An Indiana private annuity agreement with payments to last for the life of the annuitant is a legal contract between two parties, often family members, in which one individual (the annuitant) transfers assets to another individual (the buyer) in exchange for guaranteed payments for the rest of their life. The agreement is governed by the laws of the state of Indiana, and it offers several key benefits for both parties involved. For the annuitant, it provides a regular stream of income throughout their lifetime, which can be particularly advantageous for retirement planning or estate planning purposes. One of the main advantages of this type of agreement is the potential tax advantages it offers. By structuring the transaction as a private annuity, the annuitant may be able to reduce or defer the capital gains taxes that would have resulted from an outright sale of the assets. Furthermore, the annuitant's taxable estate may also be reduced, which can have significant implications for estate tax planning. There are also potentially different types of Indiana private annuity agreements with payments to last for the life of the annuitant. One variation is a straight life annuity, where the annuitant receives payments until their death, at which point the agreement terminates. Another variation is a joint and survivor annuity, where a second individual (often a spouse) continues to receive payments after the annuitant's death, ensuring financial security for both individuals. It is important to note that entering into an Indiana private annuity agreement should involve careful consideration and consultation with legal and tax advisors. The agreement must comply with all applicable laws and regulations to ensure its validity and the desired tax benefits. Overall, an Indiana private annuity agreement with payments to last for the life of the annuitant offers a flexible and potentially tax-efficient method for transferring assets while ensuring a stable income stream for the annuitant. By exploring this option and understanding the various types of annuity structures available, individuals can make informed decisions regarding their financial future and long-term planning goals.

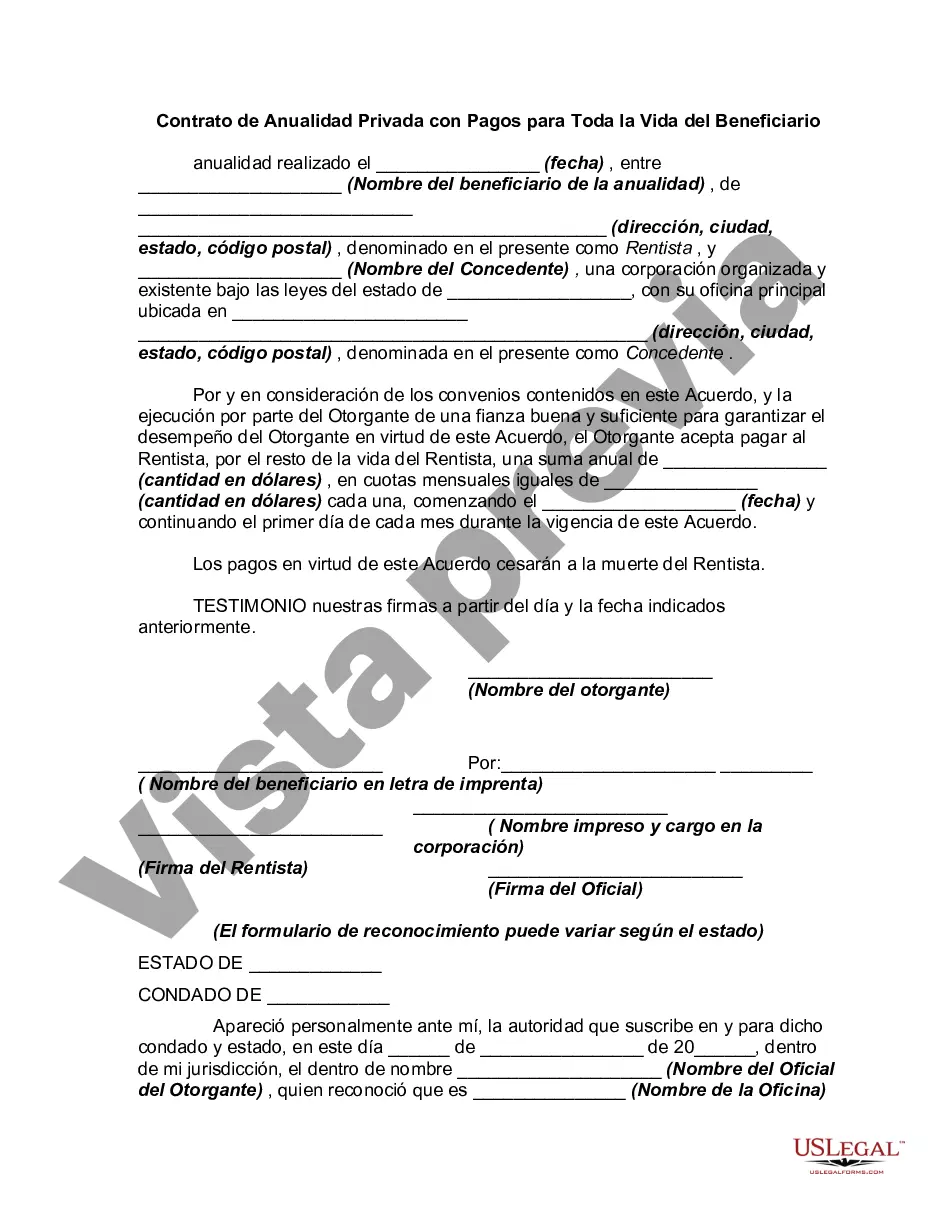

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Contrato de Anualidad Privada con Pagos para Toda la Vida del Beneficiario - Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Indiana Contrato De Anualidad Privada Con Pagos Para Toda La Vida Del Beneficiario?

Are you in a position in which you will need documents for possibly enterprise or person uses just about every day? There are tons of legal document templates available on the net, but discovering kinds you can depend on isn`t straightforward. US Legal Forms provides a large number of kind templates, just like the Indiana Private Annuity Agreement with Payments to Last for Life of Annuitant, which are written to satisfy state and federal specifications.

When you are presently knowledgeable about US Legal Forms internet site and possess a merchant account, simply log in. After that, you may down load the Indiana Private Annuity Agreement with Payments to Last for Life of Annuitant web template.

Unless you come with an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is for that right metropolis/region.

- Use the Preview option to review the form.

- Read the explanation to actually have chosen the appropriate kind.

- In case the kind isn`t what you are looking for, make use of the Research discipline to find the kind that fits your needs and specifications.

- Once you discover the right kind, click Purchase now.

- Opt for the pricing plan you would like, complete the specified info to generate your bank account, and pay for an order with your PayPal or Visa or Mastercard.

- Select a convenient data file formatting and down load your version.

Get each of the document templates you might have purchased in the My Forms menus. You can obtain a additional version of Indiana Private Annuity Agreement with Payments to Last for Life of Annuitant anytime, if necessary. Just click the required kind to down load or print the document web template.

Use US Legal Forms, the most considerable assortment of legal forms, to conserve efforts and prevent mistakes. The services provides skillfully created legal document templates which you can use for a selection of uses. Make a merchant account on US Legal Forms and initiate creating your life a little easier.