board of Directors. 6. Purpose of the Meeting The Chairman addresses the purpose of the meeting, emphasizing the importance of adopting a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 7. Presentation of Stock Ownership Plan A comprehensive presentation is made by a designated representative, outlining the key elements of the proposed Stock Ownership Plan. This may include tax benefits, potential implications, eligibility criteria, treatment of stock, and other relevant details. 8. Questions and Discussion Directors are given the opportunity to raise questions, seek clarifications, and engage in a thorough discussion concerning the proposed Stock Ownership Plan. 9. Resolution and Voting A resolution is presented to the Board of Directors, formally proposing the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Each director in attendance casts their vote, and the results are recorded in the minutes. 10. Approval and Adoption If the resolution receives the necessary majority vote, it is approved, and the Stock Ownership Plan is adopted by the Board of Directors. This decision and outcome are documented in the minutes. 11. Adjournment Once the objectives of the meeting have been accomplished, the Chairman declares the meeting adjourned, noting the time accordingly. 12. Closing Statement A closing statement is included in the minutes, expressing gratitude to the participants for their attendance, input, and active participation. Please note that variations of Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code may arise based on the specific circumstances, structure, and requirements of each corporation. It is advisable to consult legal professionals or adapt the content as necessary to suit the corporation's unique situation.

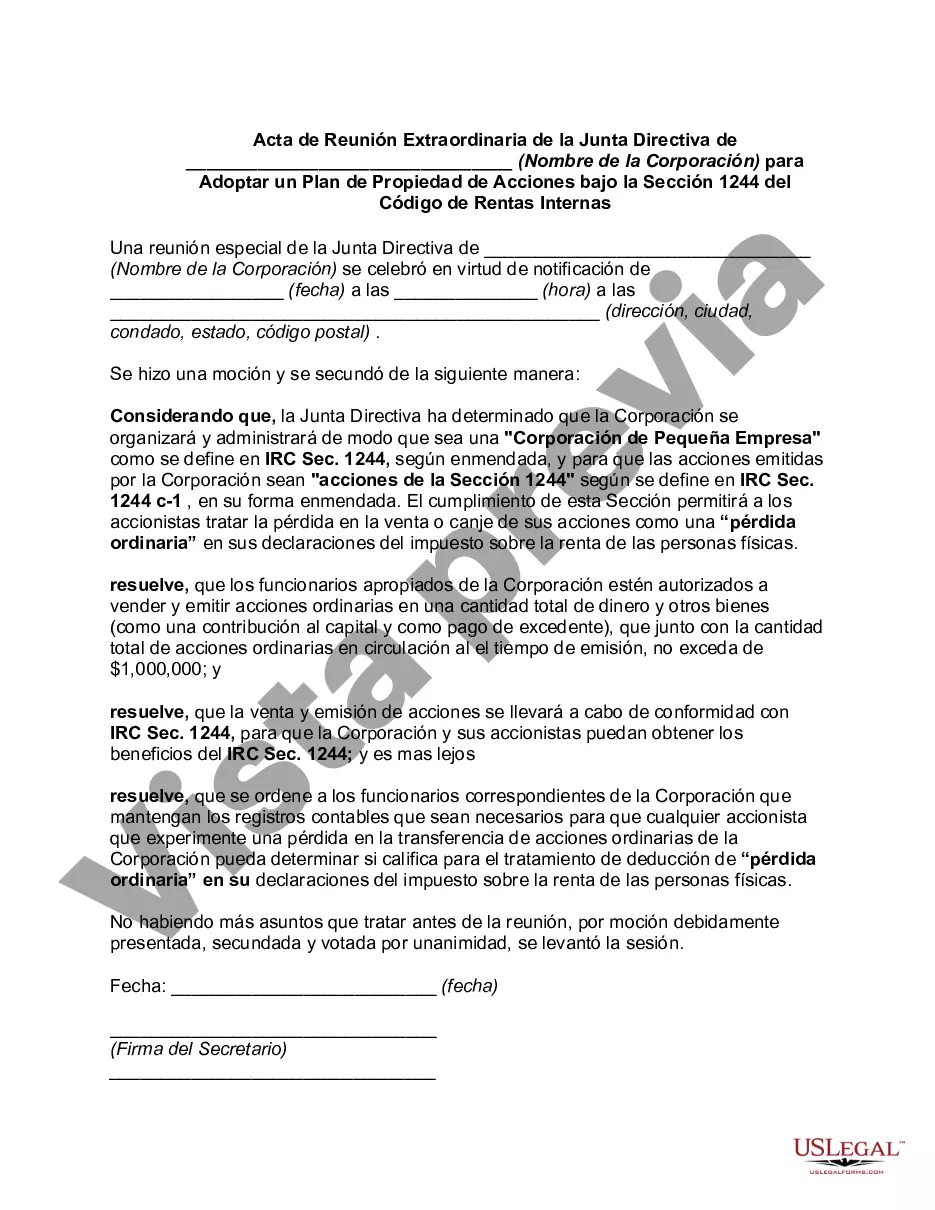

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Illinois Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

US Legal Forms - one of the most significant libraries of authorized kinds in America - provides an array of authorized file layouts you are able to down load or produce. Using the web site, you can find 1000s of kinds for enterprise and individual reasons, categorized by classes, states, or key phrases.You can get the most up-to-date variations of kinds like the Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code within minutes.

If you already possess a registration, log in and down load Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code from your US Legal Forms catalogue. The Download button will show up on every single form you view. You gain access to all previously downloaded kinds from the My Forms tab of the bank account.

If you want to use US Legal Forms initially, allow me to share straightforward directions to get you started out:

- Be sure to have selected the best form for your personal city/area. Click the Preview button to examine the form`s content. Read the form description to ensure that you have selected the correct form.

- When the form doesn`t match your demands, utilize the Research discipline on top of the screen to obtain the one which does.

- Should you be content with the form, verify your decision by visiting the Buy now button. Then, select the pricing prepare you want and offer your credentials to sign up for the bank account.

- Procedure the purchase. Utilize your credit card or PayPal bank account to perform the purchase.

- Pick the file format and down load the form on your own product.

- Make adjustments. Load, change and produce and signal the downloaded Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Every template you added to your account does not have an expiration day and it is the one you have eternally. So, in order to down load or produce an additional backup, just go to the My Forms portion and click on on the form you will need.

Gain access to the Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms, the most extensive catalogue of authorized file layouts. Use 1000s of expert and status-distinct layouts that fulfill your small business or individual requirements and demands.