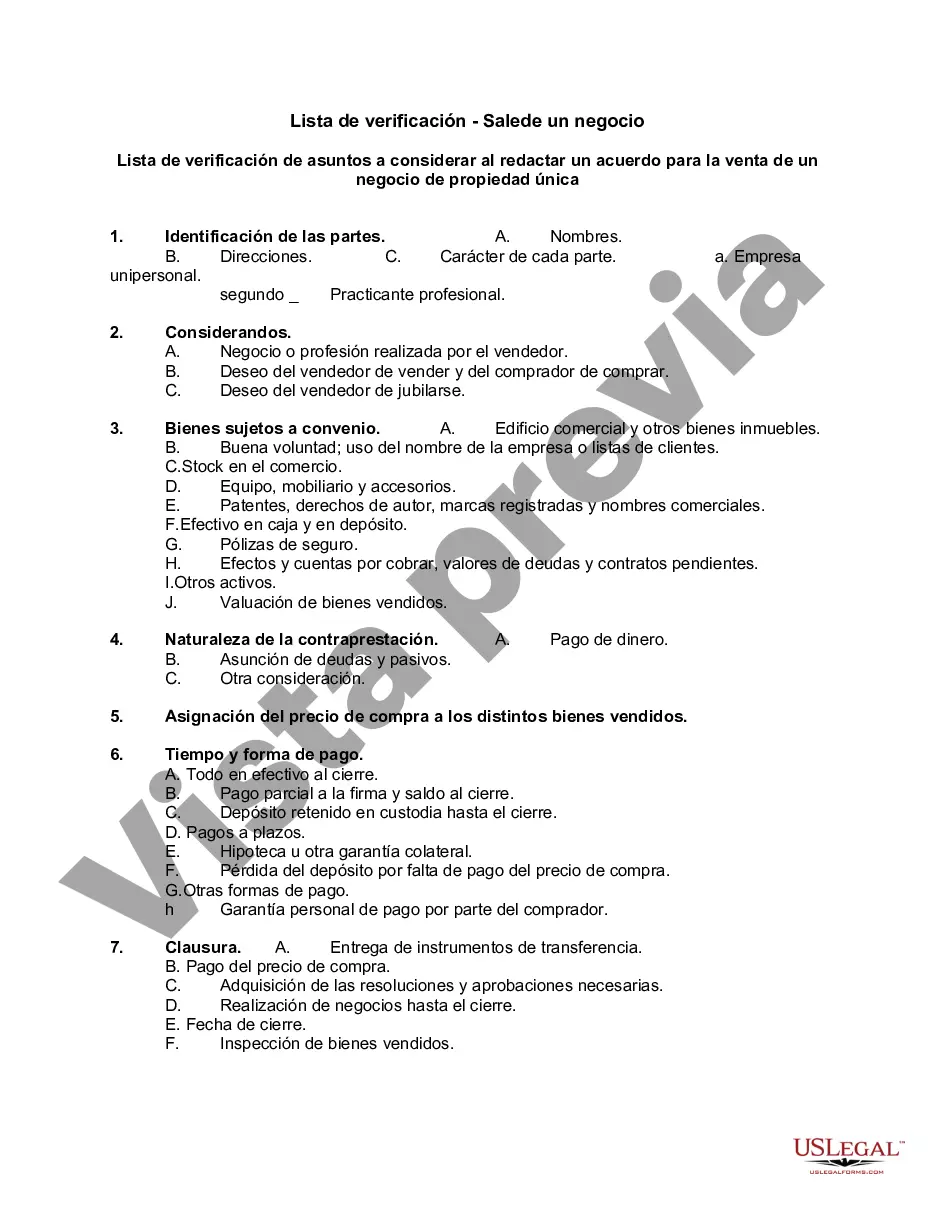

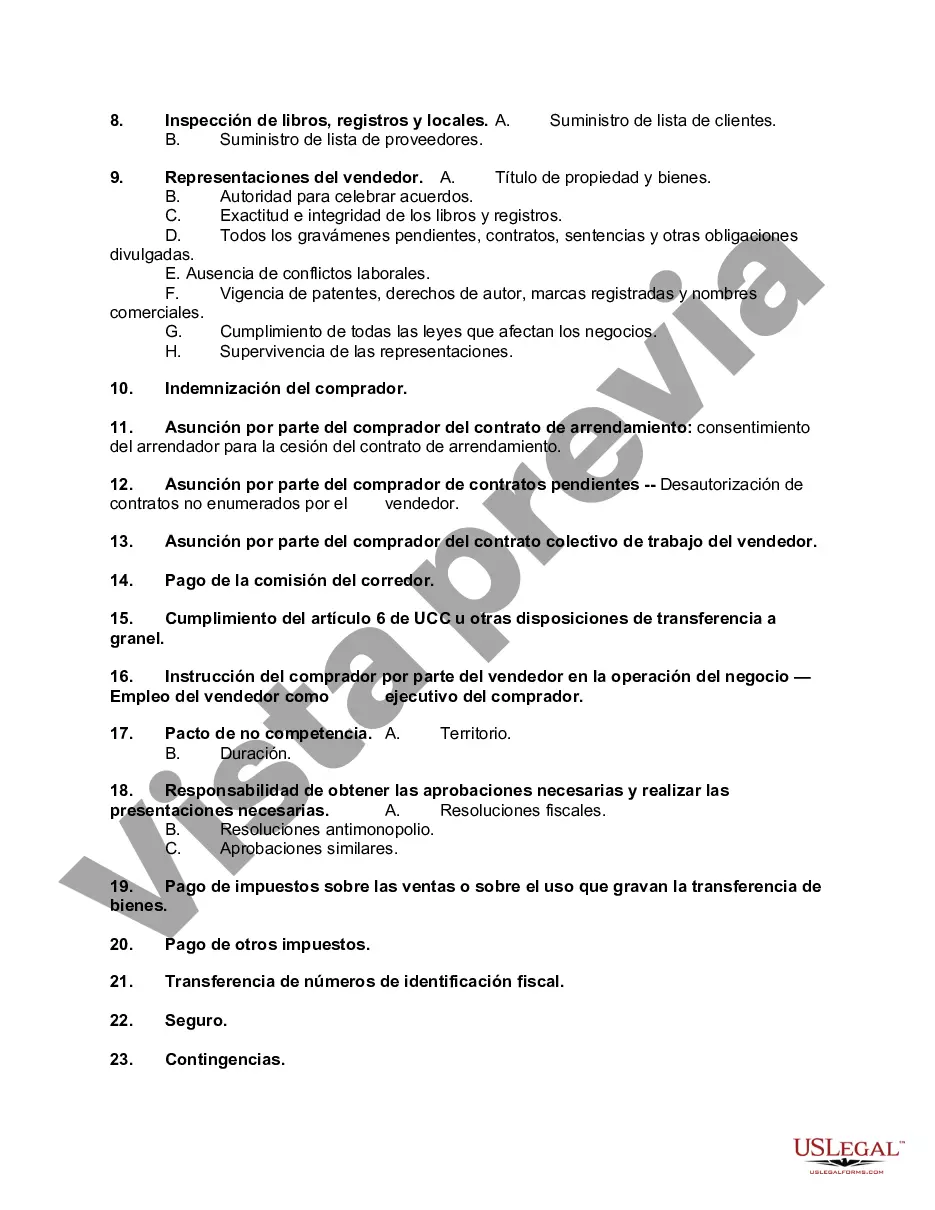

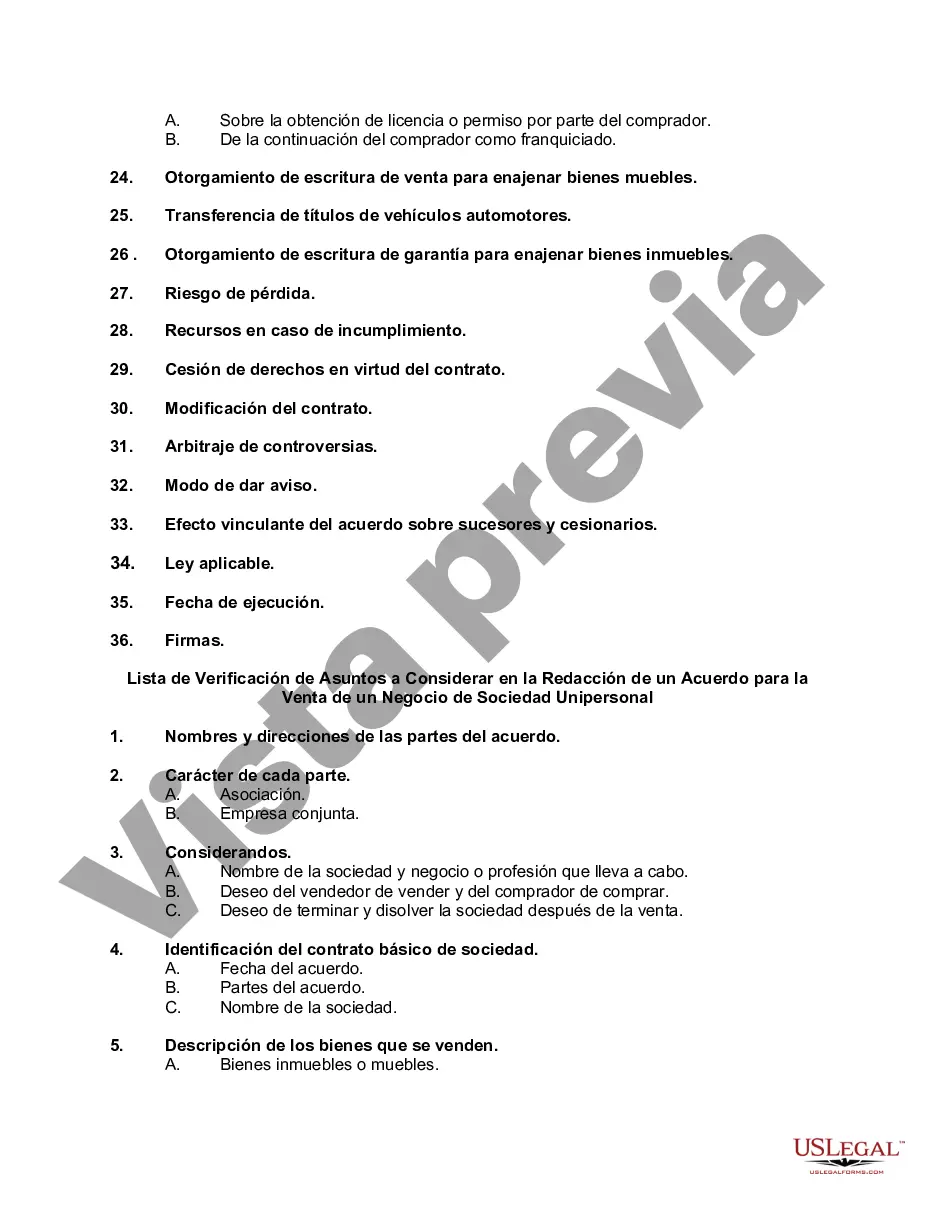

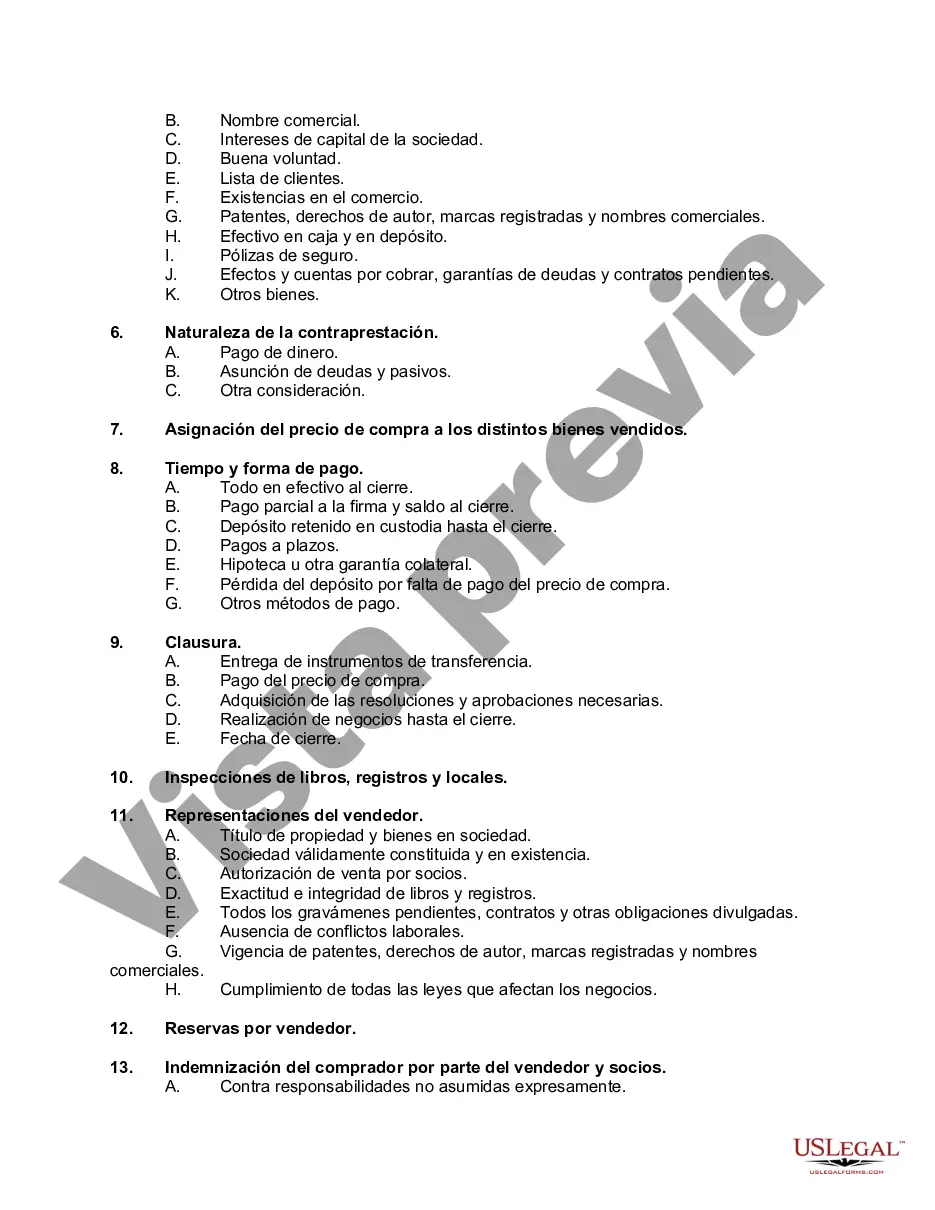

Indiana Checklist — Sale of a Business When undertaking the sale of a business in the state of Indiana, it is crucial to ensure that all necessary steps are taken to protect the interests of both the buyer and the seller. A comprehensive Indiana checklist specifically tailored for the sale of a business can be immensely helpful in this process. This checklist guides business owners and potential buyers through the various legal, financial, and strategic aspects that need to be considered and addressed in order to successfully complete the sale. Here are some key elements that may be included in an Indiana Checklist — Sale of a Business: 1. Due Diligence— - Comprehensive review of financial records, including tax returns, profit statements, and balance sheets — Examination of any outstanding liabilities, contracts, or legal disputes — Investigation of any assets involved in the sale, such as property, equipment, or intellectual property rights 2. Legal and Financial Considerations: — Consultation with an attorney to ensure compliance with Indiana business laws and regulations — Formation of a sales agreement outlining terms, conditions, and purchase price — Evaluation of any intellectual property rights, trademarks, patents, or copyrights involved in the sale — Assessment of any existing contracts, leases, or licenses that may need to be transferred or terminated 3. Employee and Labor Issues: — Communication with employees regarding the impending sale, including potential changes in ownership and employment terms — Assessment of employee contracts and benefits to ensure a smooth transition — Compliance with Indiana employment laws, including any notification requirements or severance obligations 4. Tax and Financial Planning: — Consultation with a tax professional to determine the potential tax implications of the sale — Evaluation of any applicable capital gains tax, sales tax, or other tax obligations — Financial planning to determine the most advantageous payment structure for both the buyer and the seller 5. Closing and Transfer of Ownership: — Coordination with legal professionals to ensure proper documentation and transfer of ownership — Notification of relevant parties, including creditors, customers, vendors, and government agencies — Completion of any necessary filings and registrations with the Indiana Secretary of State or other regulatory bodies It is important to note that specific checklists may vary depending on the nature of the business being sold. Some additional types of Indiana Checklists — Sale of a Business may include— - Retail Business Checklist: Tailored specifically for retail businesses, addressing considerations such as inventory, customer contracts, and point-of-sale systems. — Service Business Checklist: Geared towards service-based businesses, covering aspects like client contracts, customer databases, and intellectual property rights. — Manufacturing Business Checklist: Focusing on manufacturing-related matters, including equipment, raw material inventories, quality controls, and product warranties. In conclusion, an Indiana Checklist — Sale of a Business serves as a comprehensive guide to ensure a smooth and successful transaction. By addressing key legal, financial, and operational considerations, business owners and buyers can navigate the complexities of the sale process while safeguarding their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Lista de Verificación - Venta de un Negocio - Checklist - Sale of a Business

Description

How to fill out Indiana Lista De Verificación - Venta De Un Negocio?

Are you within a place the place you require files for possibly company or specific uses nearly every day time? There are a lot of lawful record themes accessible on the Internet, but locating types you can depend on isn`t easy. US Legal Forms delivers 1000s of type themes, such as the Indiana Checklist - Sale of a Business, which are composed in order to meet federal and state requirements.

When you are currently informed about US Legal Forms site and have a free account, basically log in. Next, it is possible to obtain the Indiana Checklist - Sale of a Business template.

If you do not provide an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and ensure it is for that proper town/county.

- Utilize the Preview key to analyze the shape.

- Look at the description to ensure that you have chosen the appropriate type.

- If the type isn`t what you`re looking for, use the Look for field to find the type that fits your needs and requirements.

- Once you find the proper type, simply click Purchase now.

- Pick the costs strategy you want, fill out the necessary details to produce your account, and pay money for the transaction using your PayPal or charge card.

- Select a hassle-free file formatting and obtain your copy.

Locate every one of the record themes you possess bought in the My Forms menu. You can get a further copy of Indiana Checklist - Sale of a Business whenever, if possible. Just select the essential type to obtain or printing the record template.

Use US Legal Forms, one of the most considerable collection of lawful kinds, to conserve time and avoid faults. The services delivers professionally manufactured lawful record themes that can be used for an array of uses. Create a free account on US Legal Forms and commence generating your life easier.