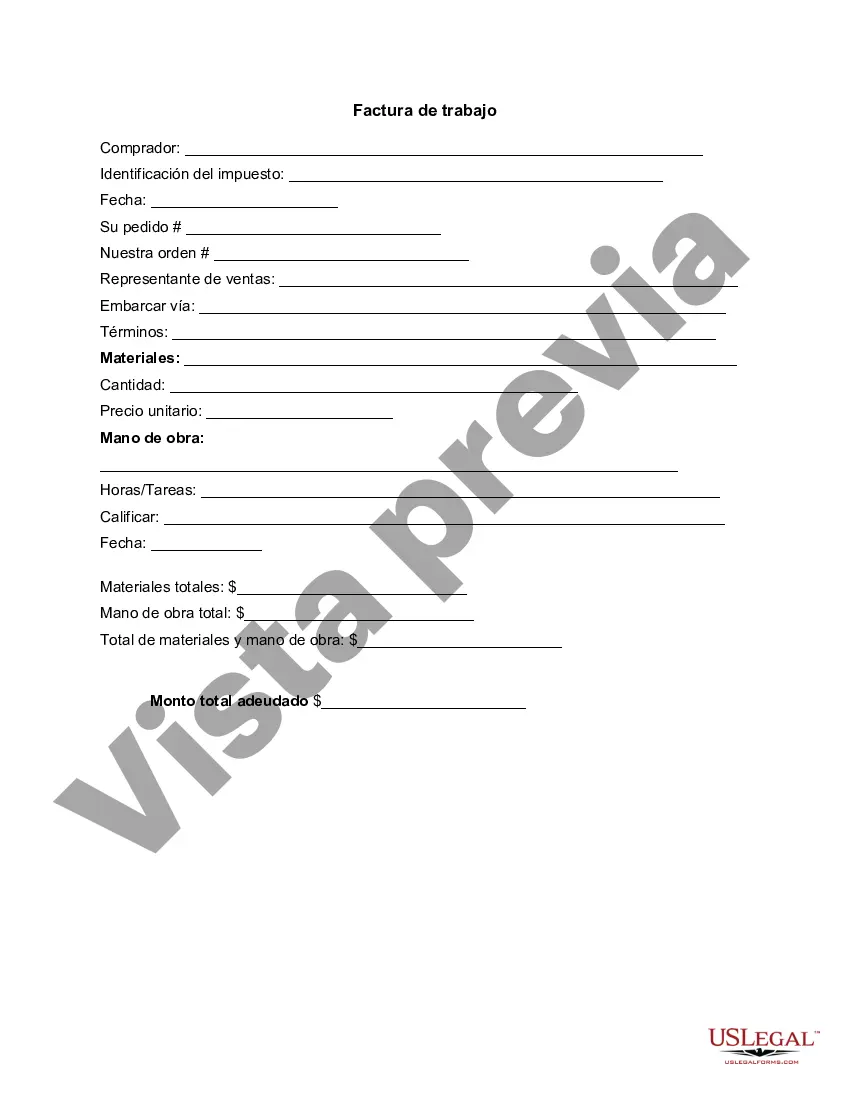

Indiana Invoice Template for Accountant is a pre-designed document specifically crafted to assist accountants in generating comprehensive and professional invoices for their clients in the state of Indiana. These templates are an invaluable tool for both self-employed accountants and accounting firms who need a standardized format to create efficient and accurate invoices. The Indiana Invoice Template for Accountant incorporates all the essential elements required in an invoice, including the accountant's contact information, client details, invoice number, invoice date, payment terms, and a breakdown of services provided. Additionally, these templates offer sections for itemizing each service or product rendered, quantity, unit price, and subtotal, allowing accountants to accurately present their charges to clients. Utilizing an Indiana Invoice Template for Accountant provides numerous benefits. Firstly, it helps accountants maintain a professional image by presenting invoices that are clean, visually appealing, and well-structured. These templates ensure that important details are not overlooked, preventing any confusion or disputes regarding the services rendered or payments due. Furthermore, Indiana Invoice Templates for Accountant can be customized to incorporate company logos, colors, and specific branding elements, giving invoices a personalized touch. This enhances brand recognition and reinforces the credibility of the accountant or accounting firm. Different types of Indiana Invoice Templates for Accountant may include: 1. Standard Indiana Invoice Template for Accountant: This is the most widely used template and suits general accounting services. It comprises all the necessary sections for invoicing clients, including service descriptions, hourly rates, and totals. 2. Hourly Rate Indiana Invoice Template for Accountant: This template is suitable for accountants who charge clients based on the number of hours worked. It includes an area to specify the hourly rate, hours worked per service, and automatically calculates the total amount. 3. Retainer Fee Indiana Invoice Template for Accountant: Designed for accountants who collect a retainer fee before commencing work, this template allows them to outline the retainer fee terms, the amount applicable, and deduct it from the total invoice accordingly. 4. Expense Reimbursement Indiana Invoice Template for Accountant: This type of template is utilized when accountants need to itemize expenses incurred during the provision of their services. It allows for clear documentation of reimbursable expenses and separation of service charges for transparency. In conclusion, Indiana Invoice Templates for Accountants are essential tools that simplify the invoicing process and enhance professionalism for accountants operating in Indiana. These templates come in various types and can be customized to accommodate specific accounting practices, ensuring accurate and efficient billing for services rendered.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Plantilla de factura para contador - Invoice Template for Accountant

Description

How to fill out Indiana Plantilla De Factura Para Contador?

US Legal Forms - among the largest libraries of legitimate varieties in the United States - gives a wide array of legitimate document layouts you are able to down load or produce. Making use of the web site, you may get a large number of varieties for organization and specific purposes, sorted by classes, claims, or key phrases.You can find the most up-to-date versions of varieties much like the Indiana Invoice Template for Accountant in seconds.

If you have a subscription, log in and down load Indiana Invoice Template for Accountant through the US Legal Forms library. The Obtain button can look on each form you perspective. You have access to all previously acquired varieties inside the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you started:

- Ensure you have picked out the right form to your town/region. Click on the Review button to review the form`s content material. Look at the form explanation to ensure that you have chosen the correct form.

- When the form does not match your demands, make use of the Lookup industry at the top of the monitor to obtain the one who does.

- Should you be content with the shape, validate your decision by clicking on the Acquire now button. Then, choose the costs strategy you favor and supply your accreditations to sign up for the accounts.

- Procedure the deal. Make use of credit card or PayPal accounts to complete the deal.

- Choose the format and down load the shape in your device.

- Make alterations. Fill out, change and produce and indicator the acquired Indiana Invoice Template for Accountant.

Every single format you included with your bank account does not have an expiration day and it is yours eternally. So, in order to down load or produce yet another copy, just visit the My Forms portion and click in the form you require.

Get access to the Indiana Invoice Template for Accountant with US Legal Forms, the most comprehensive library of legitimate document layouts. Use a large number of professional and express-specific layouts that fulfill your business or specific demands and demands.