Illinois Compensation Administration Checklist refers to a comprehensive guide or document that outlines the necessary steps, processes, and requirements associated with managing compensation for employees in the state of Illinois. This checklist serves as a crucial tool for HR professionals, compensation analysts, and employers to ensure compliance with Illinois labor laws, effectively administer compensation programs, and ensure fair and equitable treatment for their workforce. Keywords: 1. Illinois: Indicates the geographical scope of this checklist, focusing specifically on compensation administration practices within the state. 2. Compensation Administration: Refers to the strategizing, planning, implementation, and management of employee compensation and benefit programs within an organization. 3. Checklist: A systematic and organized list of tasks, steps, or procedures that need to be completed or followed in order to achieve a specific goal or ensure compliance. 4. HR Professionals: Individuals responsible for managing personnel-related activities within an organization, including compensation management. 5. Compensation Analysts: Specialists who analyze and evaluate compensation data, market trends, and internal equity to develop and maintain competitive and fair compensation structures. 6. Employers: Organizations or individuals who hire and employ individuals to perform specific job roles or functions. 7. Compliance: Refers to adhering to regulations and laws set forth by government entities, such as the Illinois Department of Labor, to avoid legal repercussions. 8. Labor Laws: Legislation enacted by federal, state, or local governments regulating employment practices, wage rates, benefits, and working conditions within a particular jurisdiction. 9. Equitable: Denoting fairness, impartiality, and justice, prevalent when considering compensation practices ensuring non-discriminatory treatment of employees. Types of Illinois Compensation Administration Checklists: 1. Illinois Compensation Compliance Checklist: Focuses on ensuring adherence to Illinois labor laws and regulations governing employee compensation, including minimum wage requirements, overtime pay, prevailing wage rates, and benefits. 2. Illinois Payroll Administration Checklist: Provides guidance on accurately processing and managing employee payroll, including tax withholding, deductions, benefits, and recording hours worked. 3. Illinois Compensation and Benefits Communication Checklist: Offers a framework for effectively communicating employee compensation and benefits information to ensure transparency, understanding, and engagement among employees. 4. Illinois Compensation Structuring Checklist: Aids in designing and developing compensation structures, such as salary ranges, pay bands, and incentive systems, in compliance with Illinois labor laws and industry standards. 5. Illinois Performance-Based Compensation Checklist: Outlines best practices for implementing performance-based compensation systems, including goal setting, performance evaluation, and establishing appropriate rewards or bonuses.

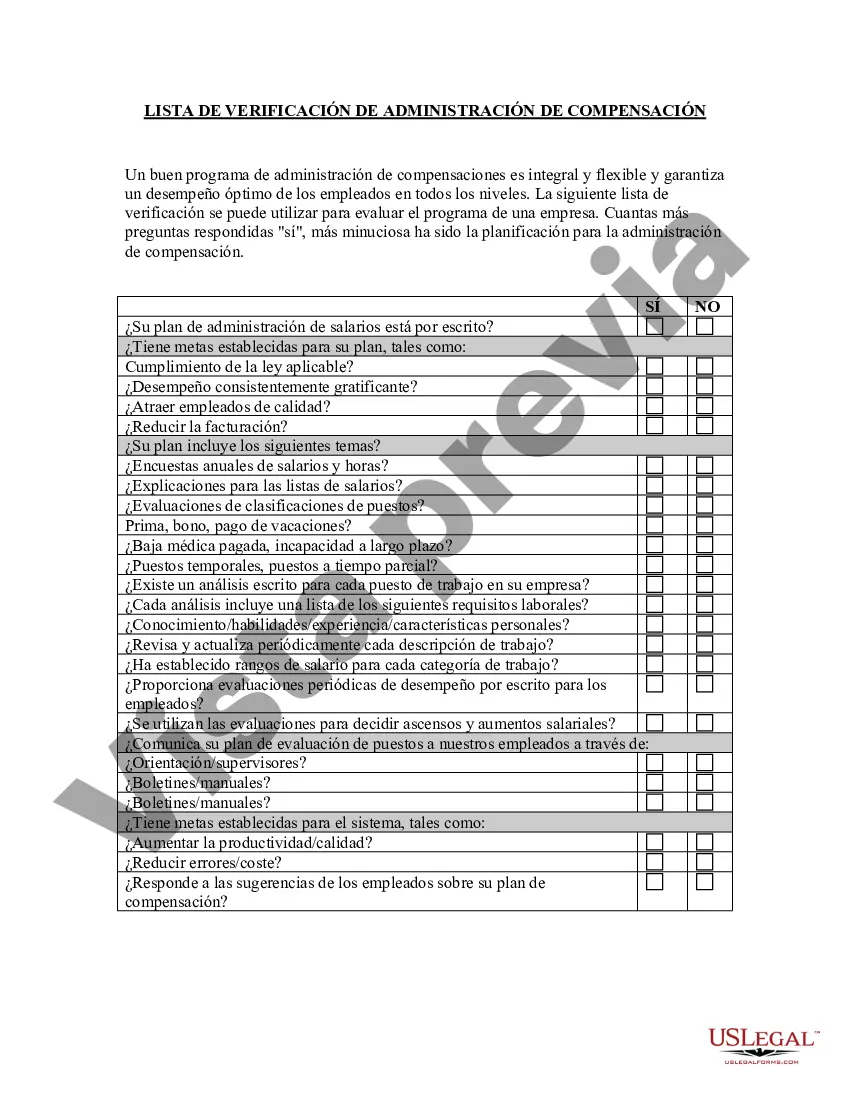

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out Illinois Lista De Verificación De Administración De Compensación?

Are you presently in a position in which you need documents for sometimes company or person purposes just about every day? There are plenty of authorized document web templates available on the net, but finding ones you can rely is not straightforward. US Legal Forms delivers a large number of form web templates, much like the Illinois Compensation Administration Checklist, that happen to be composed in order to meet state and federal demands.

When you are presently familiar with US Legal Forms website and have a merchant account, basically log in. Following that, it is possible to download the Illinois Compensation Administration Checklist template.

If you do not come with an account and want to begin using US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is to the proper city/region.

- Utilize the Review key to review the shape.

- See the description to ensure that you have chosen the proper form.

- When the form is not what you are looking for, utilize the Research field to get the form that meets your requirements and demands.

- Whenever you obtain the proper form, click Get now.

- Pick the rates plan you want, submit the required details to create your bank account, and buy your order with your PayPal or charge card.

- Choose a hassle-free paper format and download your version.

Find each of the document web templates you might have purchased in the My Forms menus. You can get a extra version of Illinois Compensation Administration Checklist anytime, if required. Just click on the essential form to download or print out the document template.

Use US Legal Forms, by far the most substantial selection of authorized varieties, to conserve efforts and prevent mistakes. The assistance delivers professionally made authorized document web templates which you can use for a variety of purposes. Produce a merchant account on US Legal Forms and commence producing your daily life easier.