A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

An Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal document that allows spouses to change the nature of their property from community property (assets shared between the couple) to separate property (individual ownership). In Indiana, community property laws do not apply. Instead, the state follows the principle of equitable distribution during divorce proceedings, which means that marital property is divided fairly but not necessarily equally between spouses. However, couples have the option to convert their community property into separate property through a Transmutation or Postnuptial Agreement. This agreement offers a clear delineation of each spouse's separate property rights and can help protect individual assets. Different Types of Indiana Transmutation or Postnuptial Agreements: 1. General Transmutation Agreement: This is the most common type of agreement used to convert community property into separate property. It outlines the specific assets and debts that will be converted and documents the intention of the spouses to change the property's status. 2. Specific Asset Transmutation Agreement: Couples may choose to convert only a specific asset(s) from community to separate property. For example, if one spouse inherits a valuable property, they may want to document its conversion to separate property to ensure its protection in case of divorce. 3. Debt Transmutation Agreement: In some cases, one spouse may want to assume sole responsibility for a debt that was previously considered community property. This agreement allows the debt to be converted into separate liability, relieving the other spouse from any obligations. 4. Partial Transmutation Agreement: This agreement is used when spouses want to convert only a portion of their community property into separate property. For instance, if one spouse owns a business that was initially community property, they may convert only a percentage of the business into separate property while maintaining the rest as community property. It is important to note that Indiana law requires these agreements to be in writing, signed by both parties, and notarized to ensure their enforceability. Additionally, it is recommended to seek legal advice when drafting or entering into a Transmutation or Postnuptial Agreement to ensure that the document complies with the state's laws and protects each spouse's interests.An Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal document that allows spouses to change the nature of their property from community property (assets shared between the couple) to separate property (individual ownership). In Indiana, community property laws do not apply. Instead, the state follows the principle of equitable distribution during divorce proceedings, which means that marital property is divided fairly but not necessarily equally between spouses. However, couples have the option to convert their community property into separate property through a Transmutation or Postnuptial Agreement. This agreement offers a clear delineation of each spouse's separate property rights and can help protect individual assets. Different Types of Indiana Transmutation or Postnuptial Agreements: 1. General Transmutation Agreement: This is the most common type of agreement used to convert community property into separate property. It outlines the specific assets and debts that will be converted and documents the intention of the spouses to change the property's status. 2. Specific Asset Transmutation Agreement: Couples may choose to convert only a specific asset(s) from community to separate property. For example, if one spouse inherits a valuable property, they may want to document its conversion to separate property to ensure its protection in case of divorce. 3. Debt Transmutation Agreement: In some cases, one spouse may want to assume sole responsibility for a debt that was previously considered community property. This agreement allows the debt to be converted into separate liability, relieving the other spouse from any obligations. 4. Partial Transmutation Agreement: This agreement is used when spouses want to convert only a portion of their community property into separate property. For instance, if one spouse owns a business that was initially community property, they may convert only a percentage of the business into separate property while maintaining the rest as community property. It is important to note that Indiana law requires these agreements to be in writing, signed by both parties, and notarized to ensure their enforceability. Additionally, it is recommended to seek legal advice when drafting or entering into a Transmutation or Postnuptial Agreement to ensure that the document complies with the state's laws and protects each spouse's interests.

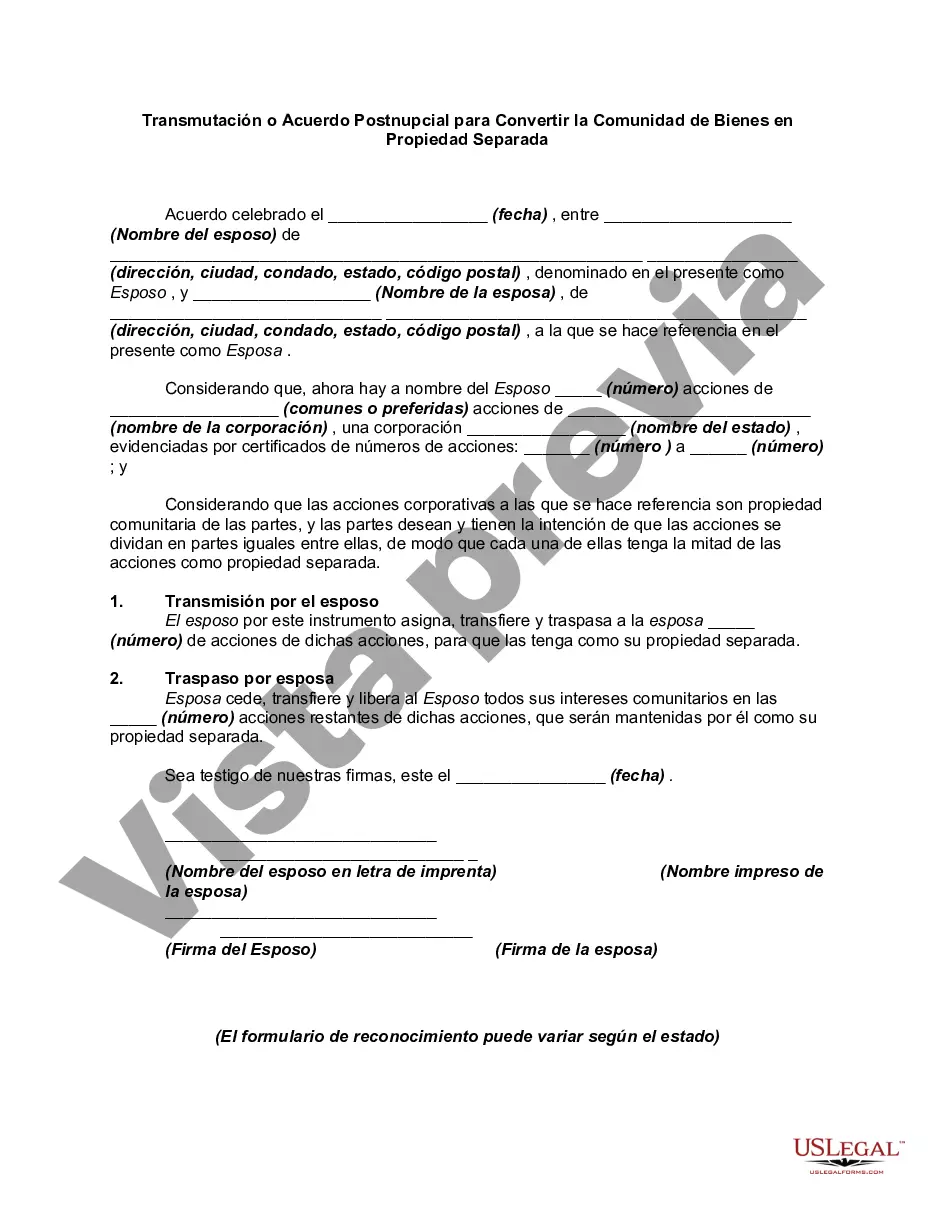

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.