Illinois Payroll Deduction — Special Services, also known as Illinois Payroll Deduction — Special Services Programs, are unique benefits offered to employees in the state of Illinois. These programs allow employees to deduct specific amounts from their paychecks for various purposes. Payroll deduction options can vary depending on the organization or employer. Some common types of Illinois Payroll Deduction — Special Services Programs include: 1. Illinois State Employee Combined Charitable Campaign (SE CCC): This program provides state employees with the opportunity to donate to various charitable organizations through payroll deductions. SE CCC aims to support causes such as health and human services, environmental conservation, education, community and economic development, and more. 2. Illinois Child Support Deduction: Employers in Illinois are required by law to deduct child support payments from employees' paychecks. This deduction ensures that child support obligations are consistently met and provides financial support to custodial parents. 3. Illinois Pension Deductions: Illinois offers different pension programs, such as the State Universities Retirement System (SURE) and the Illinois Municipal Retirement Fund (IMF). These programs require payroll deductions from employees' salaries to fund retirement benefits. 4. Illinois Healthcare Deductions: Some Illinois employers offer healthcare plans that allow employees to make payroll deductions to cover the cost of medical insurance premiums. This deduction provides employees with the convenience of paying for healthcare expenses directly from their paychecks. 5. Illinois Deferred Compensation Programs: These programs allow employees to voluntarily contribute a portion of their salary to a retirement savings account, such as a 401(k) or 457 plans. The money is then invested and grows tax-deferred until the employee reaches retirement age. 6. Illinois Union Dues Deduction: If an employee is a part of a labor union, they may have payroll deductions for union dues. These deductions help support the activities and operations of the labor union, ensuring representation and collective bargaining support for workers. It is important to note that the availability of these Illinois Payroll Deduction — Special Services Programs may vary depending on the employer and the specific terms of employment. Employers should provide detailed information regarding the payroll deduction options available to their employees.

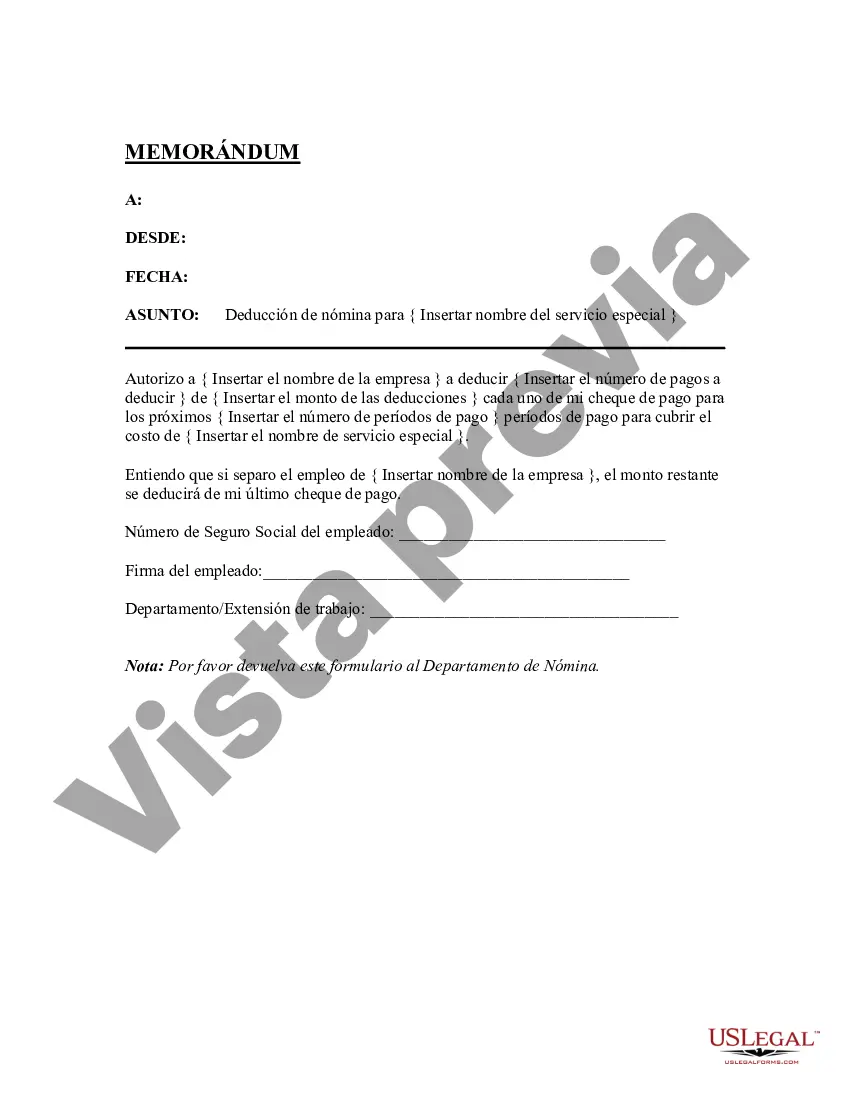

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Illinois Deducción De Nómina - Servicios Especiales?

Are you in the position where you need to have files for possibly business or specific uses virtually every day? There are tons of legitimate document layouts available on the Internet, but locating kinds you can rely on isn`t effortless. US Legal Forms delivers thousands of form layouts, just like the Illinois Payroll Deduction - Special Services, which are created to satisfy federal and state requirements.

When you are already acquainted with US Legal Forms web site and have an account, merely log in. Afterward, you are able to download the Illinois Payroll Deduction - Special Services design.

If you do not provide an account and would like to start using US Legal Forms, abide by these steps:

- Obtain the form you require and make sure it is for your correct city/area.

- Utilize the Review switch to examine the shape.

- Read the information to ensure that you have chosen the proper form.

- In case the form isn`t what you are looking for, take advantage of the Look for area to discover the form that meets your requirements and requirements.

- Whenever you get the correct form, click on Buy now.

- Opt for the prices plan you would like, complete the required information to make your money, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a practical data file file format and download your version.

Get all the document layouts you have bought in the My Forms food selection. You can get a extra version of Illinois Payroll Deduction - Special Services any time, if required. Just click the essential form to download or produce the document design.

Use US Legal Forms, by far the most considerable selection of legitimate forms, to conserve time and stay away from mistakes. The services delivers professionally manufactured legitimate document layouts that you can use for a selection of uses. Generate an account on US Legal Forms and begin producing your way of life a little easier.