The Illinois Charitable Contribution Payroll Deduction Form is an essential document used by employees in Illinois to allocate a portion of their paycheck towards charitable donations. This form allows individuals to make recurring, tax-deductible contributions to eligible nonprofit organizations directly from their wages. By utilizing this form, employees demonstrate their commitment to giving back to their community and supporting worthy causes. One of the primary benefits of the Illinois Charitable Contribution Payroll Deduction Form is that it streamlines the donation process. Instead of separately writing checks or making online payments, this form allows employees to conveniently authorize a deduction from their salary on a regular basis. This ensures a consistent flow of contributions and makes it easier for individuals to budget their charitable giving. To fill out the form correctly, employees are required to input relevant personal and employment details, including their name, address, Social Security Number, employer's name, and payroll identification number. It is crucial to provide accurate information to ensure the deductions are applied correctly and the tax benefits can be claimed. Additionally, employees must specify the charitable organization(s) they wish to support and the exact dollar amount or percentage they would like to contribute from each paycheck. This form provides an opportunity to split donations among multiple organizations if desired. The chosen nonprofit must be registered and must meet the eligibility requirements established by the state of Illinois. It is worth noting that there may be various versions or variations of the Illinois Charitable Contribution Payroll Deduction Form, depending on the specific requirements of different employers or government entities. These alternate versions could include modifications such as additional fields for employer-specific information, alternative ways of determining donation amounts (e.g., based on salary brackets), or different formatting. Therefore, it is important to obtain the correct form from the employer or applicable entity to ensure compliance with their individual guidelines. Overall, the Illinois Charitable Contribution Payroll Deduction Form is a valuable tool that empowers employees to contribute to charitable causes conveniently and consistently. By leveraging this form, individuals can make a positive impact on the greater Illinois community while also maximizing their tax benefits associated with charitable giving.

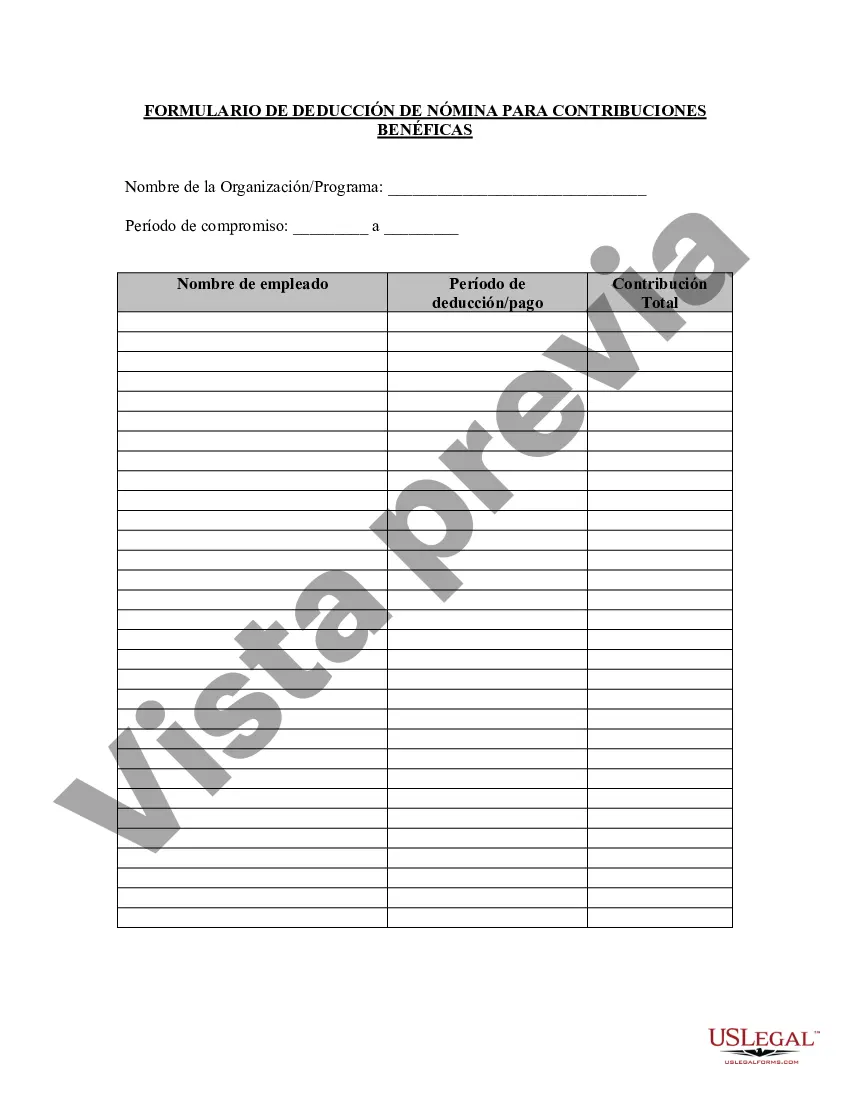

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Illinois Formulario De Deducción De Nómina De Contribución Benéfica?

You may invest hrs on-line trying to find the lawful record web template that fits the state and federal specifications you need. US Legal Forms provides thousands of lawful kinds which are reviewed by experts. It is possible to down load or produce the Illinois Charitable Contribution Payroll Deduction Form from the service.

If you already have a US Legal Forms bank account, you can log in and then click the Acquire button. Afterward, you can comprehensive, change, produce, or indicator the Illinois Charitable Contribution Payroll Deduction Form. Each and every lawful record web template you purchase is yours for a long time. To get yet another backup of any bought type, proceed to the My Forms tab and then click the related button.

If you use the US Legal Forms web site the very first time, adhere to the straightforward recommendations below:

- Very first, make sure that you have selected the proper record web template for the region/area of your choosing. Look at the type explanation to make sure you have selected the appropriate type. If readily available, take advantage of the Preview button to look through the record web template also.

- If you want to find yet another version of the type, take advantage of the Lookup discipline to obtain the web template that meets your needs and specifications.

- Upon having located the web template you would like, simply click Get now to continue.

- Find the rates strategy you would like, type in your credentials, and register for an account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal bank account to purchase the lawful type.

- Find the file format of the record and down load it to the device.

- Make changes to the record if necessary. You may comprehensive, change and indicator and produce Illinois Charitable Contribution Payroll Deduction Form.

Acquire and produce thousands of record templates utilizing the US Legal Forms Internet site, which provides the greatest variety of lawful kinds. Use professional and status-distinct templates to handle your organization or personal requires.