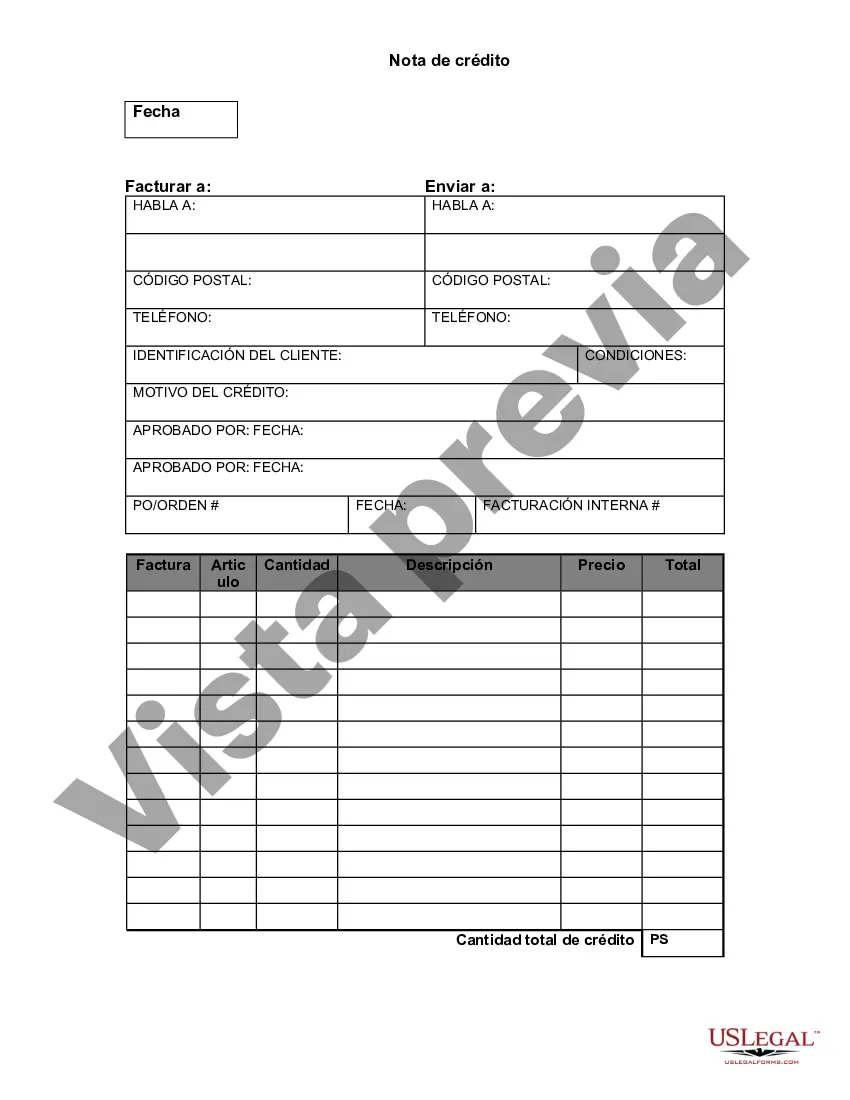

Indiana Credit Memo is a document issued by a business or organization in Indiana to a customer or client, acknowledging that they have a credit balance with the company. It serves as a proof of credit amount available that can be applied towards future purchases or as a refund. The primary purpose of an Indiana Credit Memo is to provide transparency and proper documentation to both the company and the customer regarding the credit amount owed. It ensures accuracy in accounting and acts as a record of the transaction for reference in the future. The key elements usually included in an Indiana Credit Memo are: 1. Debtor Information: The customer's or client's name, address, contact details, and account number. 2. Creditor Information: The business or organization's name, address, contact details, and invoice number. 3. Credit Amount: The specific amount credited to the customer's account. 4. Reason for Credit: A brief description of why the credit was issued, such as returned or damaged goods, billing errors, overpayment, or any other relevant circumstances. 5. Issuance Date: The date when the Indiana Credit Memo was issued. 6. Terms and Conditions: Any specific conditions or restrictions related to the credit, such as expiration dates or limitations on its use. Different types of Indiana Credit Memos may include: 1. General Credit Memo: A credit memo issued for various reasons, such as returns, faulty products, or overpayments. 2. Sales Discount Credit Memo: A credit memo issued to reflect a discount given to a customer for a specific purchase or as part of a sales promotion. 3. Billing Error Credit Memo: A credit memo issued to correct invoicing errors, overcharging, or undercharging. 4. Refund Credit Memo: A credit memo issued for a refund due to cancellation of services, unused credits, or overpayments. 5. Loyalty Credit Memo: A credit memo issued to loyal customers as a reward or as part of a loyalty program. In conclusion, an Indiana Credit Memo is an essential document that outlines the credit amount owed to a customer or client in Indiana. It ensures transparency, accuracy, and proper record-keeping in business transactions, helping to maintain good customer relationships and efficient accounting practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Nota de crédito - Credit Memo

Description

How to fill out Indiana Nota De Crédito?

Finding the correct legitimate document template can be a challenge.

Certainly, there are numerous designs accessible online, but how do you find the authentic form you desire.

Use the US Legal Forms site. The service offers thousands of templates, including the Indiana Credit Memo, which you can apply for business and personal purposes.

- All of the forms are reviewed by professionals and comply with state and federal standards.

- If you are already registered, Log In to your account and click on the Download button to obtain the Indiana Credit Memo.

- Use your account to browse the legal forms you have purchased previously.

- Navigate to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your city/region. You can preview the document using the Preview option and read the document description to verify it is suitable for you.

Form popularity

FAQ

A credit memo in your bank account may indicate a variety of transactions that benefit you. This could stem from overpayments, returned checks, or adjustments for fees. An Indiana Credit Memo usually reflects a company’s acknowledgment of errors or changes that impact your finances. Check with your bank or accounting software for precise details that clarify this credit.

When you receive a credit memo, it signifies a positive adjustment to your balance. In the context of Indiana Credit Memos, this could relate to refunds or adjustments in your transaction history. It serves as an official document acknowledging that funds are being credited to your account. If you have questions, don’t hesitate to consult customer support to clarify the memo’s purpose.

Receiving an unexpected Indiana Credit Memo can be puzzling, but it usually ties to a transaction or correction involving your account. It may reflect a credit for changes to your previous purchases or fees waived by the company. Always review the details of the credit memo to understand its origin. If in doubt, reach out to your service provider for more information.

Banks issue credit memos for various reasons, including adjustments to customer accounts or corrections of previous errors. An Indiana Credit Memo might arise due to returned deposited checks or resolved disputes. Understanding the context helps clarify why your bank has taken this action. It is always good practice to verify with your bank for clarification.

Using an Indiana Credit Memo offers significant benefits for both businesses and customers. It simplifies record-keeping by maintaining accurate accounts of transactions, ensuring that both parties agree on amounts owed. Additionally, it enhances customer satisfaction by facilitating easy returns and adjustments, promoting trust and loyalty in your business transactions.

Filling out an Indiana Credit Memo involves a few key steps. Begin with the header, which includes your business name, the customer’s information, and the date. Next, specify the credit amount and the products or services related to the transaction. Finally, review the information for accuracy before saving or sending it to the customer.

Entering an Indiana Credit Memo in your accounting system is straightforward. First, access your accounting software where you manage customer transactions. Then, create a new entry for the credit memo, selecting the appropriate customer and inputting the details of the credit. This action will adjust the customer's balance and ensure accurate financial records.

To write an Indiana Credit Memo, start by including your company details and the date of issuance at the top. Next, add the customer’s information, including their name and address. Then, clearly outline the reasons for the credit, the amount being credited, and any relevant transaction details. Finally, ensure that you sign and date the memo to validate it.

An Indiana Credit Memo serves as a document issued by a seller to a buyer, reducing the amount owed by the buyer on their account. For example, if a customer returns products that were previously purchased, the seller can issue an Indiana Credit Memo to reflect this return. This document helps ensure accurate records and allows the buyer to apply the credit to future purchases.

Sending an Indiana Credit Memo can be done electronically or via traditional mail, depending on your preferred method of communication. If you are using an online platform, like US Legal Forms, you can simply generate and email the credit memo directly to the customer. If mailing, print the memo, include any necessary documentation, and send it to the customer's address. Keeping a copy for your records is also a wise step to ensure proper documentation.

More info

Simply pick the option that best matches your needs.