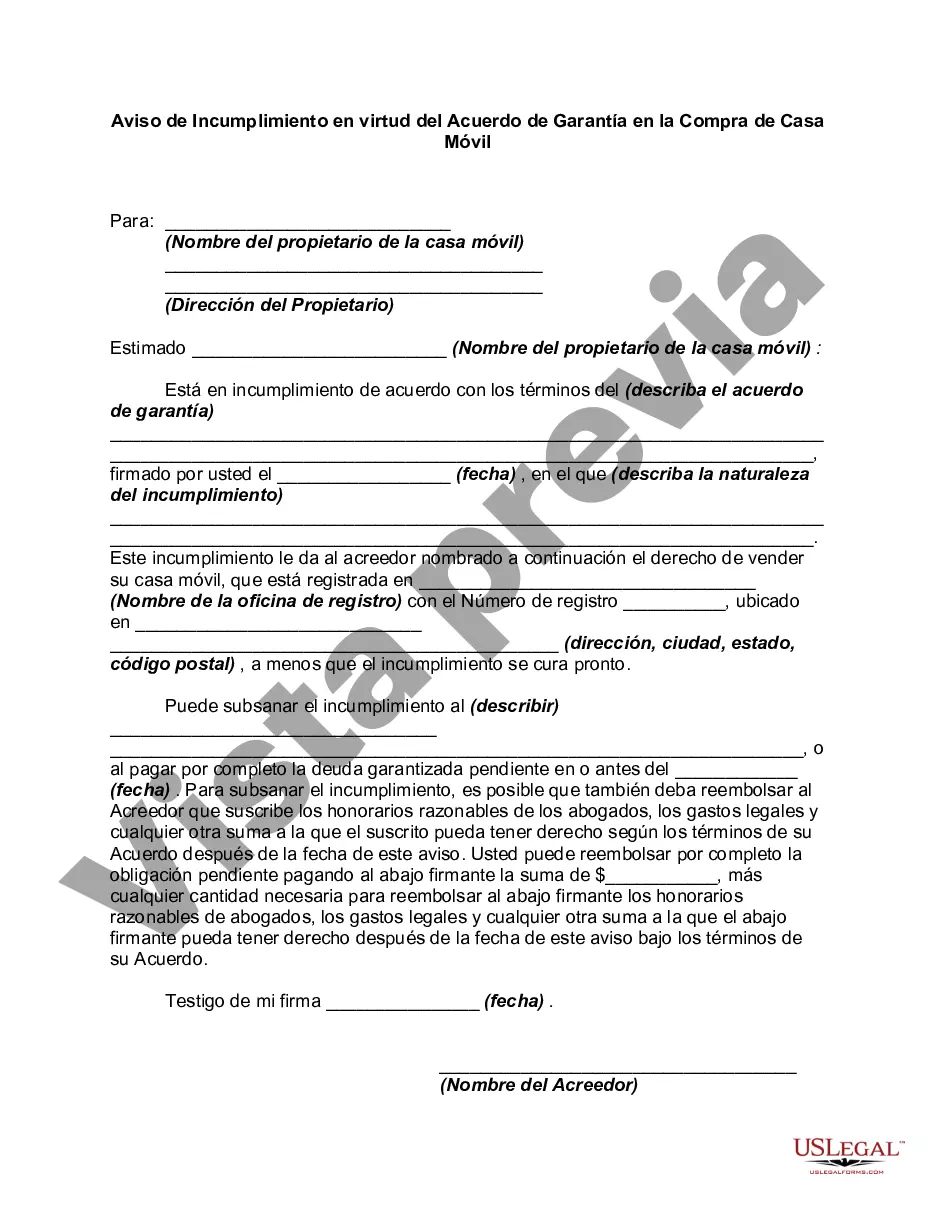

Indiana Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that serves as a formal notice to a mobile homeowner about their default in making payments or not fulfilling the terms and conditions outlined in the security agreement signed during the purchase of the mobile home. This notice notifies the owner that their mobile home is at risk of being repossessed or foreclosed upon by the creditor. Keywords: Indiana, Notice of Default, Security Agreement, Purchase of Mobile Home, default, payments, terms and conditions, repossessed, foreclosed, creditor. Types of Indiana Notice of Default under Security Agreement in Purchase of Mobile Home: 1. Indiana Notice of Default for Late Payments: This type of notice is issued when the mobile homeowner has failed to make their monthly payments on time as per the agreed-upon terms in the security agreement. It notifies the owner of their late payments and warns them of the potential consequences if they do not rectify the situation. 2. Indiana Notice of Default for Breach of Terms: This type of notice is sent to the mobile homeowner if they have violated any of the terms and conditions specified in the security agreement, such as failure to maintain insurance coverage on the mobile home or engaging in illegal activities on the premises. The notice highlights the specific breaches and provides a deadline for the owner to resolve the issues. 3. Indiana Notice of Default for Non-Payment: When the mobile homeowner has completely stopped making payments, this type of notice is employed. It notifies the owner that they are in default for non-payment and that legal actions, such as repossession or foreclosure, may be initiated if the outstanding balance is not settled within a specified timeframe. 4. Indiana Notice of Default for Failure to Maintain the Mobile Home: In cases where the owner neglects to maintain the mobile home adequately or fulfill their responsibilities towards keeping the property in good condition, this notice is issued. It highlights the specific maintenance issues, provides a deadline for corrective measures, and warns of potential legal actions if the default is not rectified promptly. Please note that the specific format and requirements for an Indiana Notice of Default under Security Agreement in Purchase of Mobile Home may vary, and it is advised to consult with a legal professional for accurate and up-to-date information tailored to your specific situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Indiana Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

You may invest hrs on the web trying to find the lawful papers format that fits the state and federal specifications you want. US Legal Forms gives a large number of lawful kinds that happen to be examined by pros. You can easily obtain or print out the Indiana Notice of Default under Security Agreement in Purchase of Mobile Home from your support.

If you already possess a US Legal Forms account, you may log in and then click the Down load button. Following that, you may full, edit, print out, or sign the Indiana Notice of Default under Security Agreement in Purchase of Mobile Home. Each and every lawful papers format you purchase is your own eternally. To acquire another version of the bought form, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms site the very first time, follow the easy directions below:

- Initial, be sure that you have selected the proper papers format for the region/town that you pick. Read the form outline to make sure you have picked out the proper form. If readily available, utilize the Preview button to search with the papers format too.

- In order to find another model from the form, utilize the Lookup area to get the format that suits you and specifications.

- Once you have identified the format you need, click on Purchase now to proceed.

- Pick the costs program you need, type your accreditations, and register for an account on US Legal Forms.

- Complete the transaction. You can use your charge card or PayPal account to purchase the lawful form.

- Pick the format from the papers and obtain it in your gadget.

- Make alterations in your papers if possible. You may full, edit and sign and print out Indiana Notice of Default under Security Agreement in Purchase of Mobile Home.

Down load and print out a large number of papers templates making use of the US Legal Forms Internet site, which provides the most important variety of lawful kinds. Use professional and state-certain templates to take on your company or person requires.