The Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories is a legal document that outlines the process and requirements for corporations to choose a depository bank and designate account signatories. This resolution is crucial for ensuring proper financial management and control within a corporation. In Indiana, there are different types of resolutions available for selecting a depository bank and account signatories, depending on the specific needs and structure of the corporation. These types may include: 1. Indiana Resolution Selecting Depository Bank for Corporation: This resolution focuses on the selection of a depository bank for the corporation's funds. It outlines the procedure for evaluating different banks, considering their services, interest rates, fees, and any other relevant factors. The resolution should also address how the corporation will monitor the bank's performance and review options periodically. 2. Indiana Resolution Selecting Account Signatories: This resolution primarily deals with the appointment of account signatories within the corporation. It identifies the individuals authorized to sign and conduct financial transactions on behalf of the company. The resolution may specify requirements such as the signatories' positions within the corporation, their levels of authorization, and any necessary documentation or approvals. When creating the Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories, certain keywords should be included to ensure its relevance: — Corporate Banking: This keyword highlights the focus on selecting a bank that specializes in corporate financial services and understands the unique needs and requirements of businesses. — Legal Compliance: This term emphasizes the importance of complying with Indiana state laws and regulations while selecting a depository bank and designating account signatories. — Financial Management: Highlighting this keyword shows the resolution's purpose in ensuring efficient and proper management of the corporation's finances. — Due Diligence: This phrase emphasizes the need for a thorough review and evaluation of potential depository banks and individuals designated as account signatories to reduce risks and maintain financial integrity. — Board of Directors: This term signifies the involvement and approval of the corporation's board of directors in the decision-making process for the selection of the depository bank and appointment of account signatories. — Risk Assessment: This keyword emphasizes the importance of assessing the potential risks associated with the chosen depository bank and account signatories to protect the corporation's financial interests. — Financial Accountability: This phrase highlights the need for designated account signatories to act responsibly and be held accountable for their financial decisions and transactions on behalf of the corporation. — Documentation: This term stresses the importance of maintaining records and documentation related to the resolution and the selection of the depository bank, ensuring transparency and legal compliance. By incorporating these relevant keywords and understanding the different types of Indiana Resolutions available, corporations can effectively document their selection of a depository bank and designate account signatories, promoting responsible financial management within the organization.

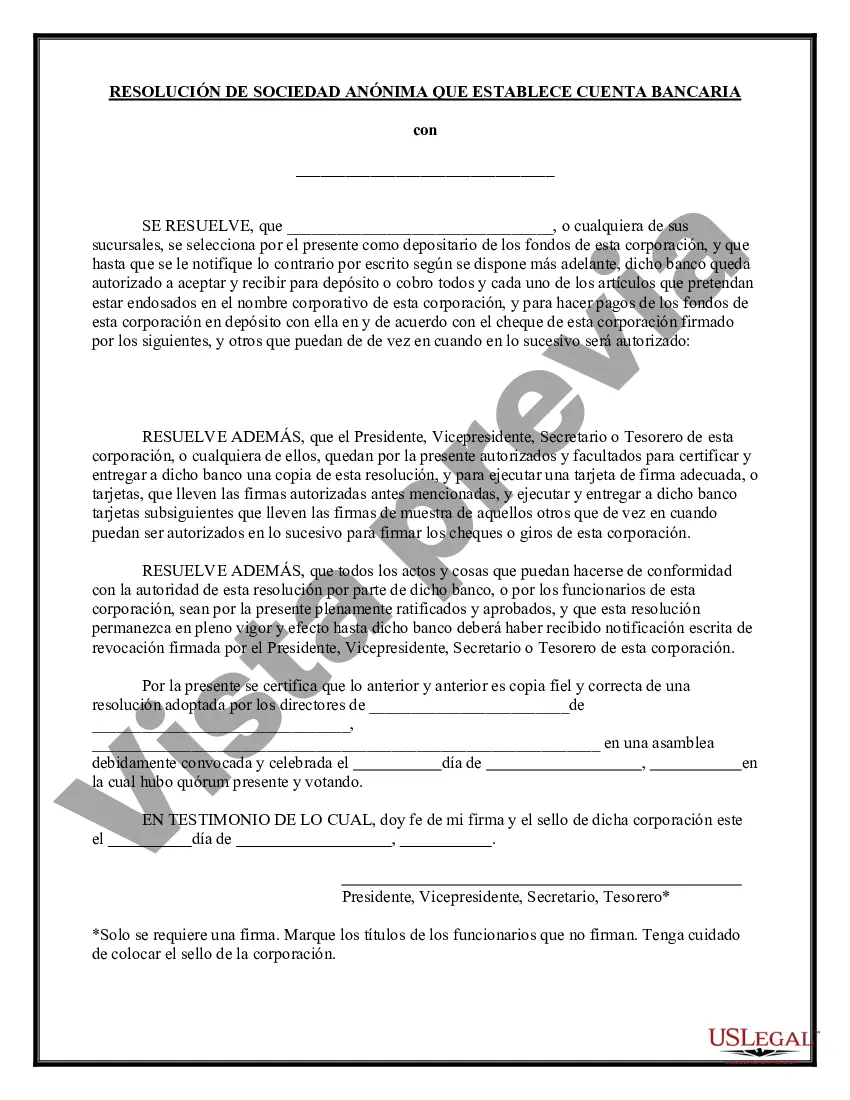

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Indiana Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

If you have to comprehensive, down load, or print legitimate file web templates, use US Legal Forms, the largest assortment of legitimate kinds, that can be found online. Use the site`s easy and hassle-free lookup to discover the paperwork you want. Numerous web templates for enterprise and personal uses are sorted by categories and says, or keywords and phrases. Use US Legal Forms to discover the Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories in a number of click throughs.

In case you are previously a US Legal Forms client, log in to your account and click on the Obtain key to obtain the Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories. You may also access kinds you previously downloaded from the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your appropriate metropolis/country.

- Step 2. Take advantage of the Review option to look through the form`s articles. Do not forget to read through the description.

- Step 3. In case you are not satisfied with the kind, use the Lookup field at the top of the screen to locate other models of your legitimate kind web template.

- Step 4. When you have found the shape you want, click on the Acquire now key. Select the costs program you prefer and add your credentials to register for the account.

- Step 5. Method the transaction. You should use your charge card or PayPal account to accomplish the transaction.

- Step 6. Select the format of your legitimate kind and down load it in your system.

- Step 7. Full, modify and print or signal the Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories.

Each legitimate file web template you get is the one you have forever. You might have acces to each kind you downloaded inside your acccount. Go through the My Forms area and choose a kind to print or down load again.

Be competitive and down load, and print the Indiana Resolution Selecting Depository Bank for Corporation and Account Signatories with US Legal Forms. There are millions of professional and state-distinct kinds you can use for your enterprise or personal requirements.