Indiana Assignment and Transfer of Stock refers to the legal process of transferring ownership of shares from one party to another in the state of Indiana. This procedure involves the assignment of stock certificates or endorsement of stock certificates by the current shareholder to the intended recipient or buyer. The Indiana Assignment and Transfer of Stock can take place in various scenarios such as when an individual sells their shares to another person or entity, when transferring shares as a gift or inheritance, or when a corporation issues new shares to its shareholders. This process is governed by the laws and regulations set forth by the Indiana Securities Division and the Indiana Secretary of State. There are several types of Indiana Assignment and Transfer of Stock that are noteworthy: 1. Private Company Stock Transfer: This type of transfer involves the sale or transfer of shares of stock in a privately held company. The buyer and the seller negotiate the terms and conditions of the transaction, including the price of the shares and any restrictions or conditions that may apply. Once the agreement is reached, the stock certificates are endorsed or assigned to the buyer, completing the transfer. 2. Public Company Stock Transfer: When shares of stock in a public company are transferred, the process typically involves brokers and is facilitated through stock exchanges. The buyer and seller will execute a stock transfer form and the shares will be transferred electronically through the Depository Trust Company (DTC). 3. Interfamily Transfer: This type of transfer usually occurs when shares of stock are transferred between family members as a gift or inheritance. The transfer may be subject to certain tax implications, and it is important to consult with a tax professional or attorney to ensure compliance with applicable laws. 4. Corporate Stock Issuance: In Indiana, corporations may issue new shares of stock to their existing shareholders. This issuance can occur as part of a stock split, stock dividend, or as a result of a corporate action. The corporation will prepare the necessary documentation, such as stock certificates, and distribute them to the shareholders. 5. Stock Pledge or Collateralized Transfer: In some cases, stock may be transferred as collateral for a loan or other financial arrangement. This involves the borrower pledging their shares as security, and upon default or other specified conditions, the lender may take ownership of the pledged shares. The Indiana Assignment and Transfer of Stock process requires careful attention to detail and compliance with applicable legal requirements. It is advisable to consult with legal professionals or financial advisors to ensure that all necessary steps are taken correctly and that the transfer is documented appropriately.

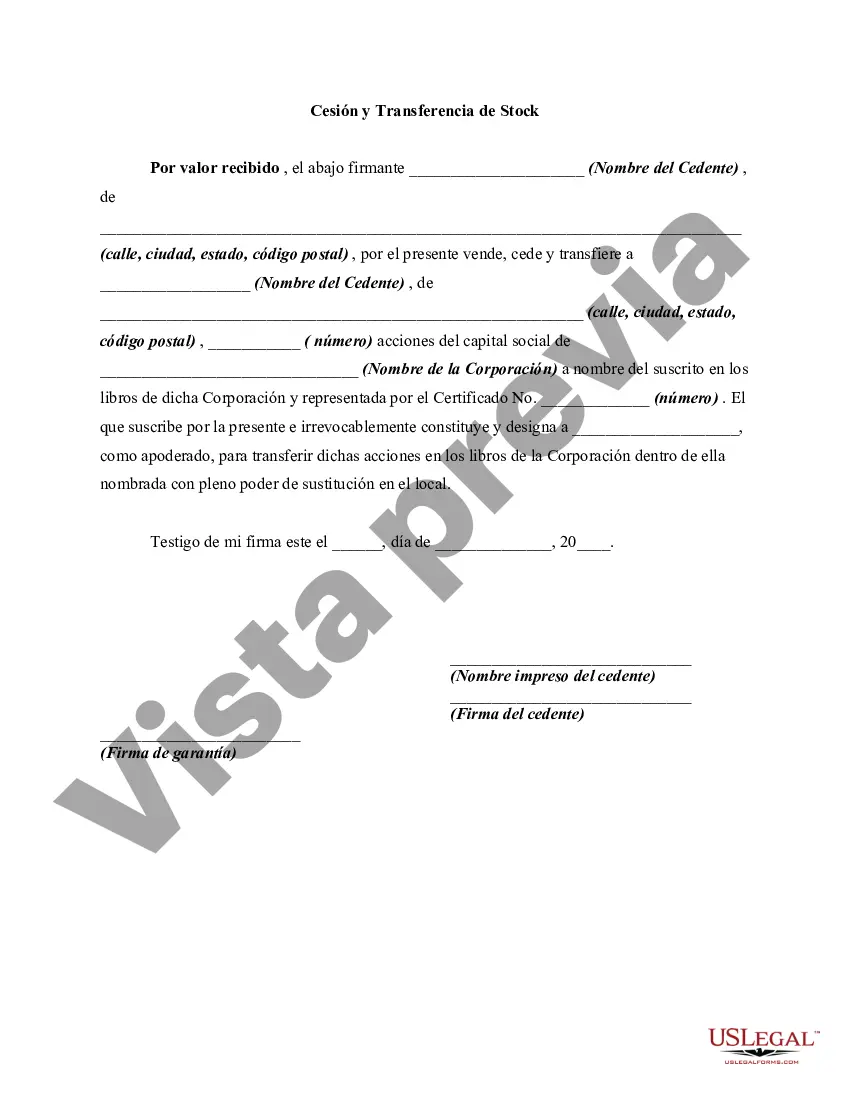

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Indiana Cesión Y Transferencia De Stock?

If you wish to comprehensive, acquire, or printing legal file templates, use US Legal Forms, the largest collection of legal kinds, that can be found on the Internet. Use the site`s basic and hassle-free search to obtain the documents you need. Various templates for business and specific uses are sorted by types and suggests, or keywords. Use US Legal Forms to obtain the Indiana Assignment and Transfer of Stock within a number of mouse clicks.

Should you be presently a US Legal Forms client, log in for your account and then click the Acquire switch to get the Indiana Assignment and Transfer of Stock. You may also gain access to kinds you previously acquired from the My Forms tab of your respective account.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form to the right area/land.

- Step 2. Use the Review method to examine the form`s information. Do not neglect to see the description.

- Step 3. Should you be not happy with the develop, utilize the Research industry on top of the display to get other models of your legal develop template.

- Step 4. Upon having discovered the form you need, click on the Buy now switch. Opt for the prices prepare you favor and add your accreditations to register for the account.

- Step 5. Procedure the deal. You should use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Pick the format of your legal develop and acquire it on the device.

- Step 7. Comprehensive, modify and printing or indication the Indiana Assignment and Transfer of Stock.

Each and every legal file template you get is your own property eternally. You have acces to every single develop you acquired within your acccount. Click on the My Forms area and select a develop to printing or acquire once more.

Remain competitive and acquire, and printing the Indiana Assignment and Transfer of Stock with US Legal Forms. There are thousands of expert and express-specific kinds you can utilize for your personal business or specific needs.