Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a legal document that establishes a trust between a married couple as the trustees and designates certain assets to be held and managed for their benefit. This type of trust is commonly used for estate planning purposes in Indiana. The Indiana Revocable Trust Agreement allows the trustees, who are the husband and wife, to retain control over the trust assets during their lifetime, while also ensuring that their wishes on distributing the assets upon death are followed. The revocability feature allows them to modify or revoke the trust as circumstances change. Keywords: Indiana, Revocable Trust Agreement, Husband and Wife, Trustees, Income Different types of Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to may include: 1. General Indiana Revocable Trust Agreement: This is the most common type of trust agreement where the trustees transfer a variety of assets, such as real estate, investments, and personal property, into the trust. The trustees retain control and receive income generated by the trust assets during their lifetime. 2. Indiana Revocable Living Trust Agreement: This trust agreement is established during the lifetime of the trustees and can be changed or revoked. It allows them to manage their assets efficiently while providing for the disposition of those assets after they pass away. 3. Indiana Irrevocable Trust Agreement with Husband and Wife as Trustees and Income to: Unlike the revocable trust, this agreement cannot be changed or revoked once it is established. It often serves specific purposes like tax planning or asset protection, and the trustees relinquish control over the assets. 4. Indiana Charitable Revocable Trust Agreement with Husband and Wife as Trustees and Income to: This trust agreement allows the trustees to establish a charitable trust, benefiting a charitable organization or cause of their choice. It provides income to the trustees during their lifetime and gives a charitable contribution upon their death. In summary, an Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a flexible estate planning tool that allows a married couple to maintain control over their assets during their lifetime and determine their distribution after death. It provides income to the trustees while ensuring their wishes are followed, and there are various types available based on specific needs and objectives.Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a legal document that establishes a trust between a married couple as the trustees and designates certain assets to be held and managed for their benefit. This type of trust is commonly used for estate planning purposes in Indiana. The Indiana Revocable Trust Agreement allows the trustees, who are the husband and wife, to retain control over the trust assets during their lifetime, while also ensuring that their wishes on distributing the assets upon death are followed. The revocability feature allows them to modify or revoke the trust as circumstances change. Keywords: Indiana, Revocable Trust Agreement, Husband and Wife, Trustees, Income Different types of Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to may include: 1. General Indiana Revocable Trust Agreement: This is the most common type of trust agreement where the trustees transfer a variety of assets, such as real estate, investments, and personal property, into the trust. The trustees retain control and receive income generated by the trust assets during their lifetime. 2. Indiana Revocable Living Trust Agreement: This trust agreement is established during the lifetime of the trustees and can be changed or revoked. It allows them to manage their assets efficiently while providing for the disposition of those assets after they pass away. 3. Indiana Irrevocable Trust Agreement with Husband and Wife as Trustees and Income to: Unlike the revocable trust, this agreement cannot be changed or revoked once it is established. It often serves specific purposes like tax planning or asset protection, and the trustees relinquish control over the assets. 4. Indiana Charitable Revocable Trust Agreement with Husband and Wife as Trustees and Income to: This trust agreement allows the trustees to establish a charitable trust, benefiting a charitable organization or cause of their choice. It provides income to the trustees during their lifetime and gives a charitable contribution upon their death. In summary, an Indiana Revocable Trust Agreement with Husband and Wife as Trustees and Income to is a flexible estate planning tool that allows a married couple to maintain control over their assets during their lifetime and determine their distribution after death. It provides income to the trustees while ensuring their wishes are followed, and there are various types available based on specific needs and objectives.

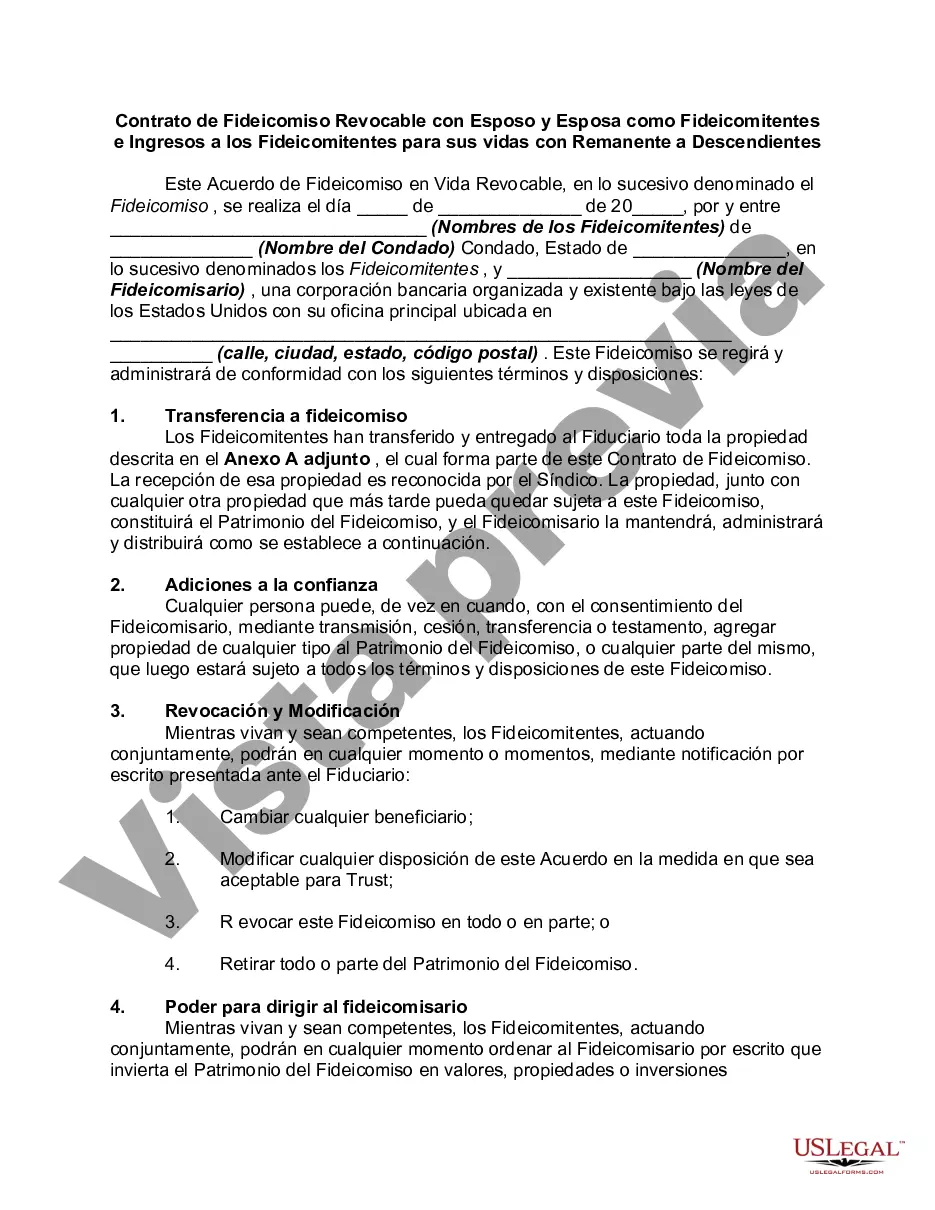

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.