Illinois Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

If you require comprehensive, download, or printing authentic document formats, utilize US Legal Forms, the premier compilation of authentic templates, accessible online.

Leverage the site’s straightforward and user-friendly search to acquire the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you require, click the Buy Now button. Choose your preferred payment plan and provide your information to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Illinois Warranty Agreement concerning Web Site Software in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Illinois Warranty Agreement related to Web Site Software.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

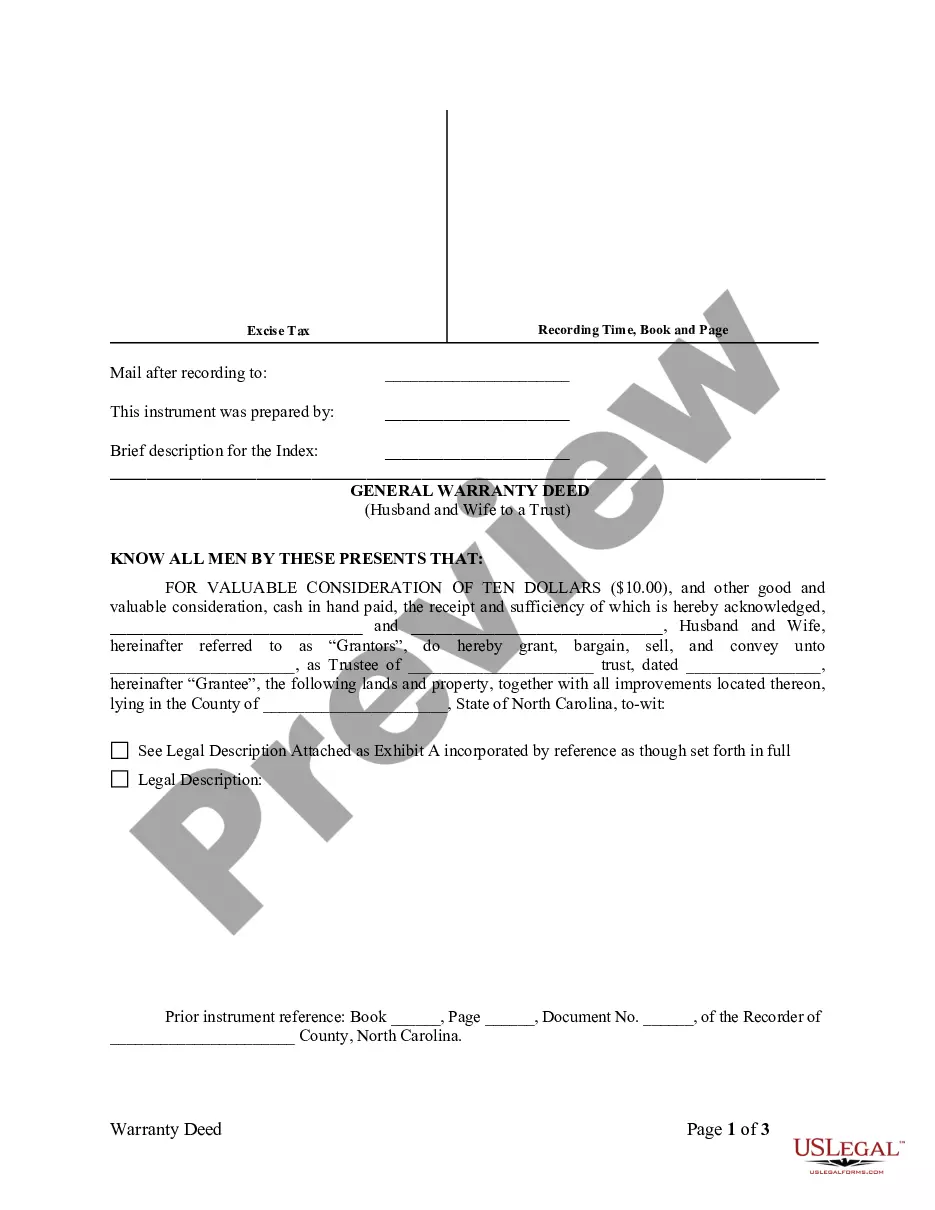

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

Yes, Arkansas generally charges sales tax on SaaS. As this tax applies to the service of accessing software via the internet, you should be aware when developing Illinois Warranty Agreements as to Web Site Software that this could also involve tax considerations in other states. To ensure compliance and avoid missteps, it is best to consult a tax professional familiar with both Illinois and Arkansas regulations.

Despite the Illinois Department of Revenue's historically complex stance on the taxation of computer software, the Department has now stated that SaaS is not subject to sales tax in Illinois.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

The Department of Taxes has issued a Fact Sheet that states that charges to remotely accessed computer software over the cloud and the use of the software is an exempt computer service or the sale of an intangible.

Any custom software that is delivered through electronic means or via the load and leave method is not considered tangible personal property nor subject to sales tax. However, it is only tax-exempt if separately stated on the invoice from charges for manuals, disks, CDs or other tangible property, which is taxable.

In the state of Illinois, any modified software which is held for general or repeated sale or lease is considered to be taxable. Sales of digital products are exempt from the sales tax in Illinois.

Under Illinois law, canned software is considered to be tangible personal property no matter how it is transmitted or transferred: via card, disc, tape, electronic means, or other media.

Illinois does not impose tax on SaaS delivered via a cloud-based system, provided the transaction does not include a transfer of tangible personal property.

Illinois does not impose tax on SaaS delivered via a cloud-based system, provided the transaction does not include a transfer of tangible personal property.

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.