The Indiana Partnership Agreement for LLC is a legal document that outlines the terms and conditions agreed upon by the members of a limited liability company (LLC) in the state of Indiana. This agreement serves as a crucial tool for organizing and operating an LLC, ensuring that all partners are on the same page and that the company operates smoothly. The Indiana Partnership Agreement for LLC covers various aspects of the LLC's operations, including the roles and responsibilities of each partner, profit and loss distribution, decision-making processes, rights and obligations of members, and procedures for admitting or removing partners. By clearly defining these terms, the agreement helps to minimize conflicts and disagreements among partners, ultimately protecting the interests of all involved parties. In Indiana, there are different types of Partnership Agreements for LLC, depending on the specific needs and goals of the company. These include: 1. General Partnership Agreement: This type of agreement is suitable for LCS with two or more partners who share equal responsibility in managing the company. Each partner has an active role in the decision-making process and is liable for the company's debts and obligations. 2. Limited Partnership Agreement: This agreement is designed for LCS that have both general partners and limited partners. General partners are responsible for managing the business and are personally liable for the company's debts, while limited partners contribute capital but have limited involvement in management and reduced personal liability. 3. Joint Venture Agreement: Sometimes, LCS in Indiana enter into a partnership with another company or individual for a specific project or venture. In such cases, a Joint Venture Agreement is used to outline the terms, responsibilities, and profit distribution relating to that particular endeavor. Regardless of the type of Partnership Agreement for LLC in Indiana, it is crucial for all parties involved to carefully consider and negotiate the terms to ensure that the agreement suits their specific needs and objectives. Additionally, it is strongly recommended consulting with a qualified attorney experienced in business law to draft or review the agreement to ensure compliance with Indiana state laws and regulations.

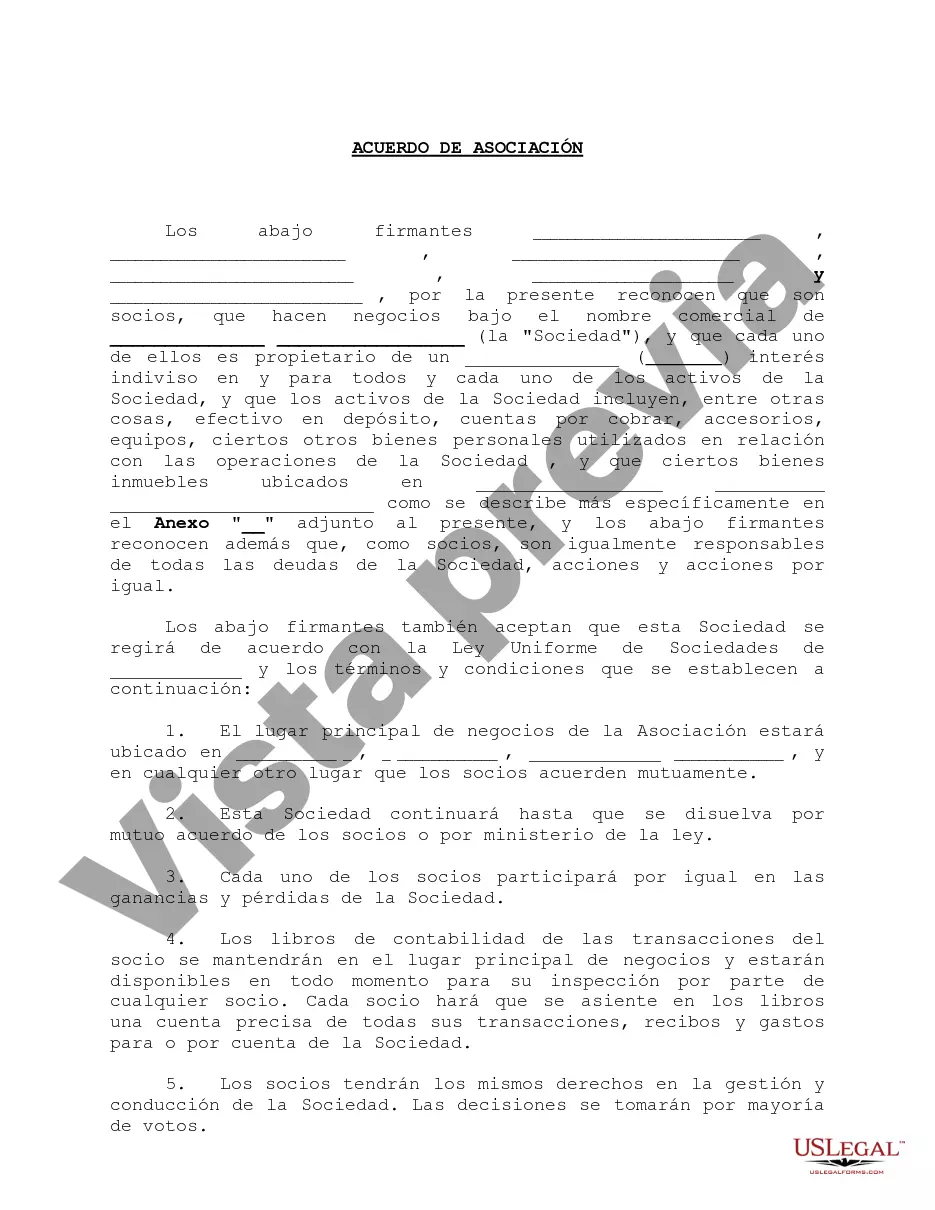

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Acuerdo de asociación para LLC - Partnership Agreement for LLC

Description

How to fill out Indiana Acuerdo De Asociación Para LLC?

If you have to full, acquire, or print out lawful document layouts, use US Legal Forms, the most important assortment of lawful kinds, which can be found on the web. Use the site`s simple and easy handy research to discover the files you require. Numerous layouts for business and specific uses are categorized by types and says, or keywords. Use US Legal Forms to discover the Indiana Partnership Agreement for LLC with a number of clicks.

If you are already a US Legal Forms client, log in for your bank account and click the Obtain switch to get the Indiana Partnership Agreement for LLC. You may also accessibility kinds you previously delivered electronically from the My Forms tab of the bank account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the right metropolis/nation.

- Step 2. Make use of the Preview option to check out the form`s content. Never overlook to read through the explanation.

- Step 3. If you are unsatisfied using the type, make use of the Research industry towards the top of the monitor to find other versions of your lawful type format.

- Step 4. Upon having located the form you require, click on the Get now switch. Opt for the pricing program you choose and put your references to sign up for the bank account.

- Step 5. Process the financial transaction. You should use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the file format of your lawful type and acquire it on your device.

- Step 7. Comprehensive, edit and print out or signal the Indiana Partnership Agreement for LLC.

Every lawful document format you purchase is yours forever. You possess acces to every single type you delivered electronically in your acccount. Click on the My Forms section and select a type to print out or acquire once again.

Remain competitive and acquire, and print out the Indiana Partnership Agreement for LLC with US Legal Forms. There are thousands of expert and status-certain kinds you can use for your business or specific needs.