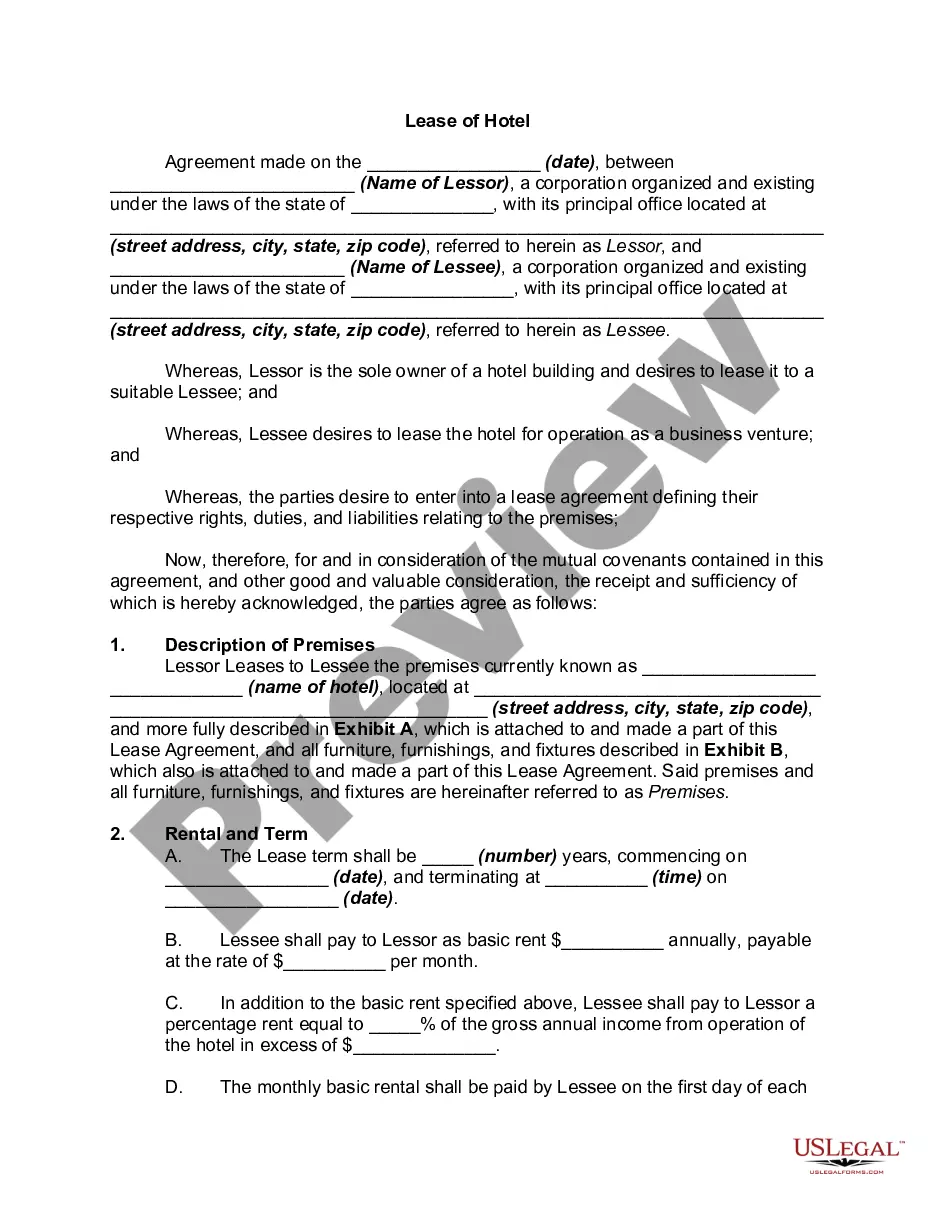

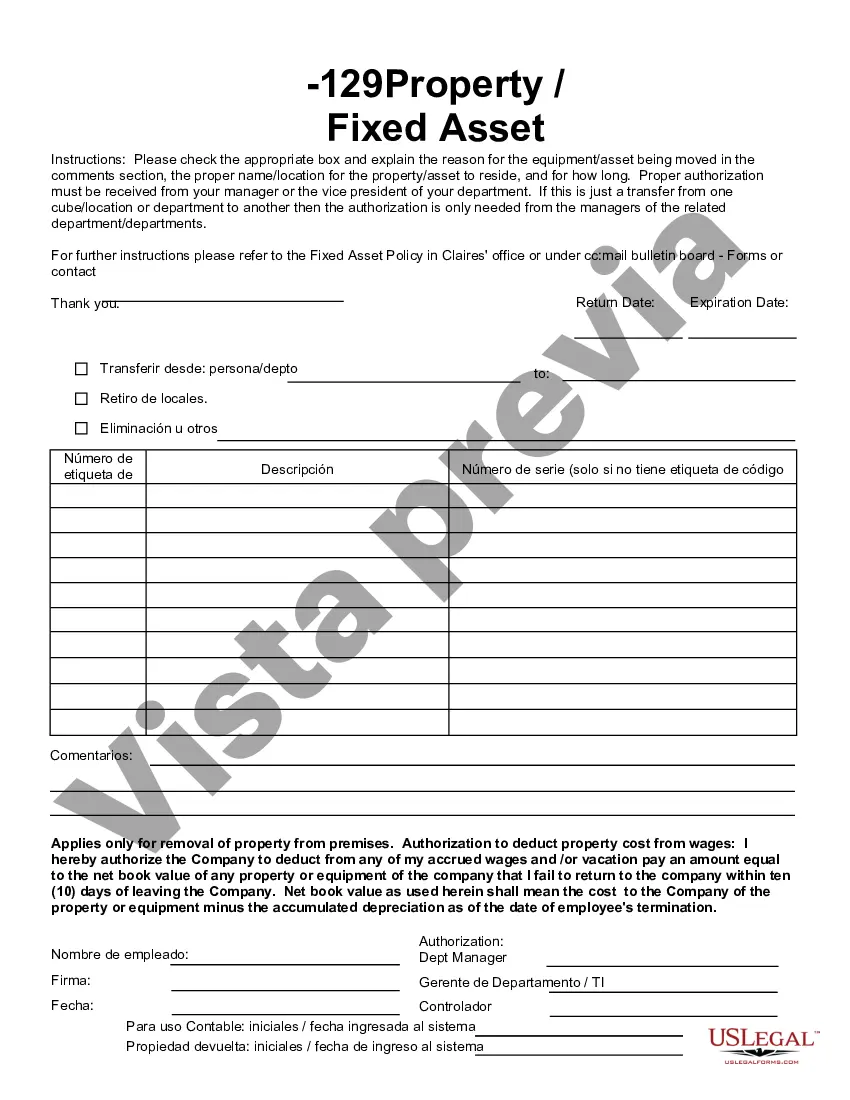

Illinois Fixed Asset Removal Form is a document used for recording the disposal or removal of fixed assets from an organization's inventory in the state of Illinois. This form is crucial for maintaining accurate records and ensuring compliance with state regulations. The purpose of the Illinois Fixed Asset Removal Form is to document the details of fixed assets that are being either sold, donated, scrapped, stolen, or destroyed. By completing this form, organizations can update their asset records, adjust depreciation schedules, and maintain transparency in financial reporting. The Illinois Fixed Asset Removal Form typically includes the following details: 1. Asset Information: This section requires information about the fixed asset being removed, such as its asset name, identification number, description, and current location. 2. Removal Details: Here, details about the reason for removal are mentioned. It allows you to specify if the asset is being sold, donated, or disposed of due to theft, obsolescence, or any other reason. Additionally, you may need to provide the expected removal date. 3. Disposition Details: In this section, you will indicate how the asset will be disposed of. It could be through an auction, private sale, transfer to another department, or donation to a charitable organization. If the asset is being scrapped or destroyed, you may need to provide information about the method and location of disposal. 4. Approval and Signature: This space is reserved for authorized personnel to sign off on the removal. It ensures that the removal is authorized and documented properly. It is important to note that there might be different types of Illinois Fixed Asset Removal Forms available, depending on the industry or type of organization. Some common variations include: 1. Illinois Fixed Asset Removal Form for Educational Institutions: This version may include additional sections to adhere to specific regulations and requirements applicable to schools, colleges, or universities. 2. Illinois Fixed Asset Removal Form for Government Entities: Government agencies often have unique procedures and guidelines for asset removal. The form used by these organizations may incorporate additional sections related to compliance and accountability. 3. Illinois Fixed Asset Removal Form for Non-Profit Organizations: Non-profit entities might require specific documentation for asset removal due to their tax-exempt status. The form designed for them could incorporate additional sections related to tax reporting and documentation of charitable donations. By utilizing the appropriate Illinois Fixed Asset Removal Form and providing accurate information, organizations can ensure compliance with state regulations, maintain clear records of fixed asset disposals, and streamline financial reporting processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Illinois Formulario De Retiro De Activos Fijos?

If you need to comprehensive, acquire, or print legitimate record web templates, use US Legal Forms, the greatest collection of legitimate forms, which can be found on the Internet. Make use of the site`s simple and handy look for to find the paperwork you need. A variety of web templates for organization and specific reasons are sorted by categories and states, or keywords. Use US Legal Forms to find the Illinois Fixed Asset Removal Form with a couple of mouse clicks.

If you are currently a US Legal Forms consumer, log in to your profile and click on the Down load switch to have the Illinois Fixed Asset Removal Form. You can also access forms you earlier downloaded inside the My Forms tab of your own profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the proper metropolis/region.

- Step 2. Make use of the Review choice to check out the form`s information. Don`t overlook to see the information.

- Step 3. If you are unsatisfied with all the type, take advantage of the Research area on top of the display to find other variations of the legitimate type web template.

- Step 4. Once you have identified the shape you need, click the Buy now switch. Opt for the costs plan you like and include your qualifications to register for the profile.

- Step 5. Procedure the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Find the file format of the legitimate type and acquire it on the gadget.

- Step 7. Total, modify and print or indication the Illinois Fixed Asset Removal Form.

Each legitimate record web template you get is the one you have for a long time. You may have acces to every single type you downloaded within your acccount. Go through the My Forms section and select a type to print or acquire once more.

Contend and acquire, and print the Illinois Fixed Asset Removal Form with US Legal Forms. There are millions of professional and state-distinct forms you may use to your organization or specific demands.