Indiana Simple Promissory Note for Family Loan is a legally binding document used to establish the terms and conditions of a loan between family members in the state of Indiana. This note clearly outlines the borrower's promise to pay back the borrowed amount to the lender within a specified timeframe. It serves as evidence of the loan agreement, ensuring transparency and preventing any potential disputes in the future. Keywords: Indiana, Simple Promissory Note, Family Loan, terms and conditions, borrowed amount, lender, timeframe, loan agreement. Types of Indiana Simple Promissory Note for Family Loan: 1. Lump Sum Repayment Note: This type of promissory note for family loans in Indiana involves the borrower repaying the entire borrowed amount at once, typically on a specified date or within a specific period. It outlines the repayment schedule and any applicable interest rate. 2. Installment Repayment Note: In this type of promissory note, the borrowed amount is repaid in regular installments over a predetermined period. The note specifies the frequency, amount, and due dates of payments, creating a clear repayment plan. 3. Secured Promissory Note: This note includes an additional provision that allows the lender to hold a security interest in specific property or assets provided by the borrower. This helps protect the lender's interests in case of default, as they can potentially claim ownership of the collateral. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not involve any collateral or security interest. The borrower's promise to repay the loan is solely based on their creditworthiness and personal commitment to honor the loan agreement. 5. Demand Promissory Note: This type of note provides flexibility to the lender as they have the option to demand the full repayment of the loan amount at any time, regardless of the agreed repayment period. However, the lender must give proper notice before exercising this option. 6. Balloon Promissory Note: A balloon note sets lower periodic payments initially, and a large "balloon" payment is due at the end of the loan term. It allows borrowers to have easier initial repayments, with the expectation of paying off the remaining balance in one final payment or by refinancing the loan. By utilizing the appropriate Indiana Simple Promissory Note for Family Loan, both borrowers and lenders can safeguard their interests and establish a clear understanding of the loan terms. It is crucial to always consult legal professionals when creating such agreements to ensure compliance with Indiana state laws and to protect the rights and responsibilities of all parties involved.

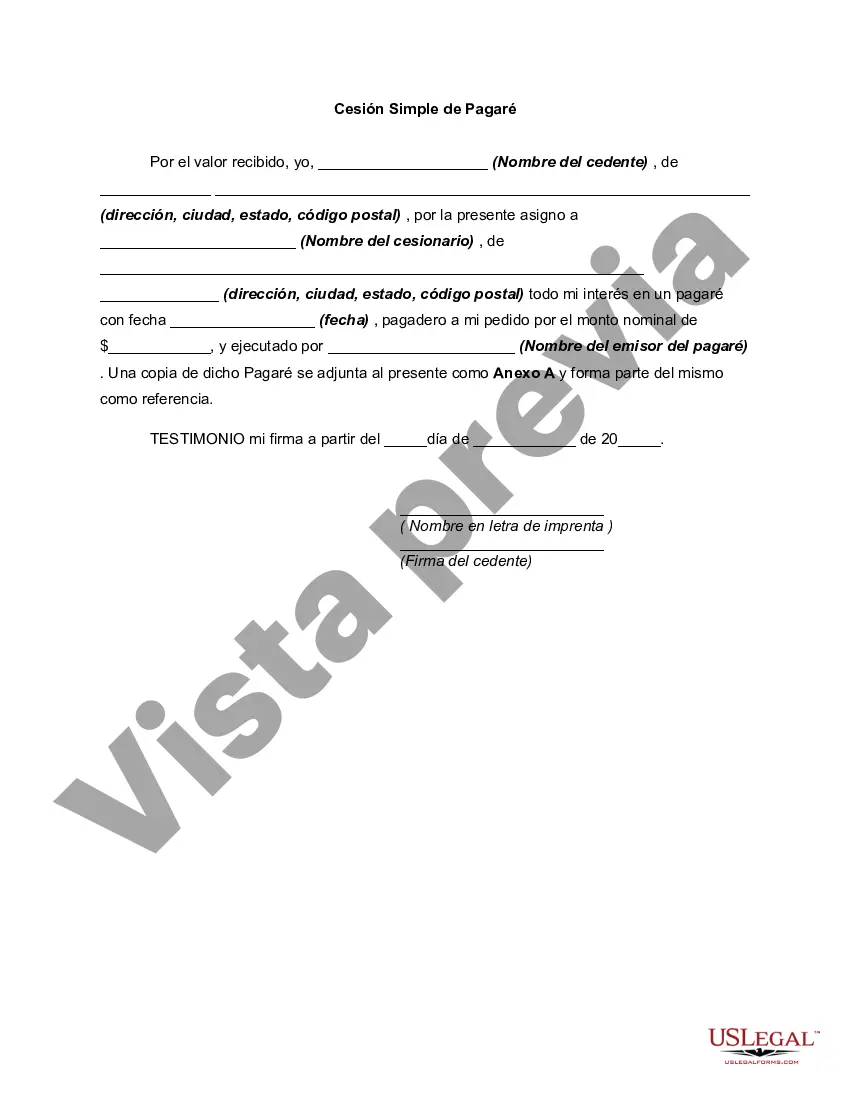

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Indiana Pagaré Simple Para Préstamo Familiar?

If you have to total, down load, or print out legal document templates, use US Legal Forms, the largest variety of legal kinds, which can be found online. Make use of the site`s simple and handy lookup to find the paperwork you require. Different templates for business and specific purposes are sorted by types and claims, or key phrases. Use US Legal Forms to find the Indiana Simple Promissory Note for Family Loan in just a handful of clicks.

If you are previously a US Legal Forms customer, log in to your profile and click the Download button to find the Indiana Simple Promissory Note for Family Loan. You can even gain access to kinds you earlier downloaded in the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the form for your correct town/region.

- Step 2. Utilize the Preview choice to check out the form`s content material. Never overlook to see the information.

- Step 3. If you are unhappy together with the form, take advantage of the Look for field on top of the display to discover other versions in the legal form format.

- Step 4. Upon having found the form you require, click on the Buy now button. Select the rates prepare you like and include your qualifications to register on an profile.

- Step 5. Procedure the deal. You should use your charge card or PayPal profile to perform the deal.

- Step 6. Select the structure in the legal form and down load it on the device.

- Step 7. Total, edit and print out or signal the Indiana Simple Promissory Note for Family Loan.

Every single legal document format you get is yours eternally. You have acces to each form you downloaded with your acccount. Select the My Forms area and choose a form to print out or down load again.

Compete and down load, and print out the Indiana Simple Promissory Note for Family Loan with US Legal Forms. There are millions of specialist and condition-distinct kinds you may use for the business or specific needs.