Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

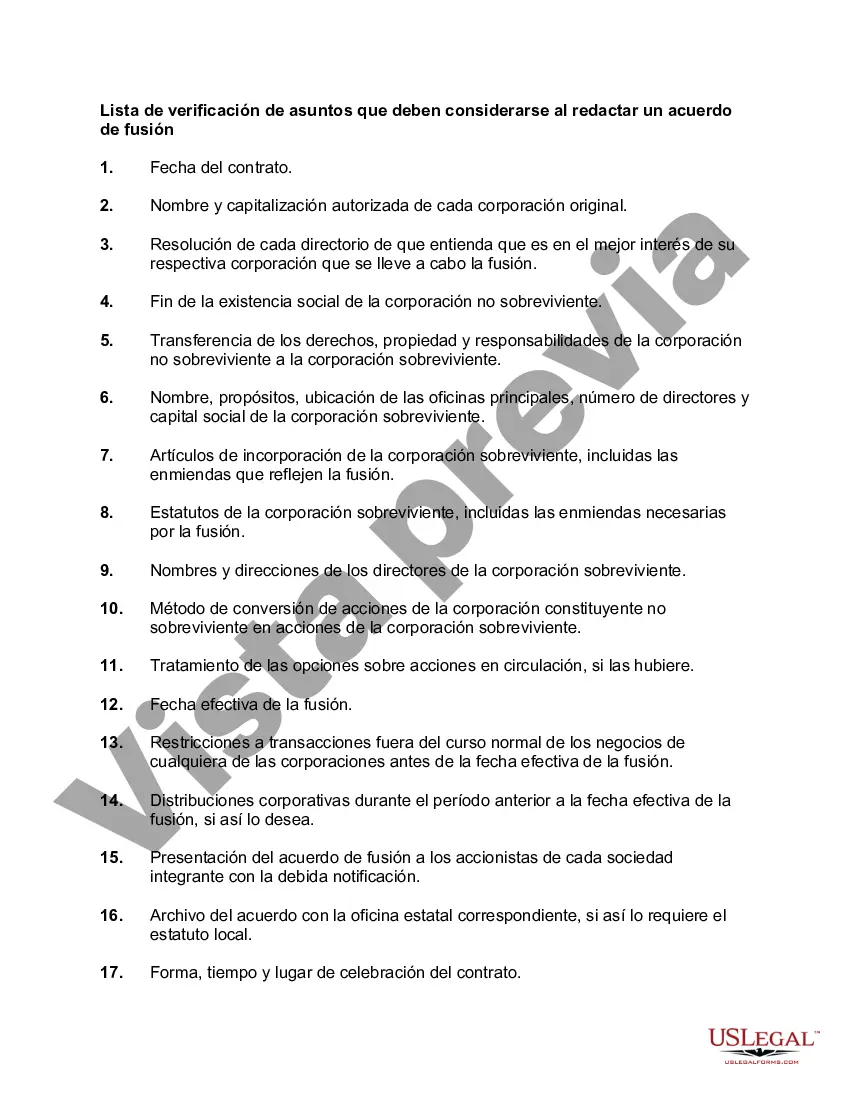

Title: Indiana Checklist of Matters to Consider in Drafting a Merger Agreement Keyword: Indiana, checklist, merger agreement, matters to consider, drafting Introduction: When navigating the complex process of merging two companies in the state of Indiana, a carefully crafted merger agreement is crucial. This article delves into the various aspects of drafting a merger agreement in Indiana while providing a comprehensive checklist of matters that should be considered. Whether it's a horizontal merger, vertical merger, or conglomerate merger, a well-drafted merger agreement is essential for a successful and compliant merger. 1. Corporate Structure and Parties: — Identify the acquiring and target companies' legal names, addresses, and types of entities (corporations, LCS, etc.). — Determine the key stakeholders, such as shareholders, directors, officers, and their respective roles post-merger. — Consider any necessary changes to the corporate structure, including amendments to articles of incorporation, bylaws, or operating agreements. 2. Merger Terms and Consideration: — Determine the type of merger (e.g., statutory, assets acquisition, or stock acquisition) and outline the specific terms and conditions. — Allocate the consideration for the merger (cash, stocks, or a combination). — Identify any contingencies, such as regulatory approvals or financing arrangements, along with their specific timelines. 3. Representations and Warranties: — Craft detailed representations and warranties to ensure the accuracy and completeness of information exchanged between the parties. — Include provisions for knowledge qualifiers, survival periods, and indemnification for any breaches of representations and warranties. 4. Employment and Employee Benefits: — Address the treatment of employees and any potential changes to their roles, salaries, or benefits post-merger. — Analyze and negotiate key employee agreements, including non-compete and non-disclosure agreements. 5. Intellectual Property and Contracts: — Assess the intellectual property rights owned by both companies and clearly define their treatment during the merger process. — Identify important contracts, licenses, permits, or leases that need to be transferred or terminated as part of the merger. 6. Due Diligence and Regulatory Compliance: — Conduct a comprehensive due diligence review to identify any potential legal, financial, or operational risks. — Ensure compliance with federal and state regulations, including any notification requirements with the Indiana Secretary of State or applicable regulatory bodies. 7. Post-Merger Integration: — Outline the integration plan, including key milestones, timelines, and responsibilities for combining the businesses smoothly and efficiently. — Establish guidelines for assimilating cultures, systems, processes, and aligning strategies. Conclusion: Drafting a merger agreement in Indiana involves careful consideration of various vital matters. By following this checklist, companies can ensure a smoother merger process while addressing legal, financial, operational, and cultural aspects that arise during consolidation. Seek legal expertise to navigate through the nuances of Indiana's merger laws and regulations effectively.Title: Indiana Checklist of Matters to Consider in Drafting a Merger Agreement Keyword: Indiana, checklist, merger agreement, matters to consider, drafting Introduction: When navigating the complex process of merging two companies in the state of Indiana, a carefully crafted merger agreement is crucial. This article delves into the various aspects of drafting a merger agreement in Indiana while providing a comprehensive checklist of matters that should be considered. Whether it's a horizontal merger, vertical merger, or conglomerate merger, a well-drafted merger agreement is essential for a successful and compliant merger. 1. Corporate Structure and Parties: — Identify the acquiring and target companies' legal names, addresses, and types of entities (corporations, LCS, etc.). — Determine the key stakeholders, such as shareholders, directors, officers, and their respective roles post-merger. — Consider any necessary changes to the corporate structure, including amendments to articles of incorporation, bylaws, or operating agreements. 2. Merger Terms and Consideration: — Determine the type of merger (e.g., statutory, assets acquisition, or stock acquisition) and outline the specific terms and conditions. — Allocate the consideration for the merger (cash, stocks, or a combination). — Identify any contingencies, such as regulatory approvals or financing arrangements, along with their specific timelines. 3. Representations and Warranties: — Craft detailed representations and warranties to ensure the accuracy and completeness of information exchanged between the parties. — Include provisions for knowledge qualifiers, survival periods, and indemnification for any breaches of representations and warranties. 4. Employment and Employee Benefits: — Address the treatment of employees and any potential changes to their roles, salaries, or benefits post-merger. — Analyze and negotiate key employee agreements, including non-compete and non-disclosure agreements. 5. Intellectual Property and Contracts: — Assess the intellectual property rights owned by both companies and clearly define their treatment during the merger process. — Identify important contracts, licenses, permits, or leases that need to be transferred or terminated as part of the merger. 6. Due Diligence and Regulatory Compliance: — Conduct a comprehensive due diligence review to identify any potential legal, financial, or operational risks. — Ensure compliance with federal and state regulations, including any notification requirements with the Indiana Secretary of State or applicable regulatory bodies. 7. Post-Merger Integration: — Outline the integration plan, including key milestones, timelines, and responsibilities for combining the businesses smoothly and efficiently. — Establish guidelines for assimilating cultures, systems, processes, and aligning strategies. Conclusion: Drafting a merger agreement in Indiana involves careful consideration of various vital matters. By following this checklist, companies can ensure a smoother merger process while addressing legal, financial, operational, and cultural aspects that arise during consolidation. Seek legal expertise to navigate through the nuances of Indiana's merger laws and regulations effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.