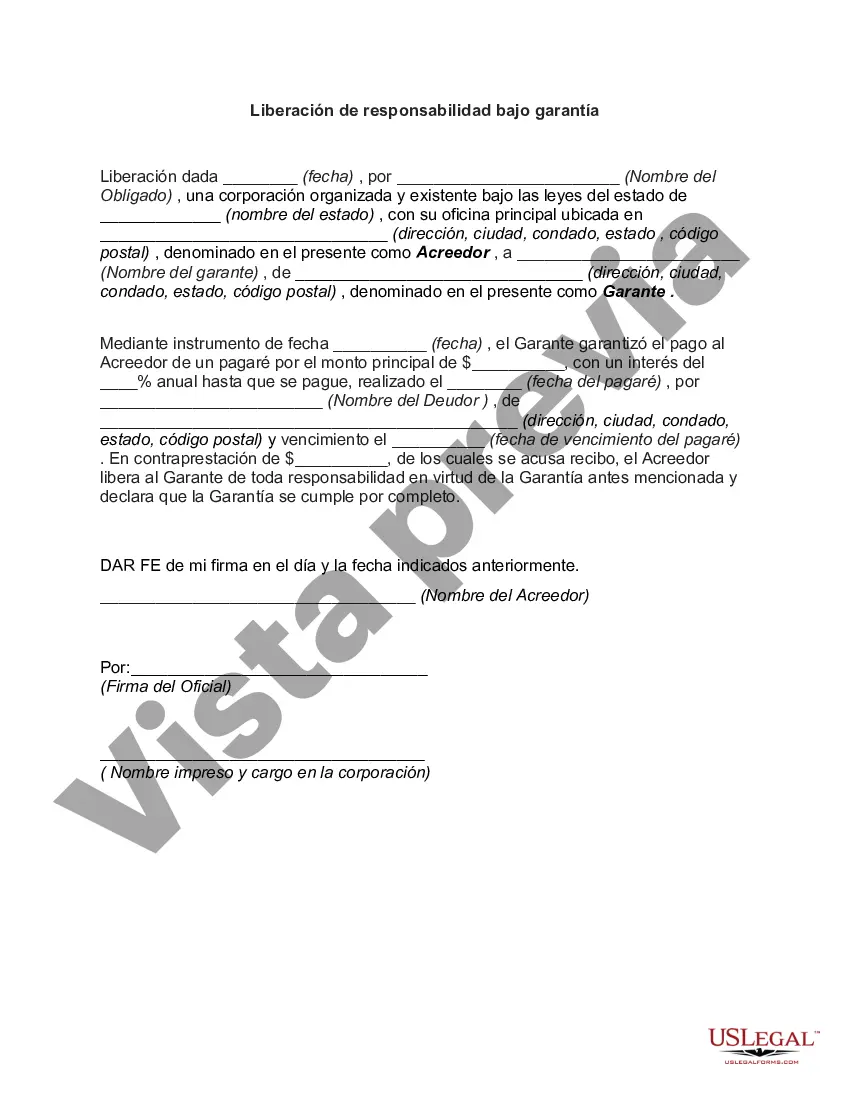

Illinois Release from Liability under Guaranty: A Detailed Description and Types The Illinois Release from Liability under Guaranty is a legal document that serves as a mutual agreement between two parties involved in a guarantee arrangement. In this contract, the guarantor, often an individual or an organization, agrees to assume responsibility for the debt or obligation of another party (the principal) in the event of default. However, in certain circumstances, the guarantor may wish to be released from this responsibility. This is where the Illinois Release from Liability under Guaranty becomes relevant. A Release from Liability under Guaranty is an essential legal instrument that grants the guarantor protection from any further obligations or responsibilities related to the initial guarantee agreement. By signing this document, the guarantor is essentially absolved from any future claims, demands, actions, or liabilities that may arise from the principal's default. The release is enforceable under the laws of Illinois. There are different types of Illinois Release from Liability under Guaranty, including: 1. Partial Release: This type of release frees the guarantor from liability for a portion of the guaranteed obligation, while still preserving their liability for the remaining portion. 2. Full Release: In a full release, the guarantor is completely relieved of any obligations or liabilities related to the initial guarantee agreement. This means that the guarantor is no longer liable for any part of the principal's debt or obligation. 3. Conditional Release: If certain conditions are met, a conditional release from liability under guaranty can be granted. These conditions are typically specified in the release agreement and must be fulfilled for the guarantor to be relieved of their responsibilities. 4. Unconditional Release: An unconditional release means that the guarantor is released from liability under the guaranty without any conditions or prerequisites. Once this release is executed, the guarantor is permanently freed from any future claims or liabilities. It is important to note that the specific terms and conditions of the release may vary depending on the individual circumstances, the nature of the guarantee, and the agreement reached between the parties involved. Consulting with legal professionals experienced in Illinois contract law is advisable to ensure that the release is properly drafted and executed according to the state's legal requirements. In conclusion, the Illinois Release from Liability under Guaranty is an essential legal tool that enables a guarantor to be released from their obligations and liabilities associated with a guarantee agreement. The types of releases include partial, full, conditional, and unconditional, each offering varying degrees of relief depending on the specific circumstances. Understanding these types and utilizing them appropriately can help protect the rights and interests of both parties involved in a guarantee arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Illinois Liberación De Responsabilidad Bajo Garantía?

You may invest time on-line searching for the legitimate papers web template that meets the state and federal needs you want. US Legal Forms gives a large number of legitimate varieties that are reviewed by specialists. You can actually acquire or print the Illinois Release from Liability under Guaranty from our assistance.

If you currently have a US Legal Forms bank account, you can log in and then click the Obtain switch. Afterward, you can complete, modify, print, or sign the Illinois Release from Liability under Guaranty. Each legitimate papers web template you acquire is the one you have for a long time. To obtain an additional backup for any purchased kind, check out the My Forms tab and then click the related switch.

If you use the US Legal Forms web site initially, adhere to the easy directions beneath:

- Very first, ensure that you have chosen the right papers web template for your county/city of your liking. Look at the kind information to make sure you have picked the appropriate kind. If available, utilize the Review switch to appear throughout the papers web template too.

- If you would like get an additional variation of the kind, utilize the Look for area to discover the web template that fits your needs and needs.

- When you have located the web template you desire, click Purchase now to proceed.

- Choose the prices plan you desire, type your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal bank account to pay for the legitimate kind.

- Choose the format of the papers and acquire it to your gadget.

- Make alterations to your papers if necessary. You may complete, modify and sign and print Illinois Release from Liability under Guaranty.

Obtain and print a large number of papers web templates using the US Legal Forms site, which provides the largest collection of legitimate varieties. Use expert and express-distinct web templates to tackle your small business or specific requires.