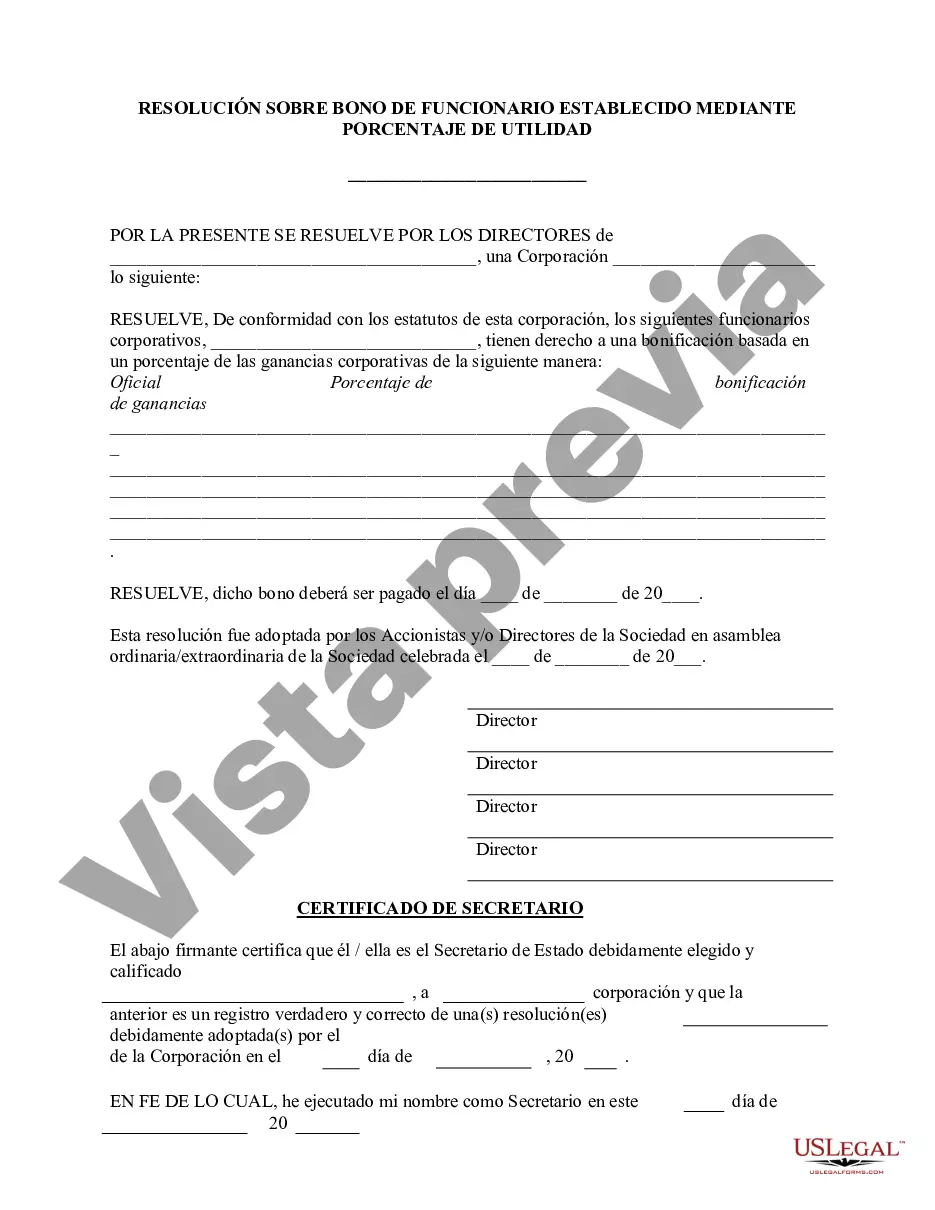

Title: Indiana Officers Bonus — Percenprofitfi— - Resolution Form: Explained and Types Keywords: Indiana Officers Bonus, Percent of Profit, Resolution Form, Types Introduction: Indiana Officers Bonus — Percenprofitfi— - Resolution Form is a legal document specific to Indiana state that outlines the process and terms for awarding bonuses to officers based on a percentage of the company's profits. This form plays a crucial role in ensuring transparency and accountability in profit-sharing agreements. In this article, we will provide a detailed description of what this form entails, its purpose, and highlight different types available. Main Body: 1. Purpose and Importance: The Indiana Officers Bonus — Percenprofitfi— - Resolution Form serves as an agreement between a company and its officers to establish a systematic approach for distributing bonuses based on a predetermined percentage of the company's profits. The form ensures that officers are rewarded fairly and incentivizes them to work towards improving the company's performance. 2. Components of the Form: The form typically includes key sections such as: a) Identification: It requires the company's name, address, and the names of officers involved in the bonus program. b) Profit Calculation: This section outlines the formula for calculating the company's profit and determining the officers' share. c) Bonus Percentage: It specifies the percentage of profits that will be allocated for bonuses. d) Terms and Conditions: This section explains the eligibility criteria, the payout schedule, and any other terms governing the bonus program. e) Signatures: The form requires the signatures of both the company representatives and participating officers to validate the agreement. 3. Types of Indiana Officers Bonus — Percenprofitfi— - Resolution Forms: a) Standard Form: The standard form is a generic template that can be used by any company in Indiana looking to implement a profit-sharing bonus program for its officers. It can be customized to suit individual company policies and requirements. b) Confidential Form: The confidential form is similar to the standard form but includes confidentiality clauses to protect sensitive financial information. This type of form is commonly used when the company wants to restrict access to profit details among non-participating employees. c) Performance-based Form: This variation of the form aligns officer bonuses not only with the company's overall profit but also with individual performance metrics. It includes additional parameters such as meeting specific targets or achieving certain milestones. d) Vesting Schedule Form: The vesting schedule form stipulates that officers must remain employed with the company for a specified period before being eligible to receive their bonus. It promotes long-term commitment and discourages job-hopping. Conclusion: The Indiana Officers Bonus — Percenprofitfi— - Resolution Form is a legal document designed to regulate and streamline the process of awarding bonuses to officers based on a percentage of the company's profits. By utilizing this form, companies ensure fairness and motivate officers to contribute towards the organization's success. Different variations of this form, including the standard form, confidential form, performance-based form, and vesting schedule form, provide flexibility to fit various business needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Bono de Oficiales - Porcentaje de Ganancia - Formulario de Resolución - Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out Indiana Bono De Oficiales - Porcentaje De Ganancia - Formulario De Resolución?

You are able to devote time on the web trying to find the authorized record template which fits the federal and state specifications you require. US Legal Forms provides a huge number of authorized types that are analyzed by professionals. You can actually down load or print out the Indiana Officers Bonus - Percent of Profit - Resolution Form from our support.

If you currently have a US Legal Forms accounts, you may log in and then click the Acquire key. Next, you may comprehensive, edit, print out, or signal the Indiana Officers Bonus - Percent of Profit - Resolution Form. Each and every authorized record template you get is your own property eternally. To get another copy of any purchased develop, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website initially, follow the basic directions below:

- Very first, make certain you have selected the correct record template for your area/city of your choosing. Read the develop explanation to ensure you have selected the proper develop. If readily available, use the Review key to check from the record template too.

- If you would like locate another model from the develop, use the Search field to discover the template that meets your needs and specifications.

- After you have located the template you desire, just click Buy now to proceed.

- Find the pricing plan you desire, type in your qualifications, and register for a free account on US Legal Forms.

- Full the financial transaction. You may use your bank card or PayPal accounts to cover the authorized develop.

- Find the formatting from the record and down load it for your system.

- Make adjustments for your record if required. You are able to comprehensive, edit and signal and print out Indiana Officers Bonus - Percent of Profit - Resolution Form.

Acquire and print out a huge number of record templates using the US Legal Forms website, which provides the greatest collection of authorized types. Use professional and condition-particular templates to tackle your organization or specific needs.