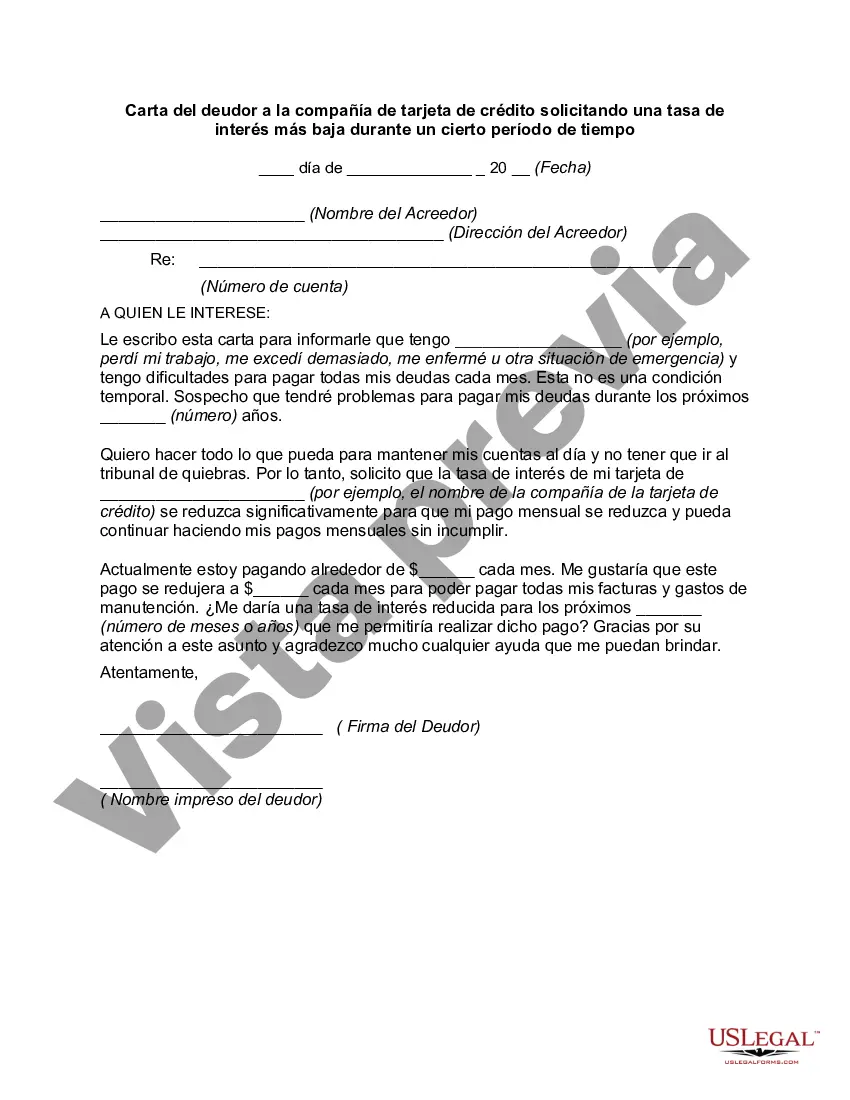

Title: Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In the state of Illinois, debtors have the right to communicate with credit card companies requesting a lower interest rate for a specific period of time. Writing a well-crafted, detailed letter can enhance the chances of successfully negotiating a temporary reduced interest rate. This article provides insights on how to structure an effective Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, along with some key variations you may encounter. Keywords: Illinois, debtor, credit card company, lower interest rate, certain period of time, negotiation, letter, request, structure, variations 1. Importance of Writing a Detailed Letter: When reaching out to your credit card company in Illinois, it's crucial to articulate your request clearly in writing. Craft a comprehensive letter that provides all necessary information to support your case, highlighting your financial situation, previous payment history, and the proposed duration for the reduced interest rate. 2. Basic Structure of an Illinois Letter from Debtor to Credit Card Company: a. Heading: Include your personal information and contact details, along with the credit card company's information. b. Salutation: Address the recipient with appropriate formalities, using their full name and title. c. Introduction and Purpose: Clearly state the purpose of your letter, explaining that you are requesting a lower interest rate for a certain period of time. d. Explanation and Justification: Provide a detailed explanation regarding why you need a reduced interest rate, such as financial hardships, medical emergencies, or any other relevant circumstances. Attach supporting documents, if necessary. e. Payment History: Detail your history of prompt payments, highlighting instances where past interest rates have been successfully negotiated or creditors have reduced rates. f. Temporary Lower Interest Rate Proposal: Clearly outline the specific period for which you request the lower interest rate, emphasizing how it can improve your ability to pay off the debt. g. Conclusion: Reiterate your request, expressing appreciation for their consideration, and state your willingness to provide further information or discuss the matter in detail. h. Closing and Signature: End the letter with a professional closing, followed by your signature, printed name, and date. 3. Possible Variations of an Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate: a. Variation 1: Requesting a Lower Interest Rate Due to Financial Hardships If you are facing financial difficulties such as unemployment, loss of income, or unexpected expenses, adapt the letter to emphasize these factors while showcasing a plan to overcome the situation and resume regular payments. b. Variation 2: Requesting a Lower Interest Rate for Debt Consolidation In situations where you are consolidating multiple debts, articulate how a reduced interest rate from your credit card company can contribute to a more manageable repayment plan, ultimately aiding your debt consolidation efforts. c. Variation 3: Requesting a Lower Interest Rate for a Fixed-Term Loan If you are considering a fixed-term loan such as a personal loan to pay off your credit card debt, explain how a reduced interest rate from the credit card company would be beneficial in reducing the overall burden and improving your ability to repay the loan. Remember, tailoring your Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time to suit your specific circumstances and being respectful and professional throughout is key to increasing your chances of successfully negotiating favorable terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Illinois Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Choosing the best legitimate record design can be a struggle. Naturally, there are plenty of layouts accessible on the Internet, but how will you obtain the legitimate form you will need? Make use of the US Legal Forms internet site. The service provides thousands of layouts, like the Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, that can be used for business and personal requires. Each of the forms are checked out by specialists and satisfy federal and state requirements.

In case you are presently registered, log in in your accounts and click on the Download key to obtain the Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Use your accounts to search with the legitimate forms you may have bought earlier. Go to the My Forms tab of your accounts and acquire one more version from the record you will need.

In case you are a new user of US Legal Forms, listed here are easy instructions that you should follow:

- First, make sure you have selected the appropriate form for your personal area/region. You may look through the form using the Review key and study the form explanation to make sure it will be the best for you.

- If the form fails to satisfy your expectations, utilize the Seach field to obtain the proper form.

- Once you are sure that the form is suitable, select the Get now key to obtain the form.

- Opt for the prices program you want and type in the needed information and facts. Design your accounts and pay for the transaction utilizing your PayPal accounts or charge card.

- Opt for the submit structure and obtain the legitimate record design in your product.

- Comprehensive, edit and printing and indicator the received Illinois Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is the biggest local library of legitimate forms where you can find various record layouts. Make use of the service to obtain skillfully-produced files that follow state requirements.