Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

How to fill out Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

Are you in a situation where you need documents for company or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

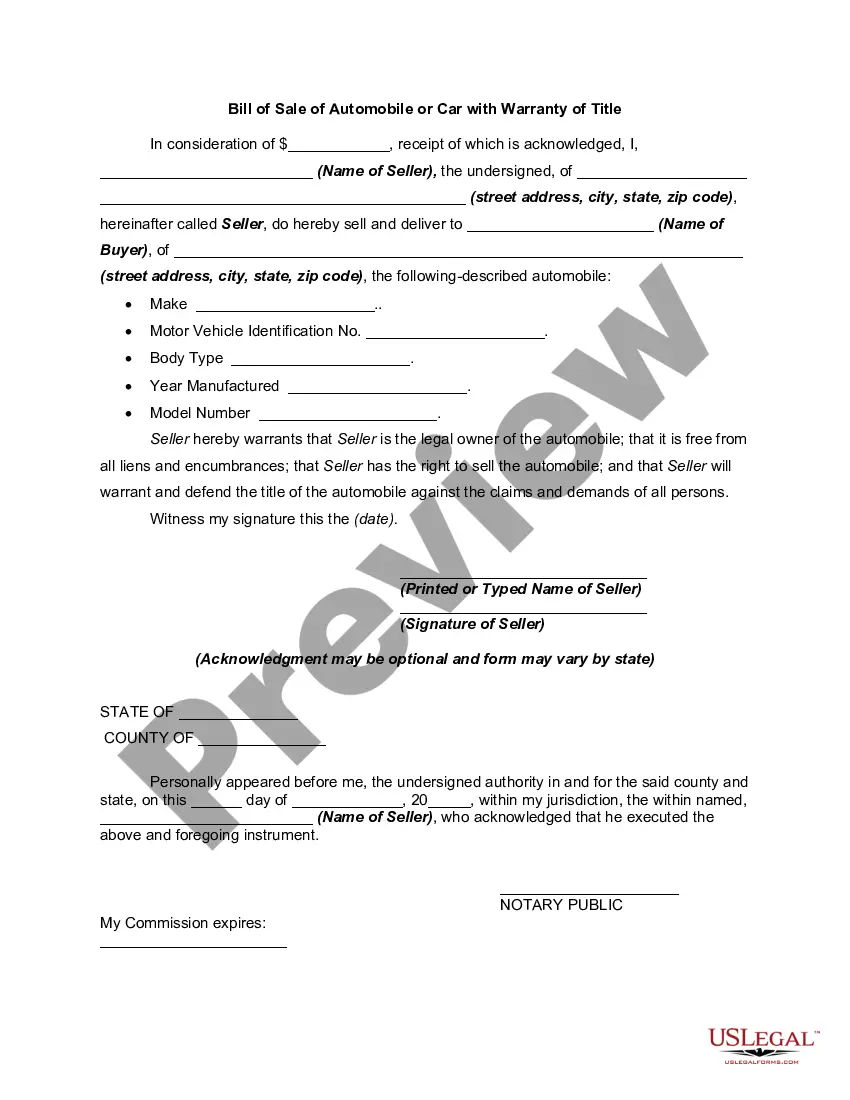

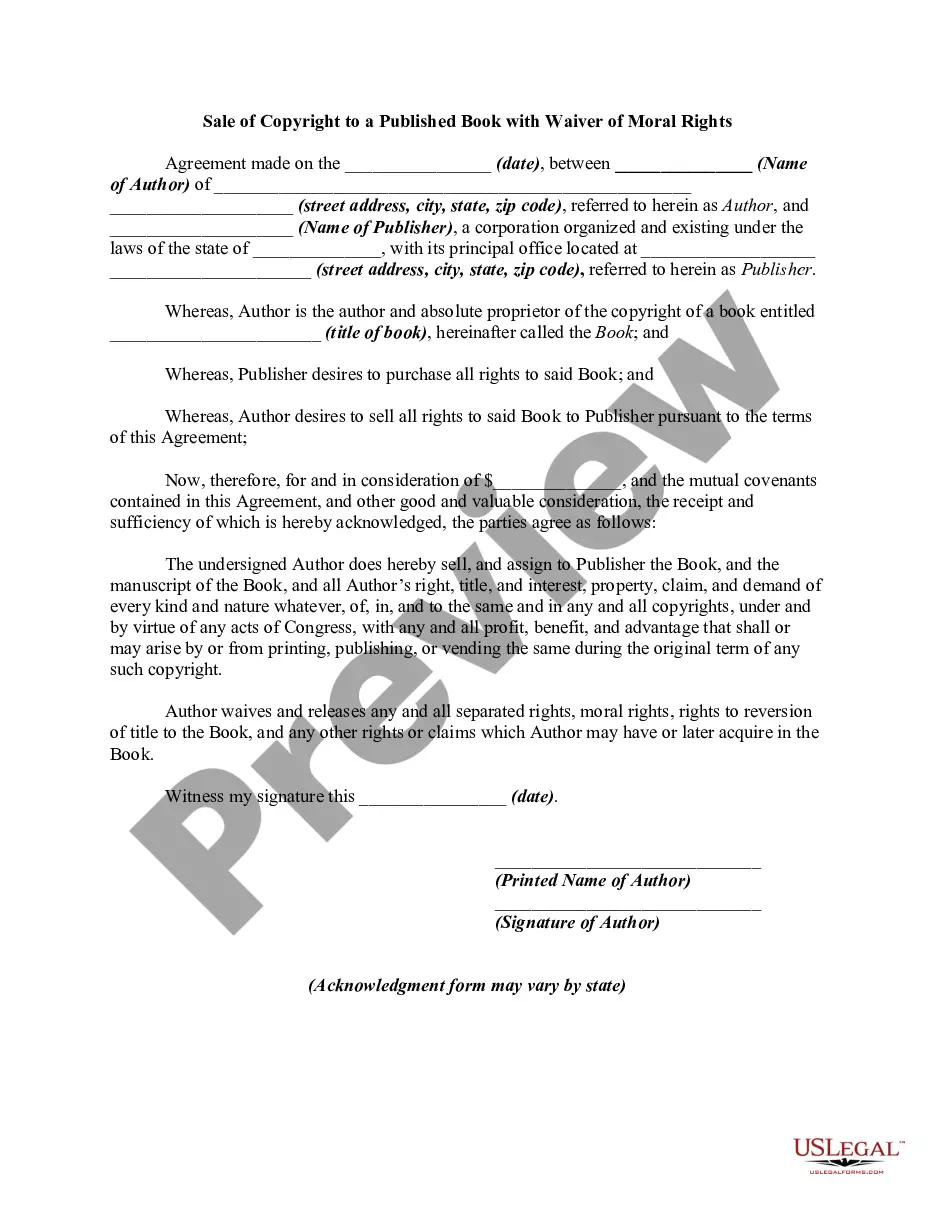

US Legal Forms offers a vast collection of form templates, including the Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, designed to meet state and federal requirements.

Once you obtain the correct form, click Acquire now.

Choose a suitable payment plan, provide the requested information to create your account, and pay for your order using PayPal or a credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents list. You can obtain another copy of the Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee whenever needed; just go through the required form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/region.

- Use the Review button to check the form.

- Examine the details to ensure you have chosen the right form.

- If the form isn’t what you are looking for, use the Search feature to find the document that meets your needs.

Form popularity

FAQ

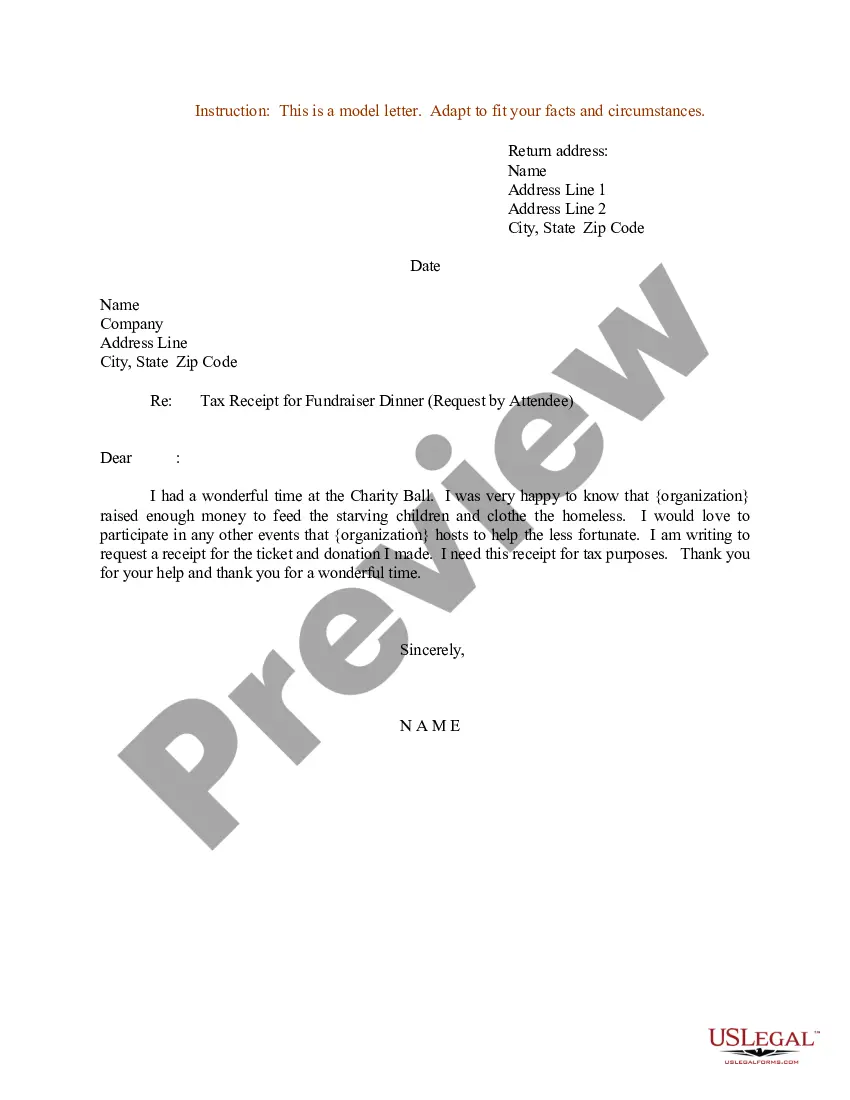

To write an acknowledgment for a donation, include a personalized opening and express appreciation. State the amount of the donation and describe its intended use. You should also reference the 'Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee' to assist the donor with tax benefits related to their generous contribution.

To write an invitation for fundraising, begin with a compelling introduction about the cause. Clearly list the event details and emphasize the impact of their attendance on the community. Include a note about receiving an Indiana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, ensuring attendees recognize the financial benefits of participating in your event.

In-kind formsA detailed description of the gift, noting if the gift was used and, if so, how old it is and its condition.The date the gift was received by your nonprofit.The donor's contact information.The estimated fair market value of the gift and how the value was determined.

Thank you for your generous gift of (Full Description) which we received on (Date). Your generous contribution will help to further the important work of our organization.

How to Write(1) Date.(2) Non-Profit Organization.(3) Mailing Address.(4) EIN.(5) Donor's Name.(6) Donor's Address.(7) Donated Amount.(8) Donation Description.More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

How to Write a Fundraising LetterAddress your recipient personally.Tell a story.Define the problem.Explain your mission and outline your goal.Explain how your donor can make an impact.Call the reader to action.

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...

The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.