Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Cartoonist Or Illustrator Agreement - Self-Employed Independent Contractor?

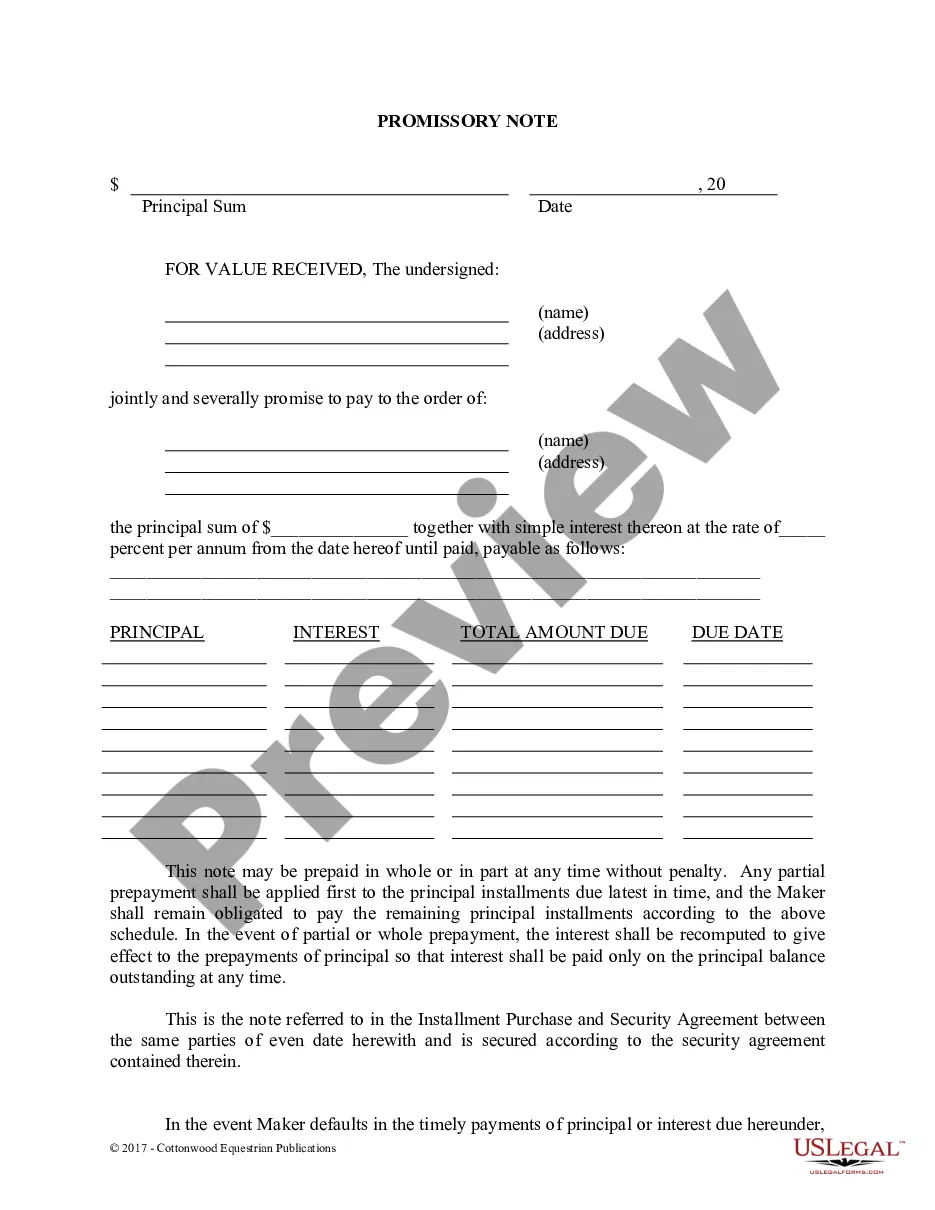

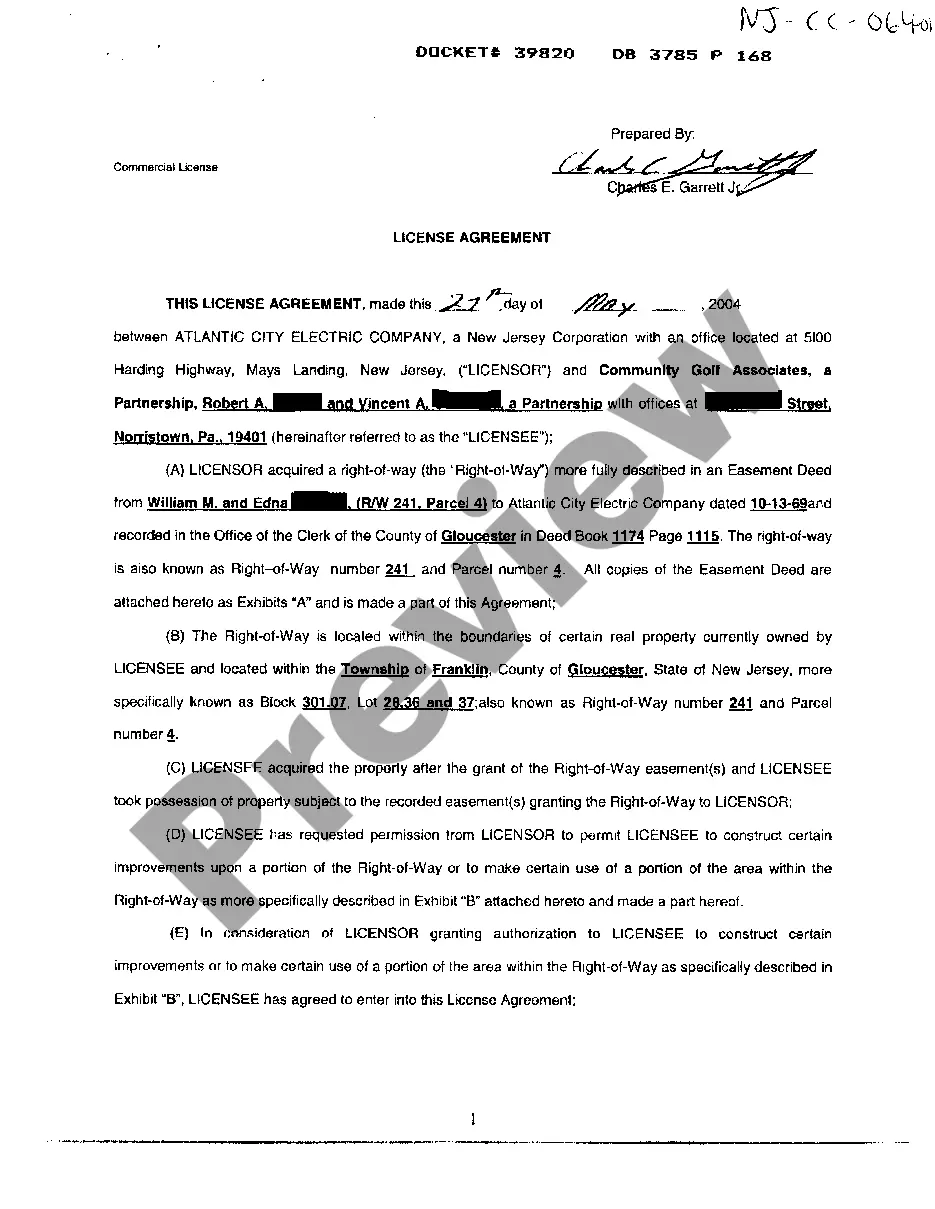

Are you currently in a situation where you require documents for business or specific purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust isn’t easy. US Legal Forms offers a vast array of form templates, such as the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor, designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Get the form you need and ensure it is for the correct city/region. Use the Preview button to review the form. Check the details to confirm that you have selected the right form. If the form isn’t what you’re looking for, utilize the Search area to find the form that suits your needs and requirements. If you find the correct form, click Buy now. Select the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient document format and download your copy.

- Locate all the document templates you have purchased in the My documents menu.

- You can obtain another copy of the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor at any time, if necessary.

- Just click on the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes.

- The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

The new 40 hour law in Illinois mandates that independent contractors should not work over 40 hours per week without appropriate compensation. This law aims to protect freelancers from overwork while allowing them to maintain a flexible schedule. Utilizing an Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor can help you outline your working hours and ensure you are fairly compensated.

While it's not legally required, having a contract as an independent contractor is highly recommended. Such an Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor clarifies your obligations and those of your clients, promoting a fair working relationship. Contracts also offer legal recourse in case disputes arise, safeguarding your freelance career.

The freelance law in Illinois protects independent contractors by ensuring prompt payment for services rendered. Under this law, hiring parties must compensate freelancers within a specified timeframe after project completion. As a cartoonist or illustrator, having an Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor in place can enhance your chances of timely payment.

The 7 day rule in Illinois pertains to the time allowed for independent contractors to make arrangements for their work. Essentially, clients must provide contractors with a minimum of seven days' notice for significant changes. Utilizing an Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor can help you navigate this rule effectively and ensure compliance.

Absolutely, you can create a contract as an illustrator. A well-drafted Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor helps define the scope of work, payment structure, and deadlines. This contract forms a solid foundation for your relationship with clients, promoting clarity and preventing misunderstandings.

Yes, an artist can be considered an independent contractor. This classification applies when an artist provides creative services to clients without any long-term commitment. By using an Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor, artists can clearly outline their work conditions and payment terms, ensuring legal and professional protection.

Freelance work involves providing services or completing projects for clients without being permanently employed. As a self-employed independent contractor, you can set your own hours and choose your clients. This flexibility allows artists to create their own Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor, which can protect their rights and interests.

To fill out an independent contractor agreement, begin with your basic information, including names and contact details. Specify the project description, payment terms, and deliverables. By aligning your agreement with the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor, you can easily meet all legal requirements and safeguard your interests.

Writing an independent contractor agreement requires clarity and specificity, starting with the parties involved and the project details. Include terms on payment, timeline, and intellectual property rights. Referring to the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor can ensure you cover all aspects necessary for a solid contract.

To write an illustration contract, start by outlining the scope of work, including the number of illustrations and deadlines. Clearly define payment details and any usage rights. Utilize the guidelines from the Illinois Cartoonist or Illustrator Agreement - Self-Employed Independent Contractor, as it provides a solid framework to protect both you and your clients.