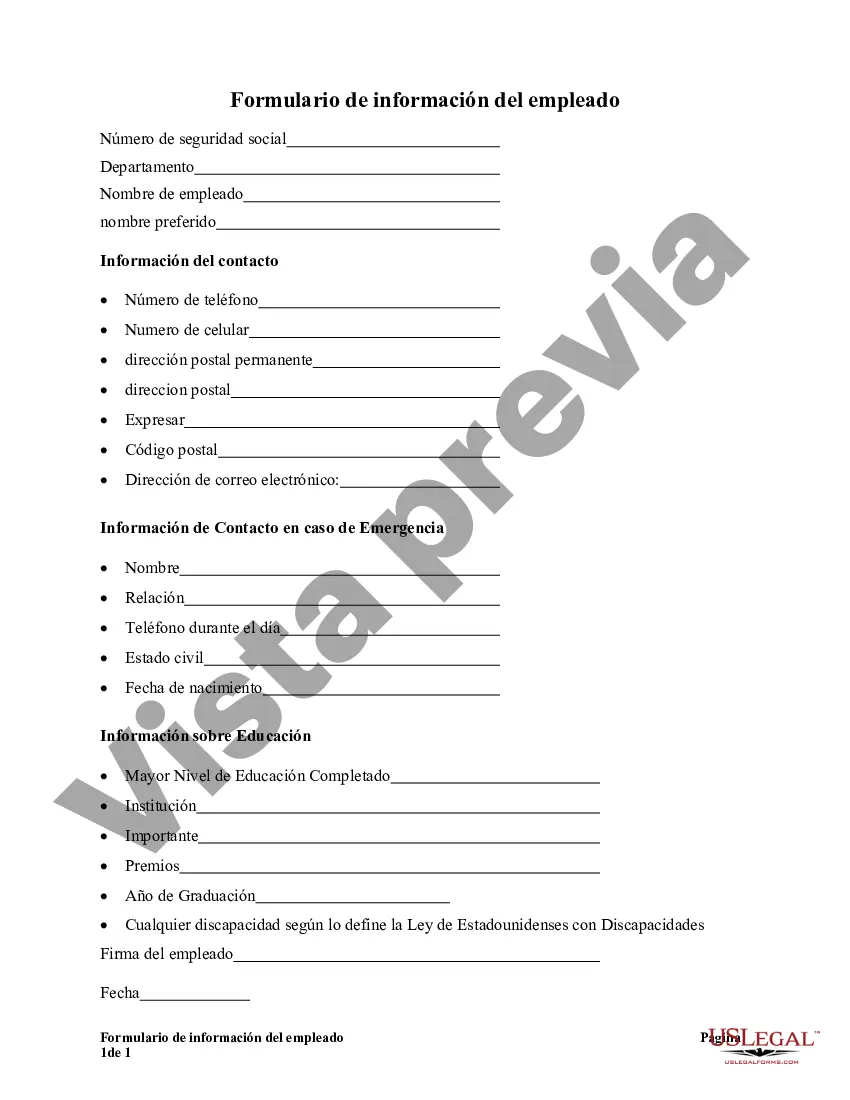

The Indiana Employee Information Form is a crucial document used by employers in the state of Indiana to gather essential details about their employees. This comprehensive form plays a vital role in maintaining accurate employee records, facilitating efficient onboarding processes, and ensuring compliance with state labor regulations. Here is a detailed description of the Indiana Employee Information Form, along with its variations: 1. Indiana Employee Information Form: The Indiana Employee Information Form is a standardized document that collects important information about individual employees. It typically includes sections covering personal details, contact information, employment history, and emergency contacts. Employers use this form to establish a comprehensive database of their workforce, ensuring efficient communication channels and essential record keeping. Keywords: Indiana, Employee Information Form, personal details, contact information, employment history, emergency contacts, database, communication, record keeping. 2. Indiana New Hire Reporting Form: In addition to the standard Indiana Employee Information Form, employers are required to complete the Indiana New Hire Reporting Form. This form serves as a means to comply with state laws, specifically the New Hire Reporting Program established by the Indiana Department of Workforce Development. Employers use this form to report newly hired employees, including their personal information and employment details, within a specified timeframe. Keywords: Indiana, New Hire Reporting Form, state laws, New Hire Reporting Program, Indiana Department of Workforce Development, newly hired employees, personal information, employment details. 3. Indiana W-4 Form: While not specifically an employee information form, the Indiana W-4 Form is an essential document provided by employees to their employers in Indiana. This form allows employees to indicate their tax withholding preferences, including the number of allowances claimed, marital status, and any additional withholding amounts. Employers refer to this form to accurately calculate the appropriate income tax deductions from employees' wages. Keywords: Indiana, W-4 Form, tax withholding preferences, allowances, marital status, withholding amounts, income tax deductions, wages. In conclusion, the Indiana Employee Information Form serves as a comprehensive tool that helps employers in Indiana gather crucial details about their employees. Variations include the Indiana New Hire Reporting Form, required to report newly hired employees, and the Indiana W-4 Form, an employee-provided document used for tax withholding purposes. Employers in Indiana rely on these forms to ensure legal compliance and maintain accurate employee records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Formulario de información del empleado - Employee Information Form

Description

How to fill out Indiana Formulario De Información Del Empleado?

Choosing the right lawful record design can be a have a problem. Obviously, there are tons of templates available online, but how would you get the lawful develop you need? Utilize the US Legal Forms internet site. The services gives 1000s of templates, such as the Indiana Employee Information Form, which you can use for enterprise and private demands. All the varieties are inspected by specialists and meet up with state and federal demands.

When you are already listed, log in to the profile and then click the Down load option to find the Indiana Employee Information Form. Make use of profile to check throughout the lawful varieties you possess purchased in the past. Go to the My Forms tab of your respective profile and have yet another version from the record you need.

When you are a fresh end user of US Legal Forms, listed here are straightforward guidelines that you can comply with:

- Very first, make certain you have selected the proper develop for the city/county. You may examine the form using the Review option and read the form description to ensure this is the best for you.

- In case the develop is not going to meet up with your preferences, take advantage of the Seach area to obtain the correct develop.

- When you are sure that the form would work, go through the Acquire now option to find the develop.

- Opt for the rates program you desire and type in the necessary details. Make your profile and pay for your order using your PayPal profile or charge card.

- Choose the data file structure and download the lawful record design to the system.

- Full, change and print out and indication the acquired Indiana Employee Information Form.

US Legal Forms will be the most significant collection of lawful varieties for which you can see a variety of record templates. Utilize the service to download skillfully-created paperwork that comply with express demands.