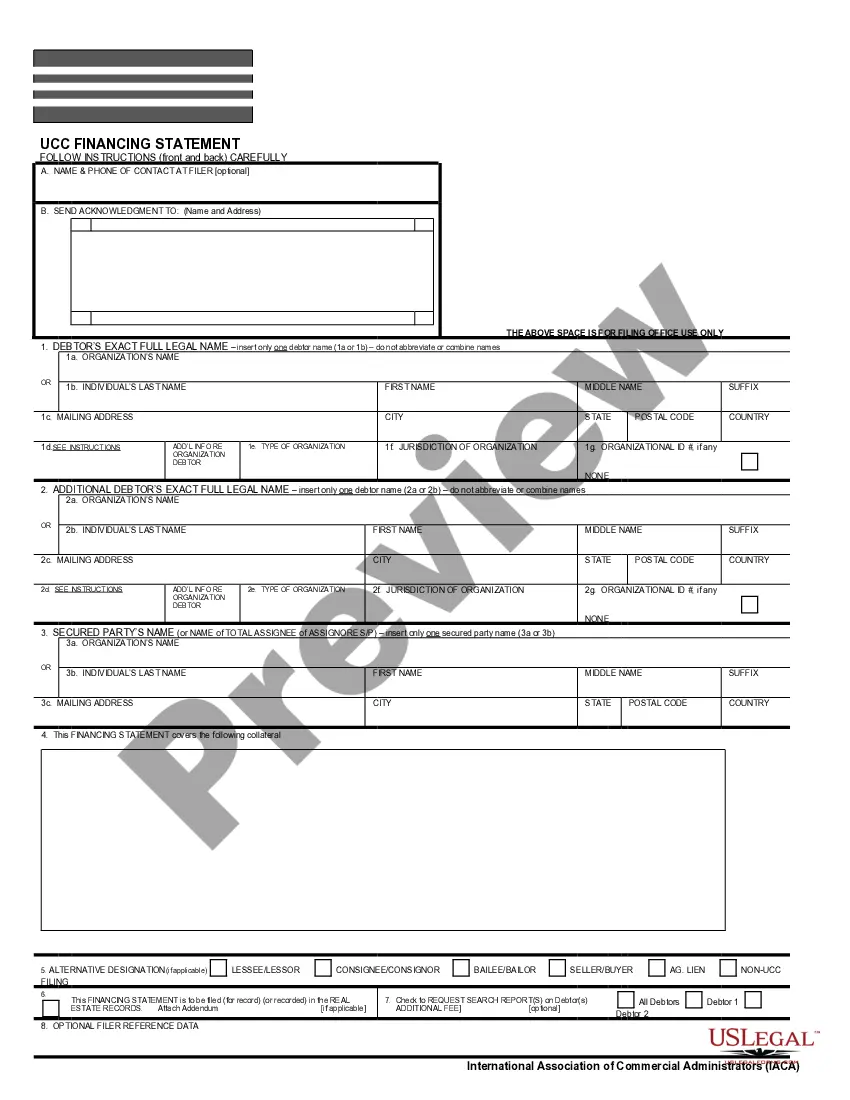

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Indiana Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Selecting the finest authentic document template can be a challenge.

Certainly, there are numerous designs accessible online, but how can you obtain the authentic format you need.

Utilize the US Legal Forms website. The service offers thousands of designs, including the Indiana Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase, which you can use for both business and personal purposes.

You can review the document using the Review button and check the document details to confirm it is the right one for you.

- All of the templates are reviewed by professionals and meet federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Indiana Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- Use your account to look through the authentic templates you may have obtained previously.

- Go to the My documents section in your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct format for your city/region.

Form popularity

FAQ

To secure an Indiana Promissory Note with real property, you typically create a mortgage or deed of trust that links the property to the debt obligation. This involves outlining the terms of the promissory note and recording the mortgage with local government authorities. By doing so, you protect the lender's investment, ensuring they can reclaim the property if the borrower defaults on their payments.

To write a simple promissory note, include the borrower's and lender's names, the borrowed amount, and the repayment terms such as interest rate and due dates. State your payment schedule clearly, whether it's monthly, quarterly, or another option. Ensure both parties sign the document for legal validity. Using a well-structured template from a reputable source, like uslegalforms, can guide you through this process.

To write a secured promissory note, begin by specifying that the note is secured. Include details about the collateral, which can be real property in this case. Clearly outline the fixed interest rate, installment payment schedule, and the consequences of default. Using a reliable legal document template can streamline this process and ensure compliance with Indiana laws.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

If the sum is not huge and the relationship is trustworthy, it is preferred to go with a promissory note to avoid potential legal issues. However, if the sum of money is huge and the relationship is not entirely trustable, make sure to use a secured loan agreement to ensure your money is safe with the borrower.

A Promissory Note with Installment Payments is a lending contract that sets terms for a loan to be repaid in installments. This Promissory Note specifies that the loan will be paid back with consistent, equal, payments. Whether you're the lender or the borrower, you know exactly what each payment will be.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

A promissory note is often included in a mortgage, student loan, car loan, business loan or personal loan agreement. Borrowers will typically sign the promissory note as one of the last steps to receiving their borrowed funds.