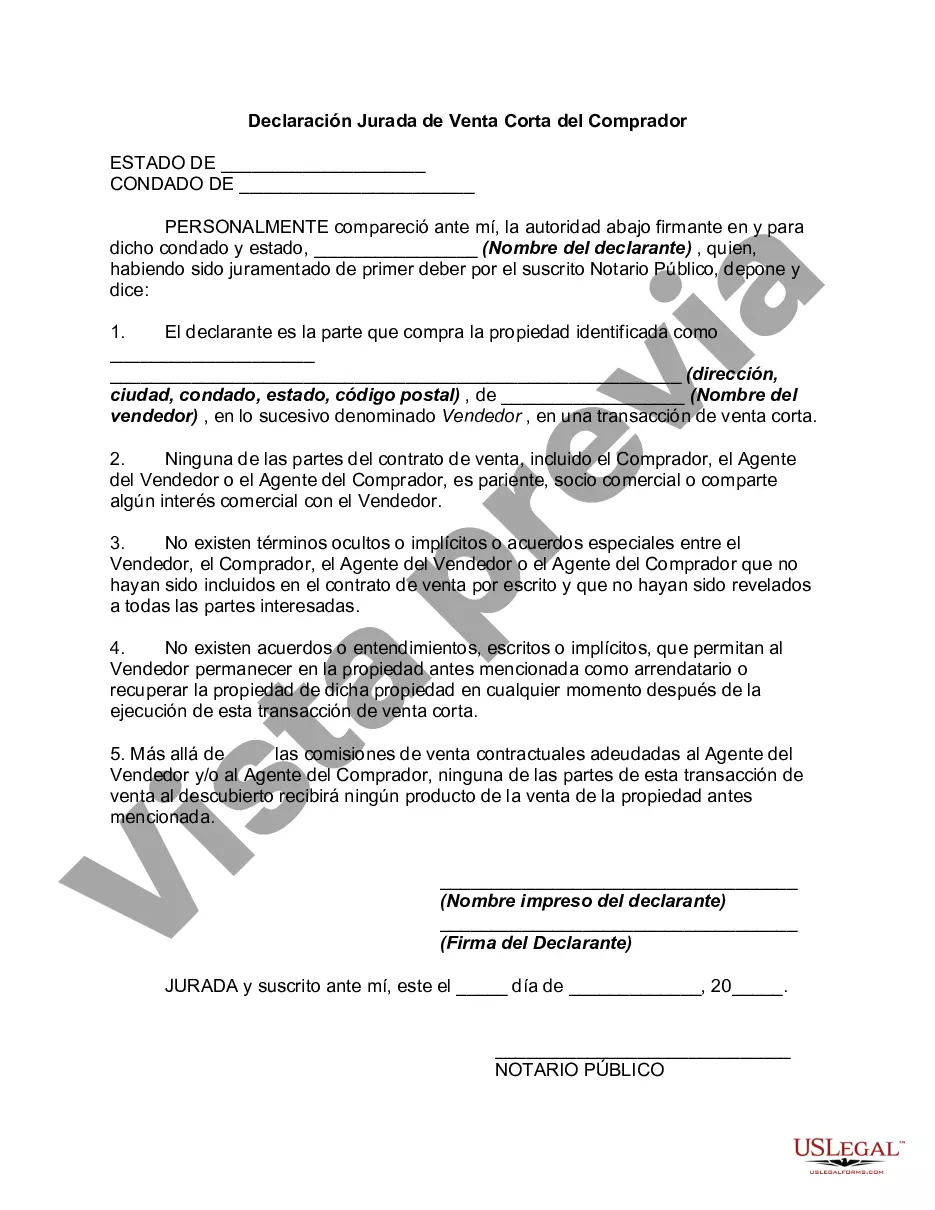

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

The Indiana Short Sale Affidavit of Buyer is a legal document utilized in the process of purchasing a property through a short sale in Indiana. It serves as a sworn statement by the buyer, outlining crucial details related to the purchase transaction. This affidavit is crucial for the lender, as it helps verify the buyer's bona fide intention to purchase the property and ensures compliance with the short sale guidelines. Keywords: — Indiana Short Sale Affidaviobeyye— - Short sale process in Indiana — Property purchase througshortfallal— - Indiana real estate transactions — Buyer's sworstatementen— - Lender verification — Short sale guideline— - Bona fide intention In Indiana, there aren't specific variations of the Short Sale Affidavit of Buyer. However, it's important to note that individual lenders or real estate agents may have their own customized versions of the affidavit, incorporating specific terms or additional clauses. It is crucial to review the lender or agent's specific requirements and instructions to ensure compliance with their guidelines. In essence, the Indiana Short Sale Affidavit of Buyer usually includes: 1. Buyer Information: The affidavit begins by capturing the buyer's full legal name, contact details, and address as per provided documentation. 2. Property Details: This section seeks specific information about the property being purchased, such as its address, legal description, parcel identification number (PIN), and any other relevant identifiers. 3. Purchase Details: The buyer is required to provide a detailed account of the proposed purchase, including the offered purchase price, any contingencies or conditions, and the planned financing option or method of payment. 4. Representation and Certifications: The buyer certifies the accuracy and authenticity of the information provided in the affidavit. This section emphasizes that any false information may lead to legal consequences. 5. Bona Fide Intention Statement: The buyer declares their genuine intention to purchase the property and confirms that the purchase is not for fraudulent purposes. 6. Acknowledgment of Consequences: The buyer acknowledges potential penalties for providing false information or engaging in fraudulent activities during the short sale process. 7. Date and Signature: The affidavit concludes with the buyer's signature, affirming the truthfulness of the provided information, along with the date of execution. It is crucial for purchasers involved in the short sale process in Indiana to carefully read and understand the contents of the Short Sale Affidavit of Buyer. Working closely with a real estate attorney or experienced agent who specializes in short sales can provide guidance and ensure compliance every step of the way.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.