The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

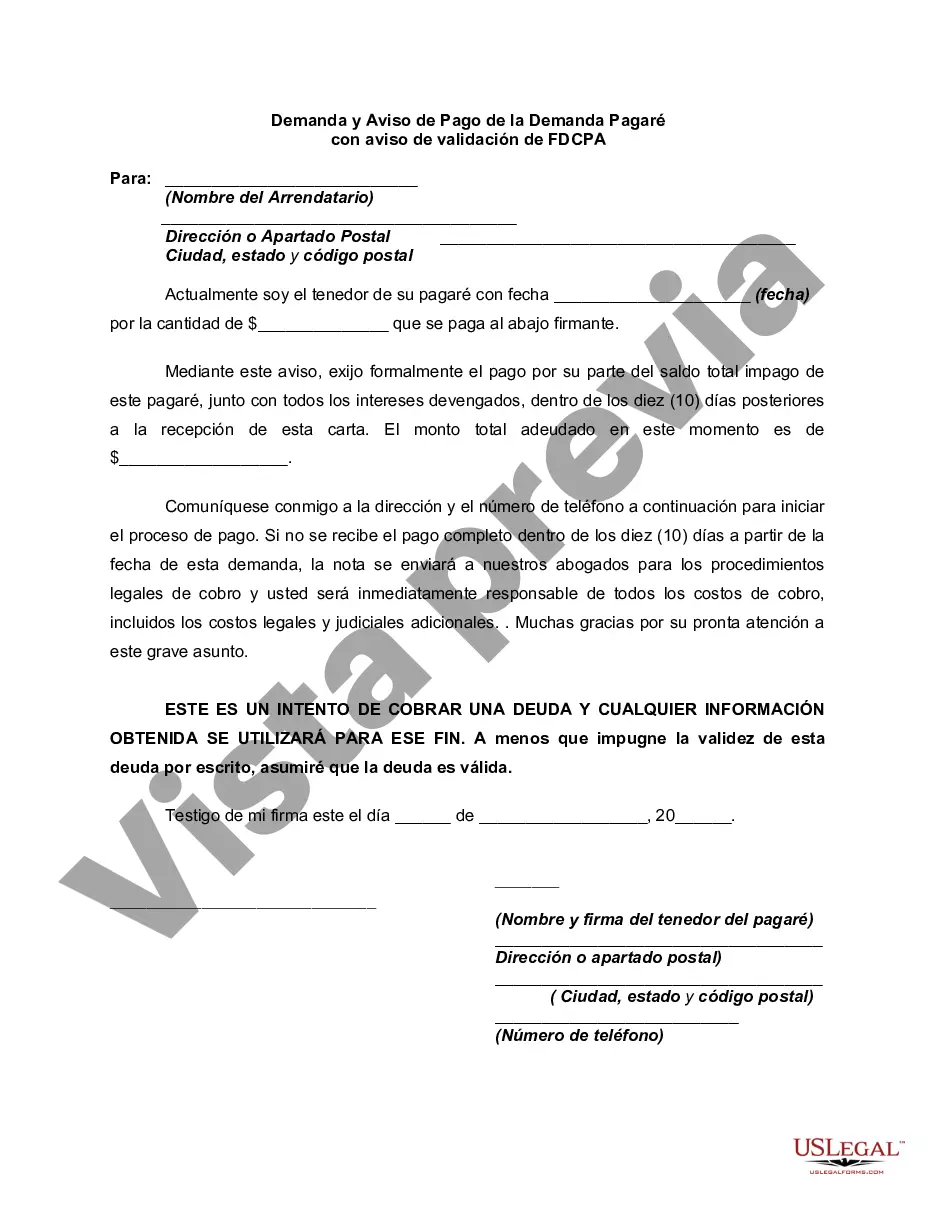

Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used to assert a demand for payment on a promissory note in the state of Indiana while providing information on the debtor's rights under the Fair Debt Collection Practices Act (FD CPA). This document is crucial for creditors as it enables them to officially request immediate payment and inform debtors about their legal obligations and available options. Key components of the Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice include: 1. Name and Contact Information: The document should clearly state the name and contact details of both the creditor and the debtor. 2. Promissory Note Details: The document should outline the details of the promissory note, such as the original loan amount, the date it was signed, and any interest or penalties accrued. 3. Demand for Payment: The creditor should state their demand for immediate payment of the outstanding balance on the promissory note. This section should specify the due amount, provide a breakdown of interest and penalties incurred, and set a deadline for payment. 4. FD CPA Validation Notice: As required by the FD CPA, this section should outline the debtor's rights, including the right to dispute the debt's validity within 30 days of receiving the notice. It should provide instructions on how to request validation and specify that any disputes should be made in writing. 5. Consequences of Failure to Comply: The document should outline the potential consequences of non-compliance, such as legal action, collection agency involvement, or damage to the debtor's credit rating. Different types of Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may exist based on specific circumstances or variations in legal requirements. Some examples include: 1. Commercial Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Used when the promissory note is between commercial entities or for business purposes. 2. Personal Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Applied when the promissory note is between individuals for personal loans or transactions. 3. Mortgage Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Utilized when the promissory note is linked to a mortgage or real estate transaction. In conclusion, the Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an essential legal document that enables creditors to demand payment on a promissory note while informing debtors about their rights under the FD CPA. It ensures transparency and compliance in debt collection processes, fostering a fair and legally sound approach.Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used to assert a demand for payment on a promissory note in the state of Indiana while providing information on the debtor's rights under the Fair Debt Collection Practices Act (FD CPA). This document is crucial for creditors as it enables them to officially request immediate payment and inform debtors about their legal obligations and available options. Key components of the Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice include: 1. Name and Contact Information: The document should clearly state the name and contact details of both the creditor and the debtor. 2. Promissory Note Details: The document should outline the details of the promissory note, such as the original loan amount, the date it was signed, and any interest or penalties accrued. 3. Demand for Payment: The creditor should state their demand for immediate payment of the outstanding balance on the promissory note. This section should specify the due amount, provide a breakdown of interest and penalties incurred, and set a deadline for payment. 4. FD CPA Validation Notice: As required by the FD CPA, this section should outline the debtor's rights, including the right to dispute the debt's validity within 30 days of receiving the notice. It should provide instructions on how to request validation and specify that any disputes should be made in writing. 5. Consequences of Failure to Comply: The document should outline the potential consequences of non-compliance, such as legal action, collection agency involvement, or damage to the debtor's credit rating. Different types of Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may exist based on specific circumstances or variations in legal requirements. Some examples include: 1. Commercial Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Used when the promissory note is between commercial entities or for business purposes. 2. Personal Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Applied when the promissory note is between individuals for personal loans or transactions. 3. Mortgage Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: Utilized when the promissory note is linked to a mortgage or real estate transaction. In conclusion, the Indiana Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an essential legal document that enables creditors to demand payment on a promissory note while informing debtors about their rights under the FD CPA. It ensures transparency and compliance in debt collection processes, fostering a fair and legally sound approach.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.