Illinois Stop Annuity Request is a legal process through which individuals in Illinois can terminate or modify an annuity contract that they have entered into. An annuity is a financial product that provides regular income payments over a specified period of time or for life. However, due to changing circumstances or the need for immediate cash, individuals may wish to stop or adjust their annuity payments. The Illinois Stop Annuity Request allows annuity holders to pursue this goal legally. One type of Illinois Stop Annuity Request is the "Stop Payment Request." This type is used when individuals want to completely cease receiving annuity payments. It may be prompted by unforeseen financial difficulties, medical emergencies, or changes in retirement plans. A Stop Payment Request enables annuity holders to halt future payments and potentially receive a lump sum payout instead. Another type is the "Annuity Modification Request." This type is appropriate when annuity holders wish to make changes to their existing annuity contract. It could involve altering payment frequency, adjusting the amount of each payment, or modifying the contract terms. Annuity Modification Requests provide flexibility to suit the annuitant's evolving financial needs or long-term goals. To initiate an Illinois Stop Annuity Request, individuals must follow a specific procedure. First, they need to contact the annuity provider or insurance company with whom they hold the annuity contract. They must submit a written request detailing their specific requirements, reasons for termination or modification, and any supporting documents. Additionally, individuals may need to provide proof of identity and ownership of the annuity. It is crucial to understand that the eligibility for an Illinois Stop Annuity Request may vary depending on the terms and conditions stated in the annuity contract. Therefore, before proceeding, individuals should thoroughly review the contract to be aware of any potential penalties, surrender charges, or limitations on stopping or modifying the annuity. In conclusion, the Illinois Stop Annuity Request is a legal process that allows individuals in Illinois to terminate or modify their annuity contracts. By using relevant keywords such as "Stop Payment Request" and "Annuity Modification Request," individuals can effectively navigate the different options available to them. It is important to consult the annuity provider and carefully review the annuity contract to understand the specific terms and conditions of the Stop Annuity Request process.

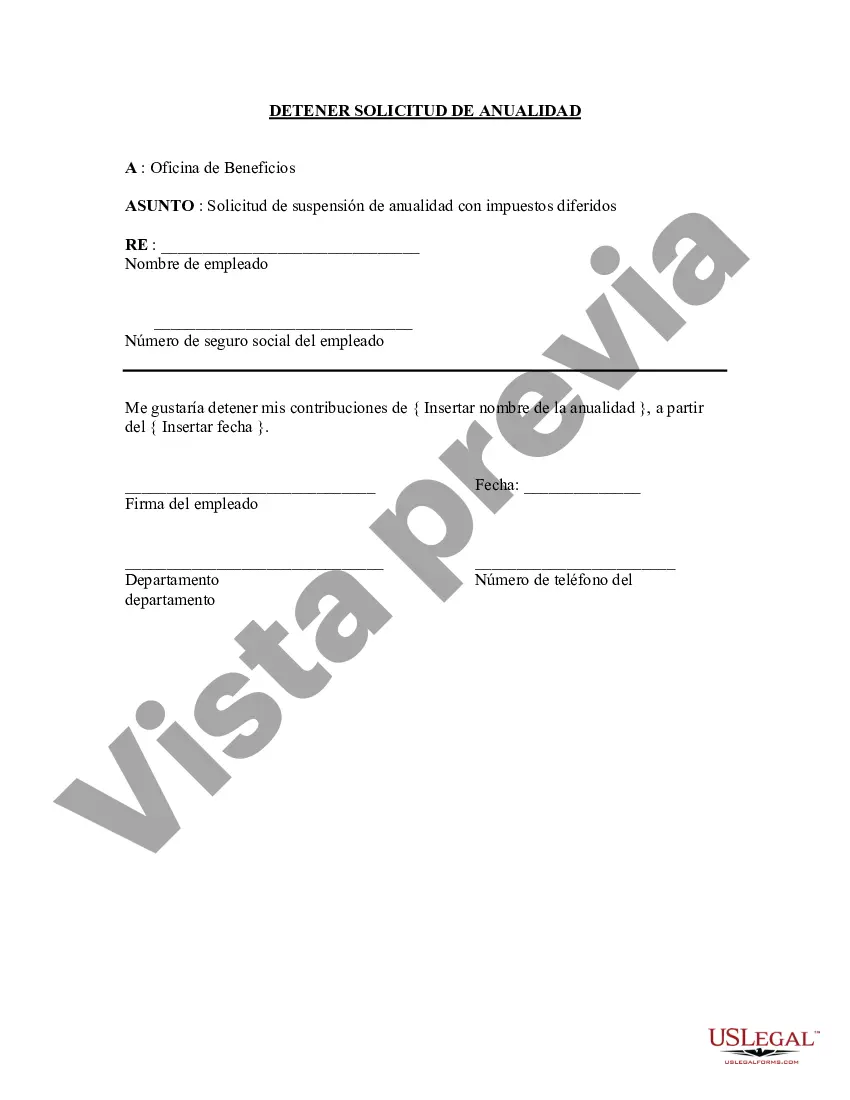

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Illinois Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Illinois Detener Solicitud De Anualidad?

You may commit several hours on-line searching for the legitimate papers web template which fits the federal and state specifications you want. US Legal Forms supplies a huge number of legitimate kinds that are analyzed by pros. You can actually down load or printing the Illinois Stop Annuity Request from my assistance.

If you have a US Legal Forms account, it is possible to log in and then click the Obtain switch. Afterward, it is possible to total, modify, printing, or indication the Illinois Stop Annuity Request. Every single legitimate papers web template you get is the one you have for a long time. To obtain one more copy of the purchased develop, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms site for the first time, adhere to the straightforward guidelines listed below:

- Initially, make certain you have selected the correct papers web template to the state/metropolis of your choice. See the develop explanation to ensure you have chosen the appropriate develop. If readily available, make use of the Preview switch to look with the papers web template too.

- In order to locate one more model in the develop, make use of the Look for field to find the web template that fits your needs and specifications.

- Upon having identified the web template you desire, simply click Buy now to proceed.

- Pick the rates prepare you desire, type your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal account to purchase the legitimate develop.

- Pick the formatting in the papers and down load it for your device.

- Make adjustments for your papers if necessary. You may total, modify and indication and printing Illinois Stop Annuity Request.

Obtain and printing a huge number of papers templates utilizing the US Legal Forms site, that provides the greatest collection of legitimate kinds. Use expert and state-particular templates to handle your company or person needs.