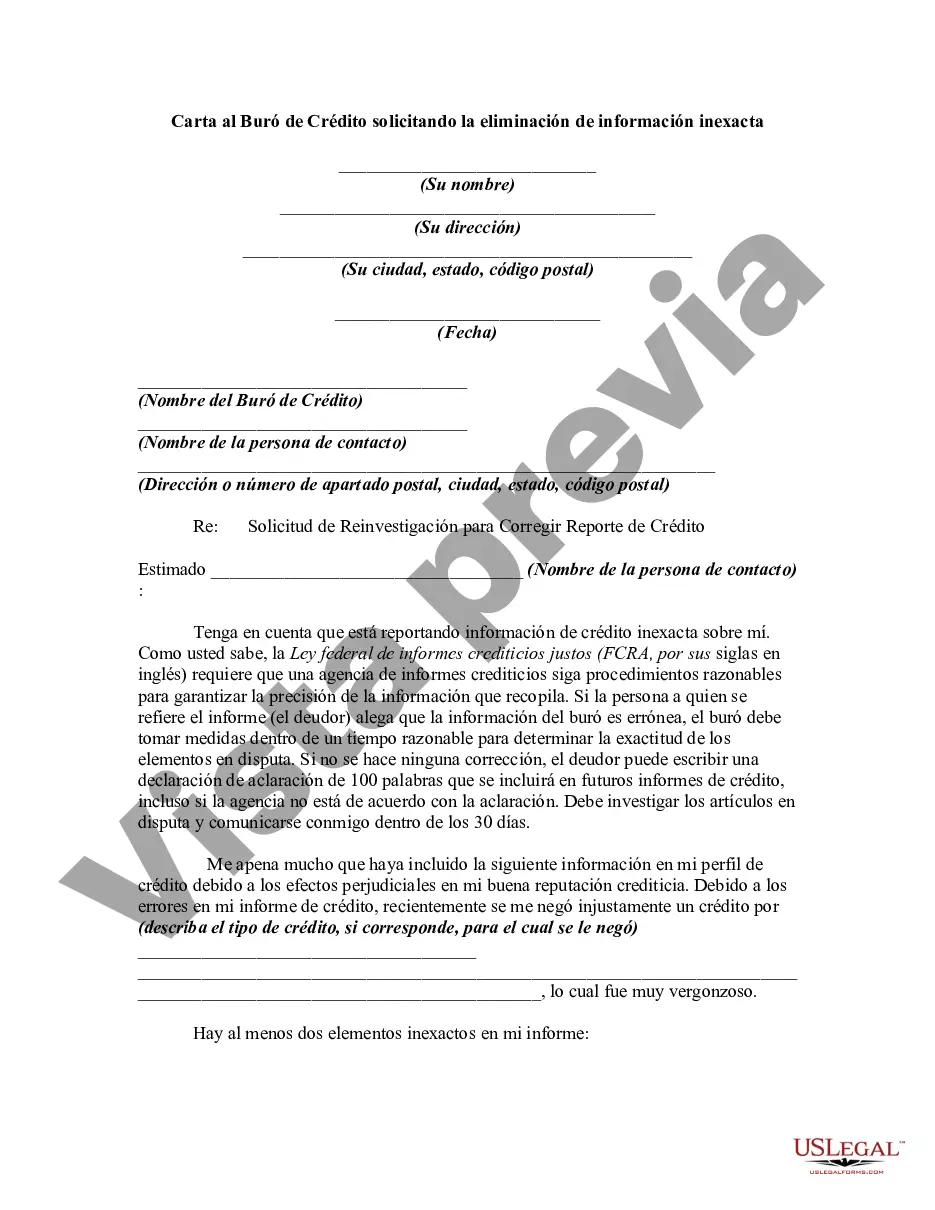

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal written document used by individuals residing in the state of Indiana to request the removal of any inaccurate or incorrect information from their credit reports. This letter is specifically tailored to comply with the laws and regulations of the state of Indiana. Credit bureaus play a crucial role in maintaining credit reports, which are used by lenders, landlords, and other entities to assess an individual's creditworthiness. However, errors and inaccuracies in credit reports can have a detrimental impact on a person's creditworthiness and financial well-being. Therefore, it is essential to rectify any incorrect information promptly. The Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information contains several key elements. Firstly, it includes the individual's personal identifying information, including their full name, address, and social security number. This information is necessary for the credit bureau to accurately identify and locate the individual's credit report. Next, the letter clearly states the purpose — requesting the removal of inaccurate information. It is essential to mention specific details about the incorrect items, such as account numbers, dates, and descriptions, to ensure the credit bureau can efficiently investigate and rectify the issue. Additionally, the letter should include supporting documentation, if available, to strengthen the case for removing inaccuracies. Examples of supporting documentation may include payment receipts, bank statements, or any correspondence proving the incorrect information. Moreover, it is vital to inform the credit bureau about any discrepancies that violate federal and state laws, such as the Fair Credit Reporting Act (FCRA) and the Indiana Consumer Credit Code. By emphasizing these legal violations, individuals can increase the chances of a prompt and appropriate resolution. Different types of Indiana Letters to Credit Bureau Requesting the Removal of Inaccurate Information may include requests for the removal of various types of inaccuracies, such as: 1. Erroneous account information: This refers to accounts that have been mistakenly reported, such as closed accounts that are marked as open or accounts that do not belong to the individual. 2. Inaccurate payment history: In cases where late payments, missed payments, or collection accounts are reported incorrectly, individuals can request their removal. 3. Identity theft-related errors: If a person has been a victim of identity theft, they can use an Indiana Letter to Credit Bureau to dispute fraudulent accounts or inquiries that resulted from the theft. Overall, an Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a powerful tool for individuals to protect their creditworthiness and rectify any errors in their credit reports. By following the appropriate format, including specific details, and providing supporting documentation, individuals residing in Indiana can increase their chances of a favorable resolution with the credit bureau and maintain a healthy credit history.Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal written document used by individuals residing in the state of Indiana to request the removal of any inaccurate or incorrect information from their credit reports. This letter is specifically tailored to comply with the laws and regulations of the state of Indiana. Credit bureaus play a crucial role in maintaining credit reports, which are used by lenders, landlords, and other entities to assess an individual's creditworthiness. However, errors and inaccuracies in credit reports can have a detrimental impact on a person's creditworthiness and financial well-being. Therefore, it is essential to rectify any incorrect information promptly. The Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information contains several key elements. Firstly, it includes the individual's personal identifying information, including their full name, address, and social security number. This information is necessary for the credit bureau to accurately identify and locate the individual's credit report. Next, the letter clearly states the purpose — requesting the removal of inaccurate information. It is essential to mention specific details about the incorrect items, such as account numbers, dates, and descriptions, to ensure the credit bureau can efficiently investigate and rectify the issue. Additionally, the letter should include supporting documentation, if available, to strengthen the case for removing inaccuracies. Examples of supporting documentation may include payment receipts, bank statements, or any correspondence proving the incorrect information. Moreover, it is vital to inform the credit bureau about any discrepancies that violate federal and state laws, such as the Fair Credit Reporting Act (FCRA) and the Indiana Consumer Credit Code. By emphasizing these legal violations, individuals can increase the chances of a prompt and appropriate resolution. Different types of Indiana Letters to Credit Bureau Requesting the Removal of Inaccurate Information may include requests for the removal of various types of inaccuracies, such as: 1. Erroneous account information: This refers to accounts that have been mistakenly reported, such as closed accounts that are marked as open or accounts that do not belong to the individual. 2. Inaccurate payment history: In cases where late payments, missed payments, or collection accounts are reported incorrectly, individuals can request their removal. 3. Identity theft-related errors: If a person has been a victim of identity theft, they can use an Indiana Letter to Credit Bureau to dispute fraudulent accounts or inquiries that resulted from the theft. Overall, an Indiana Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a powerful tool for individuals to protect their creditworthiness and rectify any errors in their credit reports. By following the appropriate format, including specific details, and providing supporting documentation, individuals residing in Indiana can increase their chances of a favorable resolution with the credit bureau and maintain a healthy credit history.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.